Market Analysis

In-depth Analysis of Handheld Surgical Devices Market Industry Landscape

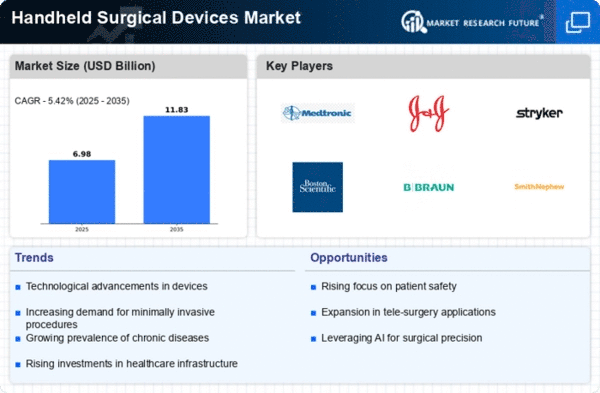

The Handheld Surgical Devices Market is seeing powerful changes driven by innovative progresses, a developing interest for insignificantly intrusive techniques, and the rising pervasiveness of persistent illnesses requiring surgical interventions. These versatile and accuracy centered devices have become basic to different surgical strengths, offering specialists more prominent adaptability, and worked on quiet results. The market elements are essentially influenced by the more extensive shift towards negligibly intrusive medical procedure (MIS). Handheld surgical devices assume a vital part in MIS, empowering specialists to carry out strategies with more modest entry points, diminished injury, and quicker recuperation times. The rising inclination for insignificantly intrusive methodologies is affecting market patterns and driving the advancement of specific handheld instruments. Handheld surgical devices track down applications across different surgical fortes, including general a medical procedure, muscular health, neurosurgery, and cardiovascular medical procedure. Their flexibility in tending to different ailments and surgical methods is a key component forming market elements. As handheld devices become more versatile, they add to the proficiency and viability of surgical intercessions. The joining of mechanical technology and computerized advancements is an eminent pattern in the handheld surgical devices market. Automated helped handheld instruments offer specialists upgraded control and accuracy during techniques. Computerized points of interaction and imaging innovations further add to constant perception, influencing market elements by raising the capacities of handheld devices. As the interest for sterile surgical environments expands, producers are consolidating highlights in handheld devices to guarantee powerful disinfection and lessen the risk of medical services related diseases. This emphasis on wellbeing guidelines shapes the turn of events and reception of handheld surgical instruments. Worldwide reception patterns of handheld surgical devices change considering the medical care framework of various locales. Created markets with cutting edge medical services frameworks show higher reception rates, while developing markets experience a steady take-up. The elements of the handheld surgical devices market are affected by geological diversities in innovation reception, market development, and monetary variables.

Leave a Comment