Top Industry Leaders in the Grid Connected PV Systems Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Competitive Landscape of Grid-Connected PV Systems Market: An Analysis

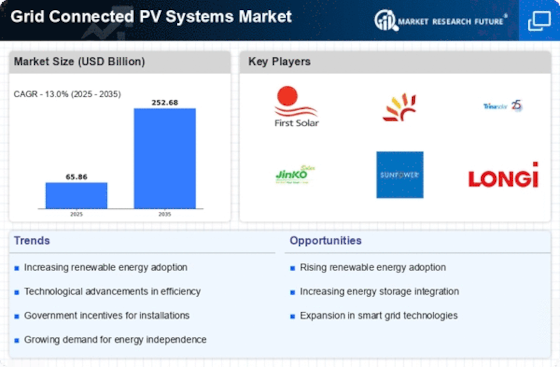

The grid-connected photovoltaic (PV) systems market is experiencing a dynamic surge, driven by rising energy demands, plummeting solar panel costs, and increasing concerns about climate change. This has ignited a fierce competition among established players and new entrants, all vying for a slice of the pie. Understanding the key strategies, market share dynamics, and emerging trends is crucial for navigating this rapidly evolving landscape.

Player Strategies and Market Share Analysis:

Giants in Motion: Traditional energy giants like Shell, BP, and TotalEnergies are leveraging their financial muscle and existing customer base to invest in large-scale solar projects. This strategy enables them to capture significant market share in the utility-scale segment.

Tech Titans Enter the Ring: Technology giants like Google and Apple are entering the fray through partnerships with solar power providers and investments in smart energy solutions. This focus on innovation and customer experience differentiates their approach.

Regional Champions Emerge: Regional players like LONGi Solar (China), JA Solar (China), and Hanwha Q CELLS (South Korea) are dominating the module manufacturing space by focusing on cost-efficiency and operational excellence. Their strong presence in their home markets gives them a competitive edge.

Niche Players Carve a Path: Smaller, agile companies are carving out niches by specializing in specific aspects like rooftop installations, off-grid solutions, or energy storage integration. These niche players differentiate themselves through customized offerings and local expertise.

Factors for Market Share Analysis:

Installed Capacity and Project Pipeline: Companies with higher installed capacity and a robust project pipeline hold a strong position in the market. Tracking project announcements and monitoring ongoing installations provides valuable insights into market share shifts.

Geographical Footprint and Market Concentration: Presence across diverse regions and diverse customer segments, including residential, commercial, and industrial, offers a competitive advantage. Market concentration levels in specific regions or segments should be considered when analyzing market share.

Technological Innovation and Product Differentiation: Companies investing in R&D, offering advanced features like bifacial panels and smart inverters, and customizing solutions for specific needs, stand out from the competition. Tracking R&D initiatives and product launches is crucial.

Financial Stability and Brand Reputation: A strong financial backing and a solid brand reputation play a crucial role in securing project financing and attracting customers. Monitoring financial performance and brand recognition metrics adds valuable context to market share analysis.

New and Emerging Trends:

Integrated Energy Solutions: Players are moving beyond just providing PV systems and are offering comprehensive energy solutions that integrate solar with storage, EV charging, and smart grid technologies. This shift demands greater customer engagement and focus on energy management services.

Digitalization and Data Analytics: Data-driven technologies like AI and machine learning are being used for system optimization, performance monitoring, and predictive maintenance. Companies embracing these technologies will gain a significant edge in efficiency and customer service.

Circular Economy Practices: Sustainability is becoming a key differentiator. Companies prioritizing responsible sourcing, material recovery, and end-of-life management of PV systems will attract environmentally conscious customers.

Financing and Business Model Innovation: Innovative financing models like power purchase agreements (PPAs) and solar as a service (SaaS) are making solar more accessible. Companies offering such models can expand their reach to previously untapped customer segments.

Overall Competitive Scenario:

The grid-connected PV systems market is witnessing a dynamic interplay between established players, regional champions, and niche specialists. Market share is fluid, driven by factors like geographical expansion, technological advancements, and evolving customer needs. Companies adapting to new trends, embracing digitization, and prioritizing sustainability will stand out in this competitive landscape. Understanding the strategies, drivers, and emerging trends is crucial for any player to gain a foothold and thrive in this rapidly growing market.

Sunpower Corporation (US):

• Acquired solar software developer Toho Energy in October 2023, expanding its residential solar offerings.

Zytech Solar (Spain):

• Opened a new 1 GW bifacial cell production facility in Portugal in October 2023.

Ravano Green Powers (Italy):

• Secured €100 million financing package from BNP Paribas and Deutsche Bank in December 2023 for its Italian solar portfolio expansion.

Top listed global companies in the industry are:

Sunpower Corporation (US)

Zytech Solar (Spain)

Ravano Green Powers (Italv)

KYOCERA Corporation (Japan)

Canadian Solar Inc (Canada)

Huawei Technologies (China)

JinkoSolar Holding Co. Ltd (China)

Trina Solar (China)

Panasonic Corporation (Japan)

Suntech Power Holding Co. Ltd.(China)

First Solar Inc. (US)

Sharp Corporation (Japan)

Kaneka Corporation (Japan)

ReneSola Power Holdings LLC (US)

TRIENERGY Schweiz AG (Switzerland)