Research Methodology on Green Packaging Market

1. Introduction

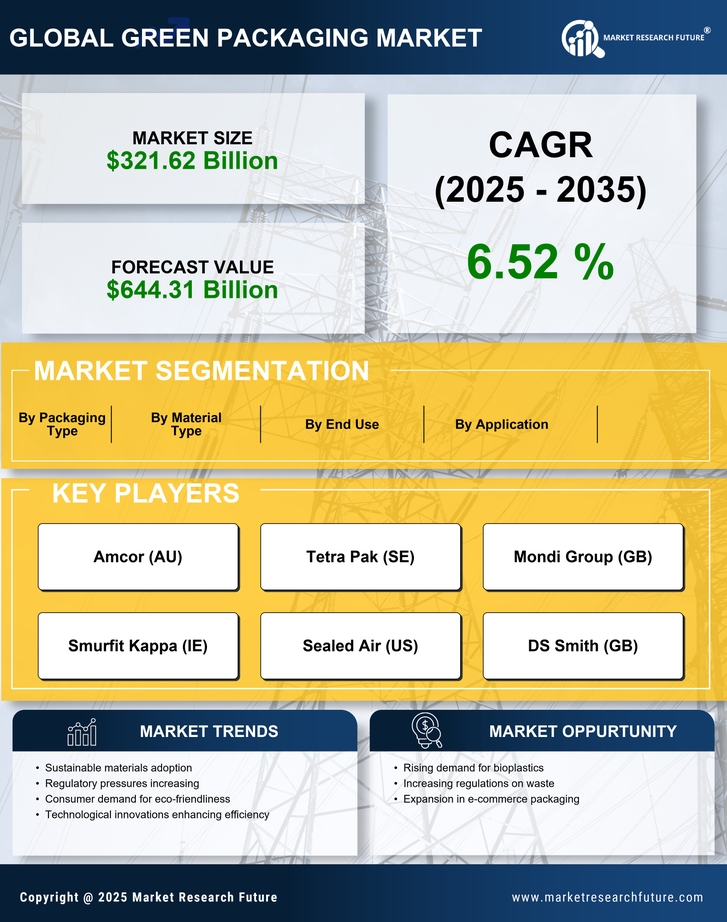

The published research report provides an in-depth review and analysis of the global green packaging market. It assesses the market size, share, trends, growth, and opportunities for the current market status and forecasts for 2023-2030. The research methodology used in this study follows Market Research Future (MRFR) methodology, which encompasses primary and secondary research techniques.

2. Secondary Research

The Research Analyst from Market Research Future first collects data and information regarding the green packaging market through secondary sources, such as press releases, Company annual reports, journals and books, and market research reports.

The report by MRFR also comprehensively analyzes the drivers, restraints, trends, and opportunities impacting the market, including economic, geological, political, technological, legal, and environmental dynamics that may influence the market's growth.

3. Primary Research

Primary research is conducted to understand the market and its performance. MRFR analysts utilize primary data to acquire an understanding of the global market. For this report, a detailed analysis of the leading market participants was conducted. Information such as product portfolios, revenue analysis, price analysis, and strategic developments are collected to develop a holistic view of the market.

The data collected from both primary and secondary research sources were analyzed and validated with the help of qualitative and quantitative analysis. The research is validated with the help of industry practitioners and senior management officials.

The information, headings and data were gathered and analyzed using tools such as Porter's Five Forces Model and Value Chain Analysis to analyze the competitive landscape in the green packaging market. The report also includes market sizing, which is the estimation of the market's overall size through the application of various techniques and algorithms.

4. Research Approach

MRFR adopts the descriptive research approach for this research study, which provides in-depth information about the green packaging market. This approach helps understand the trends and dynamics shaping the global market.

The databases used during the research process include Hoovers, Bloomberg and Factiva. Other sources include

- magazines and trade journals,

- reports from professionals in the industry,

- opinions of knowledgeable professionals and management personnel, and

- proprietary databases.

The research analyst at Market Research Future also conducts primary interviews with senior management and other leaders in the organization to get insights into the current scenario and to evaluate the potential of the companies operating in the market.

The data gathered include market size, revenue projections, and product pricing. MRFR also collected data from industry experts, and Porter's five forces analysis helped assess the current market trend and its effect on the projected market dynamics.

5. Forecast Model

The forecast model used to estimate the market size is a combination of several drivers, restraints and trends of the market, which include the following:

- The study compiles the historical data and projects growth during the forecast period (2023-2030)

- A bottom-up approach is used to arrive at the historical market size from the production value of the base product.

- The forecast market size is derived from historical data and current market trends.

- The primary interviews and feedback from industry experts verified the estimated market size.

- The data is analyzed and reviewed using secondary research and various technological tools.

- The supply-demand analysis, price volatility analysis, product cost analysis, price sensitivity analysis, SWOT analysis, and Porter's five forces analysis were used in the report to understand the market situation better.

The factors mentioned above are used to arrive at the market size of the global green packaging market.

6. Market Breakup by Segments

The report segments the global green packaging market into material type, technology, end use and region.

The market is segmented by material type: Paper & Paperboard, Metal, Glass, Plastic and Other.

By technology, the market is segmented into Vacuum Sealing, Filling, Blister Packaging, Wrapping & Overwrapping, Tray Forming and Others.

By end use, the market is segmented into Food & Beverage, Healthcare, Personal Care and Others.

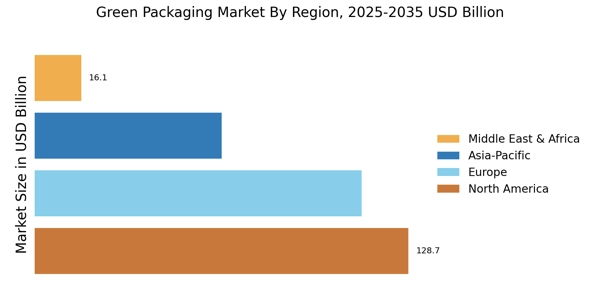

By region, the market is segmented into North America, Europe, Asia Pacific and the Rest of the World (ROW).

7. Assumptions

The assumptions made while preparing this research report were the following:

- The price of the product will remain constant over the forecast period.

- The market size estimates used in the report are based on the projections of the market players and analysts.

- The report does not include the impact of any mergers or acquisitions.

- The data collected from primary and secondary sources may be incomplete or outdated.

- Some of the numbers and output may be estimated or approximate.