- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

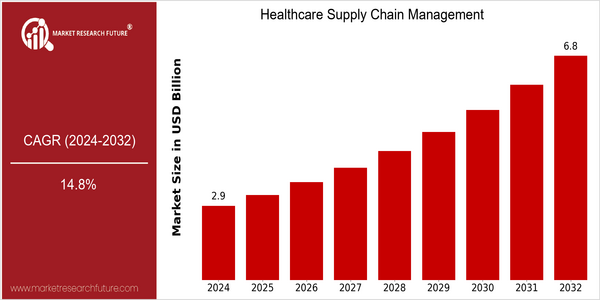

| Year | Value |

|---|---|

| 2024 | USD 2.87 Billion |

| 2032 | USD 6.81 Billion |

| CAGR (2024-2032) | 14.8 % |

Note – Market size depicts the revenue generated over the financial year

The Healthcare Supply Chain Management Market is poised for significant growth, with a current market size of USD 2.87 billion in 2024, projected to expand to USD 6.81 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 14.8% over the forecast period. The increasing complexity of healthcare delivery systems, coupled with the rising demand for efficient supply chain solutions, is driving this upward trend. As healthcare organizations seek to optimize their operations and reduce costs, the adoption of advanced technologies such as artificial intelligence, blockchain, and IoT is becoming increasingly prevalent, enhancing visibility and efficiency across the supply chain. Key players in the market, including McKesson Corporation, Cardinal Health, and Siemens Healthineers, are actively investing in innovative solutions and strategic partnerships to strengthen their market positions. For instance, McKesson has been focusing on digital transformation initiatives to streamline supply chain processes, while Cardinal Health has launched new analytics tools aimed at improving inventory management. These strategic moves not only highlight the competitive landscape but also underscore the critical role of technology in shaping the future of healthcare supply chain management.

Regional Market Size

Regional Deep Dive

The Healthcare Supply Chain Management Market is experiencing significant transformation across various regions, driven by technological advancements, regulatory changes, and the increasing demand for efficient healthcare delivery. In North America, the market is characterized by a strong emphasis on automation and data analytics, while Europe is focusing on regulatory compliance and sustainability. The Asia-Pacific region is witnessing rapid growth due to increasing healthcare expenditures and a burgeoning population, whereas the Middle East and Africa are navigating unique challenges related to infrastructure and regulatory frameworks. Latin America is also evolving, with a growing interest in digital health solutions and supply chain optimization. Overall, the market dynamics in each region reflect a blend of local needs and global trends, creating diverse opportunities for stakeholders.

Europe

- The European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) are driving healthcare organizations to adapt their supply chain practices to ensure compliance, which is fostering innovation in supply chain management solutions.

- Sustainability initiatives are gaining traction, with companies like Siemens Healthineers focusing on eco-friendly supply chain practices, which are expected to influence procurement strategies across the region.

Asia Pacific

- Countries like China and India are investing heavily in healthcare infrastructure, leading to increased demand for efficient supply chain management solutions to support their growing healthcare systems.

- The rise of telemedicine and digital health platforms is prompting healthcare providers to rethink their supply chain strategies, with companies like Alibaba Health leveraging technology to streamline operations.

Latin America

- The COVID-19 pandemic has accelerated the adoption of digital health solutions, prompting healthcare organizations to optimize their supply chains for better responsiveness and efficiency.

- Government programs aimed at improving healthcare access, such as Brazil's 'Mais Médicos' initiative, are driving demand for more robust supply chain management systems to ensure timely delivery of medical supplies.

North America

- The adoption of advanced technologies such as artificial intelligence and blockchain is reshaping supply chain processes, with companies like McKesson and Cardinal Health leading the charge in implementing these innovations.

- Regulatory changes, particularly the Drug Supply Chain Security Act (DSCSA), are pushing healthcare organizations to enhance traceability and transparency in their supply chains, thereby improving patient safety.

Middle East And Africa

- The establishment of the African Medicines Agency (AMA) is expected to enhance regulatory harmonization across the continent, which will positively impact supply chain efficiency and safety.

- Investment in healthcare infrastructure is on the rise, with governments in the UAE and Saudi Arabia launching initiatives to modernize supply chains, thereby improving access to medical supplies.

Did You Know?

“Approximately 30% of healthcare costs are attributed to supply chain inefficiencies, highlighting the critical need for effective supply chain management in the healthcare sector.” — Healthcare Supply Chain Institute

Segmental Market Size

The Healthcare Supply Chain Management (SCM) segment plays a critical role in enhancing operational efficiency and ensuring the timely delivery of medical supplies and equipment. This segment is currently experiencing growth, driven by increasing demand for transparency and efficiency in healthcare logistics. Key factors propelling this demand include the rising complexity of healthcare delivery systems and the need for cost containment amid regulatory pressures. Additionally, technological advancements in data analytics and automation are reshaping supply chain processes, making them more responsive and agile. Currently, the adoption of advanced SCM solutions is in the scaled deployment stage, with notable leaders such as McKesson and Cardinal Health implementing sophisticated systems to optimize inventory management and distribution. Primary applications include inventory tracking, order fulfillment, and demand forecasting, particularly in hospitals and pharmaceutical companies. Macro trends such as the COVID-19 pandemic have accelerated the need for robust supply chain strategies, highlighting vulnerabilities and prompting investments in resilience. Technologies like blockchain for traceability and AI for predictive analytics are pivotal in driving the evolution of this segment.

Future Outlook

The Healthcare Supply Chain Management (HSCM) market is poised for significant growth from 2024 to 2032, with a projected market value increase from $2.87 billion to $6.81 billion, reflecting a robust compound annual growth rate (CAGR) of 14.8%. This growth trajectory is driven by the increasing complexity of healthcare delivery systems, the rising demand for cost-effective solutions, and the need for enhanced operational efficiency. As healthcare providers continue to seek ways to optimize their supply chains, the adoption of advanced technologies such as artificial intelligence (AI), blockchain, and Internet of Things (IoT) will become more prevalent, facilitating real-time tracking, inventory management, and predictive analytics. By 2032, it is anticipated that over 60% of healthcare organizations will have integrated these technologies into their supply chain operations, significantly improving transparency and reducing waste. Moreover, regulatory changes and policy initiatives aimed at improving healthcare delivery and patient outcomes will further catalyze the growth of the HSCM market. The push for value-based care models is expected to drive healthcare providers to adopt more sophisticated supply chain solutions that align with these new reimbursement structures. Additionally, the ongoing emphasis on sustainability and reducing environmental impact will lead to the adoption of greener supply chain practices, which are projected to become a standard in the industry. As these trends unfold, the HSCM market will not only expand in size but also evolve in sophistication, positioning itself as a critical component of the overall healthcare ecosystem.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 2.04 Billion |

| Growth Rate | 15.40% (2022-2030) |

Healthcare Supply Chain Management Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.