- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Healthcare BPO Market Size Snapshot

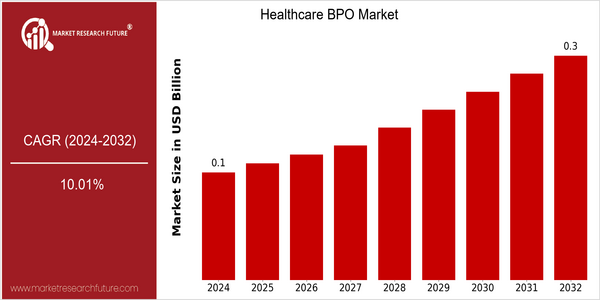

| Year | Value |

|---|---|

| 2024 | USD 0.12 Billion |

| 2032 | USD 0.28 Billion |

| CAGR (2024-2032) | 10.01 % |

Note – Market size depicts the revenue generated over the financial year

The global healthcare BPO market is expected to grow at a CAGR of 10.01 per cent from 2024 to 2032. This growth will be driven by the increasing demand for cost-effective solutions and improved operational efficiency in the healthcare sector. BPO is becoming more popular as a way to increase productivity and to focus on core activities. The growth of this market is also being driven by technological advancements such as automation, machine learning and artificial intelligence, which are improving the efficiency and accuracy of healthcare operations. Furthermore, the increasing complexity of regulations and the need for compliance is driving organizations to use BPO to navigate these challenges. Also, leading players such as Accenture, Cognizant and Optum are investing in developing new solutions and entering into strategic alliances to enhance their offerings. For example, a recent partnership between Cognizant and Health Catalyst aims to integrate artificial intelligence into the health insurance industry’s decision-making processes.

Regional Deep Dive

The health care BPO market is undergoing a significant transformation across various regions, mainly due to the increasing demand for cost-effective healthcare solutions, technological advancements, and an increasing focus on patient-centric services. North America is characterized by a high adoption of BPO services, due to the presence of major players and stringent regulations. In Europe, the trend is toward integrated health care solutions. Asia-Pacific is emerging as a hub for BPO, owing to the low cost of labor and a skilled workforce. Middle East and Africa is seeing a rise in investment in health care infrastructure. In Latin America, the growing health care sector is driving the BPO market.

North America

- In order to improve efficiency, the American health care system is increasingly turning to the management of its administrative tasks to companies like Optum and Cognizant.

- The changes in the law and the implementation of the No Surprises Act are forcing health care institutions to seek solutions that ensure compliance and facilitate billing processes.

- Telehealth services have proliferated, driving BPOs to find new ways of delivering care, such as patient engagement and remote monitoring, which enhance the patient experience.

Europe

- Earlier this year, the European Union's General Data Protection Regulation (GDPR) was enacted. This is a new data security standard, and companies such as Accenture have adapted to meet the new requirements.

- Those companies like Siemens Healthineers are investing in Business Process Outsourcing (BPO) and integrating Artificial Intelligence and Machine Learning for better patient outcomes.

- In Europe, the aging of the population is putting increasing pressure on the health services, which are causing health care professionals to outsource non-core business to maintain their focus on patient care.

Asia-Pacific

- India and the Philippines have become preferred destinations for medical and health-care BPO, with companies such as Wipro and TCS expanding their operations.

- The rise of tele-medicine in the region, which was accelerated by the COVID- 19 epidemic, has led to an increased demand for business process outsourcing (BPO) services.

- Among the many government initiatives that are encouraging the growth of the healthcare BPO industry is India’s National Digital Health Mission.

MEA

- Health care is an area where the UAE is investing heavily. The Dubai Health Strategy 2021 is encouraging the use of BPO services to improve efficiency.

- Reforms to improve the quality of health services in countries such as Saudi Arabia have increased the administrative burden on the hospitals. This has led to an increase in the out- sourcing of these administrative tasks to specialized BPO companies.

- The growing prevalence of chronic diseases in the region is driving health care service providers to adopt BPO solutions to manage patient care more effectively.

Latin America

- In Brazil and Mexico, the medical BPO is booming, mainly because of the increasing middle class and the rising health care expenditures.

- There are local companies like Qualitas that are stepping up their BPO to meet the growing demand for telehealth and remote patient monitoring services.

- In order to ensure the availability and quality of health care, changes in the regulatory framework are encouraging health care professionals to outsource their non-core activities and focus on patient care.

Did You Know?

“The health care industry is expected to be worth $300 billion by 2025, driven by the need for cost-effective medical solutions and technological developments.” — Market Research Future

Segmental Market Size

The global healthcare BPO market is experiencing a steady growth, driven by the growing demand for cost-effective healthcare solutions and the need for operational efficiency. The growing complexity of the healthcare system, which requires specialized BPO services, and the growing emphasis on patient-centric care, which requires a reorganization of administrative processes, are the main drivers of the market. Also, the latest technological innovations in data analysis and automation are transforming the way back-office functions are handled.

BPO services for health care are already in a mature stage of development. Major players like Accenture and Cognizant are offering a full range of solutions across all areas of health care. The main applications are medical billing, claims management, and patient care, which are all critical to improving operational efficiency. In addition, developments like the COVID-09 pandemic have accelerated the trend towards digital health solutions, and health care providers have had to adopt BPO to cope with the influx of patients. Artificial intelligence and machine learning are also playing a significant role in improving service quality and reducing costs.

Future Outlook

The BPO market is expected to grow from $ 1200 billion in 2024 to $2800 billion in 2032, a CAGR of 10 percent. The growth is driven by the growing demand for cost-effective solutions, the complexity of regulations, and the need for improved operational efficiency in the health care industry. In order to focus on core competences, companies will continue to outsource non-core functions such as billing, claims processing, and customer service, which will lead to higher penetration of the BPO industry.

The future of the healthcare BPO industry is expected to be shaped by the emergence of key technological developments in the areas of artificial intelligence and automation. These will not only lead to the streamlining of processes, but will also help improve accuracy and reduce lead time, thus enhancing the quality of services. As the industry moves towards a value-based care model and telemedicine, the demand for specialized BPO services will also rise. The emergence of data analytics will also play a key role in shaping the future of the industry. Data will help in making better decisions and in achieving better outcomes for patients.

Opportunities will be created for BPOs by regulatory changes and policy reforms that will increase access to and availability of health care. These changes will have a positive impact on health care systems around the world, which will have to be adapted to them. As they do so, they will need scalable and flexible outsourcing solutions. By 2032, it is estimated that a full 60% of health care organizations will use BPO services to improve their operational efficiency and patient care. This will be a strong impetus for the BPO industry to develop new solutions that are adapted to the future needs of the health care industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 247.39 billion |

| Growth Rate | 10.2% (2022-2030) |

Healthcare BPO Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.