Healthcare Supply Chain Management Market Summary

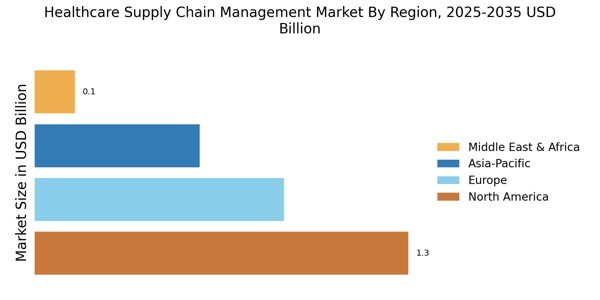

As per Market Research Future analysis, the Healthcare Supply Chain Management Market was estimated at 3.9 USD Billion in 2025. The Healthcare Supply Chain Management industry is projected to grow from 4.1 USD Billion in 2026 to 7.2 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.33% during the forecast period 2026- 2035

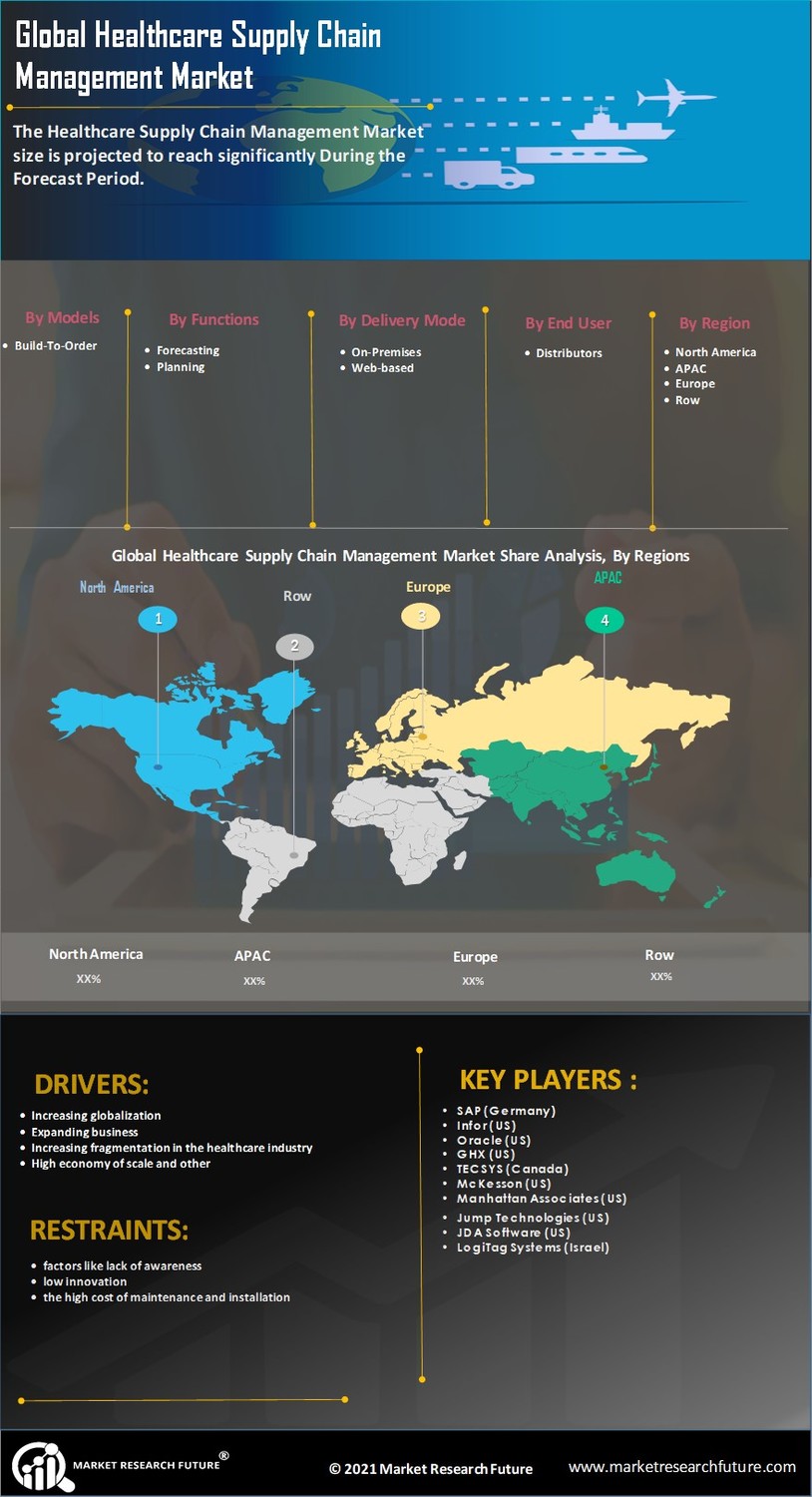

Key Market Trends & Highlights

The Healthcare Supply Chain Management Market is experiencing a transformative shift driven by technological advancements and sustainability efforts.

- Technological integration is reshaping supply chain processes, enhancing efficiency and responsiveness.

- Sustainability initiatives are becoming increasingly vital, influencing procurement and logistics strategies.

- Data-driven decision making is gaining traction, particularly in the forecasting and planning segment.

- Rising demand for efficient logistics and the adoption of advanced technologies are key drivers propelling growth in North America and Asia-Pacific.

Market Size & Forecast

| 2025 Market Size | 3.9 (USD Billion) |

| 2035 Market Size | 7.2 (USD Billion) |

| CAGR (2026 - 2035) | 6.33% |

Major Players

McKesson Corporation (US), Cardinal Health, Inc. (US), AmerisourceBergen Corporation (US), Owens & Minor, Inc. (US), Celesio AG (DE), Henry Schein, Inc. (US), B. Braun Melsungen AG (DE), Fresenius SE & Co. KGaA (DE), Medline Industries, Inc. (US)