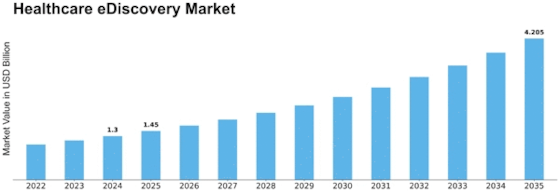

Healthcare Ediscovery Size

Healthcare eDiscovery Market Growth Projections and Opportunities

The Healthcare eDiscovery Market is notably stimulated by the stringent regulatory compliance and prison requirements governing the healthcare area. With healthcare groups dealing with complicated rules, including the Health Insurance Portability and Accountability Act (HIPAA) inside the US and various privateness legal guidelines globally, the need for eDiscovery answers that facilitate compliance and prison readiness turns vital. Data protection and patient privacy concerns are vital elements in the eDiscovery market. Healthcare businesses should make certain that eDiscovery answers adhere to strict statistics protection policies, safeguarding touchy patient data all through the criminal discovery procedure and preserving confidentiality and privacy. The integration of eDiscovery solutions with Electronic Health Records (EHRs) is a key market trend. Government investigations and audits contribute to market considerations. Healthcare businesses may face audits or investigations from regulatory bodies, requiring robust eDiscovery solutions to navigate the felony discovery method, respond to requests directly, and demonstrate compliance with healthcare regulations. Cost containment and operational performance are vital market factors. Healthcare eDiscovery answers need to provide value-powerful alternatives for legal discovery procedures, reducing the monetary burden on healthcare agencies while enhancing the speed and accuracy of record assessment and retrieval. The prevalence of cellular devices and messaging structures in healthcare necessitates comprehensive eDiscovery skills. Solutions should amplify past conventional statistics resources to encompass cell tool statistics, text messages, and different verbal exchange channels, ensuring a comprehensive approach to legal discovery in the digital age. The aggressive landscape amongst eDiscovery carriers affects market dynamics. Intense competition fosters customization alternatives, stepped-forward consumer reviews, and progressive capabilities, permitting healthcare organizations to pick out eDiscovery answers that align with their unique prison and operational necessities. The implementation of education and education applications is a large market component. Healthcare agencies need to spend money on educating the workforce on eDiscovery fine practices, ensuring that prison groups and IT professionals are equipped to address the intricacies of the eDiscovery process in compliance with healthcare regulations. Emergency response and incident management skills are vital in the eDiscovery market.

Leave a Comment