Regulatory Support and Incentives

The Petroleum Refining Hydrogen Generation Market is likely to benefit from favorable regulatory frameworks and government incentives aimed at promoting hydrogen production. Various governments are implementing policies that encourage the adoption of hydrogen technologies, including tax credits, grants, and subsidies for hydrogen production facilities. These initiatives are designed to stimulate investment in hydrogen infrastructure and research, thereby fostering innovation within the industry. For instance, the U.S. Department of Energy has allocated substantial funding for hydrogen research and development, which could enhance the competitiveness of hydrogen in the refining sector. Such regulatory support is expected to catalyze growth in the Petroleum Refining Hydrogen Generation Market, making hydrogen a more viable option for refiners.

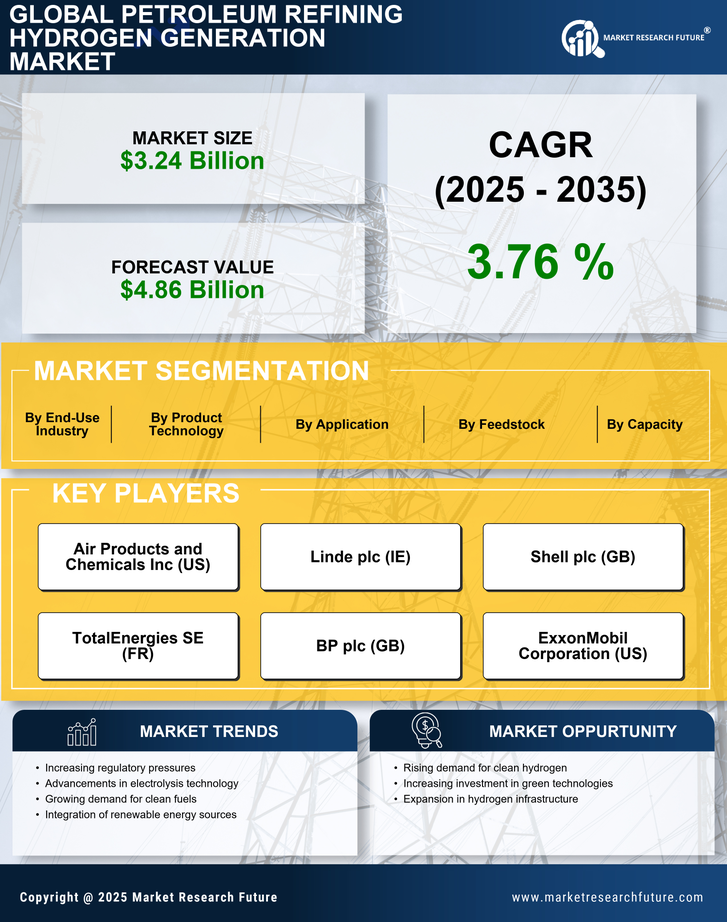

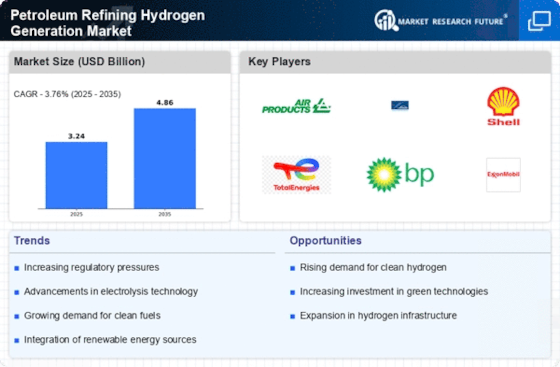

Increasing Demand for Clean Energy

The Petroleum Refining Hydrogen Generation Market is experiencing a notable surge in demand for clean energy solutions. As nations strive to meet stringent environmental regulations and reduce carbon emissions, the need for hydrogen as a clean fuel source becomes increasingly apparent. Hydrogen, when utilized in refining processes, can significantly lower greenhouse gas emissions compared to traditional fossil fuels. This shift towards cleaner energy sources is expected to drive investments in hydrogen generation technologies, thereby enhancing the growth of the Petroleum Refining Hydrogen Generation Market. Furthermore, the International Energy Agency projects that hydrogen could account for up to 18% of the global energy demand by 2050, indicating a robust market potential for hydrogen in the refining sector.

Rising Oil Prices and Economic Viability

The Petroleum Refining Hydrogen Generation Market is influenced by fluctuations in oil prices, which can impact the economic viability of hydrogen production. As oil prices rise, refiners may seek alternative energy sources to mitigate costs and maintain profitability. Hydrogen, being a versatile energy carrier, presents an appealing option for refiners looking to diversify their energy portfolio. The increasing cost of crude oil has prompted many refiners to explore hydrogen as a means to enhance operational efficiency and reduce reliance on traditional fossil fuels. This trend is likely to drive investments in hydrogen generation technologies, thereby supporting the growth of the Petroleum Refining Hydrogen Generation Market. The interplay between oil prices and hydrogen adoption could shape the future landscape of the refining sector.

Growing Interest in Hydrogen as a Feedstock

The Petroleum Refining Hydrogen Generation Market is witnessing a growing interest in hydrogen as a feedstock for various refining processes. Hydrogen is essential for processes such as hydrocracking and hydrotreating, which are critical for producing cleaner fuels and meeting regulatory standards. As refiners aim to produce low-sulfur fuels and comply with environmental regulations, the demand for hydrogen as a feedstock is expected to rise. The increasing focus on sustainability and cleaner production methods is likely to drive refiners to invest in hydrogen generation technologies. This trend indicates a potential shift in the refining landscape, where hydrogen could play a central role in achieving cleaner and more efficient refining processes, thereby bolstering the Petroleum Refining Hydrogen Generation Market.

Technological Innovations in Hydrogen Production

Technological advancements are playing a pivotal role in shaping the Petroleum Refining Hydrogen Generation Market. Innovations in hydrogen production methods, such as electrolysis and steam methane reforming, are enhancing efficiency and reducing costs. The development of more efficient catalysts and processes is likely to improve hydrogen yield and purity, making it more attractive for refining applications. According to recent studies, advancements in electrolysis technology could reduce the cost of hydrogen production by up to 30% by 2030. This reduction in production costs is expected to drive the adoption of hydrogen in petroleum refining, thereby propelling the growth of the Petroleum Refining Hydrogen Generation Market. As technology continues to evolve, refiners may increasingly integrate hydrogen into their operations.