Rising Demand for Low-Carbon Fuels

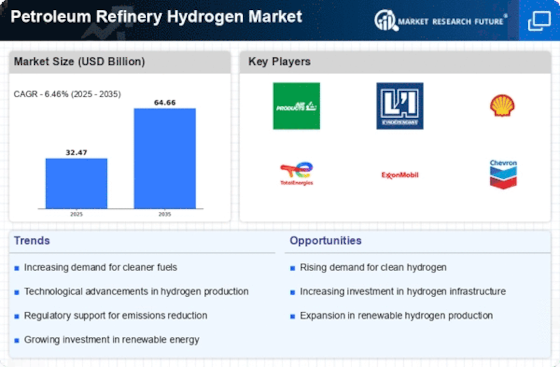

The Petroleum Refinery Hydrogen Market is significantly influenced by the rising demand for low-carbon fuels. As consumers and industries increasingly prioritize sustainability, refineries are compelled to adapt their processes to produce cleaner fuels. Hydrogen serves as a crucial component in this transition, enabling refineries to reduce greenhouse gas emissions while maintaining fuel quality. Market data suggests that the demand for hydrogen in refining applications could reach approximately 15 million metric tons annually by 2026. This trend indicates a robust growth trajectory for the Petroleum Refinery Hydrogen Market, as refineries seek to align with evolving consumer preferences and regulatory frameworks.

Investment in Hydrogen Infrastructure

Investment in hydrogen infrastructure is a critical driver for the Petroleum Refinery Hydrogen Market. As the demand for hydrogen grows, the need for robust infrastructure to support its production, storage, and distribution becomes increasingly apparent. Governments and private entities are channeling funds into developing hydrogen refueling stations and pipelines, which are essential for facilitating hydrogen's integration into the refining sector. Market analysis indicates that investments in hydrogen infrastructure could exceed $30 billion by 2030, reflecting the commitment to establishing a comprehensive hydrogen economy. This influx of capital is likely to propel the Petroleum Refinery Hydrogen Market forward, enabling refineries to enhance their operational capabilities and meet future hydrogen demands.

Regulatory Support for Hydrogen Adoption

The Petroleum Refinery Hydrogen Market is experiencing a notable shift due to increasing regulatory support aimed at reducing carbon emissions. Governments are implementing stringent regulations that encourage the adoption of cleaner fuels, including hydrogen. This regulatory landscape is fostering investments in hydrogen production technologies, which are essential for meeting compliance standards. For instance, policies promoting the use of hydrogen in refining processes are likely to enhance operational efficiencies and reduce environmental footprints. As a result, the Petroleum Refinery Hydrogen Market is poised for growth, with projections indicating a potential increase in hydrogen demand by over 20% in the next five years, driven by these supportive regulations.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a key driver in the Petroleum Refinery Hydrogen Market. Refineries are increasingly collaborating with technology providers, research institutions, and other stakeholders to enhance hydrogen production and utilization. These partnerships facilitate knowledge sharing and resource pooling, which can accelerate the development of innovative hydrogen solutions. For instance, joint ventures focused on hydrogen infrastructure development are likely to enhance supply chain efficiencies and reduce costs. This collaborative approach is expected to bolster the Petroleum Refinery Hydrogen Market, as stakeholders work together to address challenges and capitalize on opportunities in hydrogen adoption.

Technological Innovations in Hydrogen Production

Technological innovations are playing a pivotal role in shaping the Petroleum Refinery Hydrogen Market. Advances in hydrogen production methods, such as electrolysis and steam methane reforming, are enhancing efficiency and reducing costs. These innovations are critical for refineries aiming to integrate hydrogen into their operations effectively. For example, the development of more efficient catalysts and processes could potentially lower the energy requirements for hydrogen production, making it more economically viable. As these technologies mature, the Petroleum Refinery Hydrogen Market is likely to witness increased adoption, with projections indicating a compound annual growth rate of around 10% over the next decade.