- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

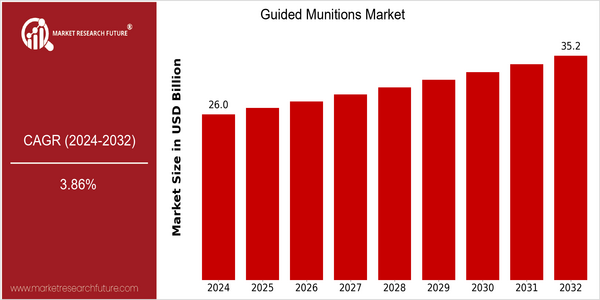

Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 25.9956 Billion |

| 2032 | USD 35.2 Billion |

| CAGR (2024-2032) | 3.86 % |

Note – Market size depicts the revenue generated over the financial year

The guided munitions market is a steady growth market, with a present value of about $ 25,995,000,000 in 2024, and is expected to grow to $ 35,200,000 in 2032. A compound annual growth rate (CAGR) of 3.86% has been calculated over the forecast period. The market growth is mainly due to the increase in defense budgets of various countries, driven by the need for advanced military capabilities and increasing international tensions. Moreover, the integration of new and emerging technologies such as artificial intelligence, precise targeting systems, and improved guidance systems is driving the demand for guided munitions. The main companies in the guided munitions industry, such as Raytheon, Lockheed Martin, and Northrop Grumman, are constantly investing in research and development to improve their products. Strategic initiatives such as strategic alliances with government agencies, strategic alliances with technology companies, and the development of next-generation guided munitions are expected to maintain a competitive advantage in the evolving market. The guided munitions market is expected to continue to grow as countries continue to modernize their military arsenals, driven by technological advancements and increased defense expenditure.

Regional Market Size

Regional Deep Dive

The Guided Munitions Market is experiencing considerable growth in many regions, driven by increasing defense budgets, technological developments and geopolitical tensions. Each region has its own characteristics, such as military expenditure, regulatory framework and technological capabilities. But the need for guided munitions is increasing as countries focus on modernization and precision capabilities.

Europe

- European nations are increasingly collaborating on defense projects, with initiatives like the European Defence Fund supporting the development of guided munitions, highlighting the region's commitment to enhancing collective security.

- Countries such as France and Germany are investing in next-generation guided munitions, driven by the need to modernize their armed forces and respond to evolving threats, which is expected to stimulate market growth.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in defense spending, particularly in countries like India and Japan, which are focusing on developing indigenous guided munitions capabilities to enhance their military readiness.

- China's rapid advancements in guided munitions technology, including the development of hypersonic weapons, are reshaping the competitive landscape and prompting neighboring countries to accelerate their own military modernization efforts.

Latin America

- Latin American countries are gradually increasing their defense budgets, with nations like Brazil and Colombia exploring partnerships with foreign defense contractors to develop guided munitions capabilities tailored to their specific security needs.

- The region's unique security challenges, including drug trafficking and border security, are driving interest in precision-guided munitions, leading to potential growth opportunities for both local and international defense firms.

North America

- In the development and production of guided missiles, the United States is still a pioneer, and Raytheon and Lockheed are investing heavily in this field.

- Recent regulatory changes, such as the U.S. Department of Defense's emphasis on integrating artificial intelligence into munitions systems, are shaping the market by promoting innovation and increasing the efficiency of guided munitions.

Middle East And Africa

- The Middle East is experiencing heightened demand for guided munitions due to ongoing conflicts and geopolitical tensions, with countries like Saudi Arabia and the UAE investing heavily in advanced military technologies.

- The partnership between local defense companies and international manufacturers is increasingly common, as is the case with the Israeli company, Rafael Advanced Defense Systems, and the local government, which is expected to increase the capabilities of guided munitions in the region.

Did You Know?

“Did you know that guided munitions can reduce collateral damage by up to 90% compared to traditional unguided munitions, making them a preferred choice in modern warfare?” — U.S. Department of Defense

Segmental Market Size

In the guided munition market the trend is for steady growth, as the number of modernizations of the armed forces increases and the demand for precision strike capabilities increases. The main driving force behind this market is the need to improve operational efficiency in combat situations and the implementation of advanced technologies that improve accuracy. Geopolitical tensions and military spending also support the market for guided munitions. Generally speaking, the implementation of guided munitions is in a mature phase, and the main examples of this are the extensive use of JDAM by the U.S. military and the integration of guided munitions by the NATO forces. The main applications are air strikes, naval operations, and ground-based artillery, with the main players being Raytheon and Lockheed Martin. Among the main trends are increasing military budgets and the trend toward unmanned systems. The main enabling technology is GPS.

Future Outlook

The Guided Munitions Market is expected to rise steadily from 2024 to 2032, with a projected rise from $24,995,600,000 to $34,200,000, representing a compound annual growth rate (CAGR) of 3.91%. This is because of the increasing demand for precision-guided munitions in military operations, driven by the need for greater accuracy and a reduction in collateral damage. The continued modernization of the military arsenals of the world's leading nations will lead to an increase in the use of guided munitions, with a penetration of up to 60% of all munitions used in military operations by 2032, compared to an estimated 46% in 2024. Technological developments, such as the integration of artificial intelligence and the development of improved guidance systems, are expected to increase the effectiveness and reliability of guided munitions. Geopolitical tensions and changes in defense strategies are expected to lead to greater investments in advanced armaments, especially among major defense spenders. The growing trend towards unmanned systems and the development of smart munitions will also play a major role in the market. The Guided Munitions Market is set to benefit from the aforementioned factors of modernization and efficiency, with the demand for guided munitions rising steadily in the coming years.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 24.9 Billion |

| Growth Rate | 3.86% (2024-2032) |

Guided Munitions Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.