Top Industry Leaders in the Heat-Assisted Magnetic Recording Device Market

Competitive Landscape of Heat-Assisted Magnetic Recording (HAMR) Device Market

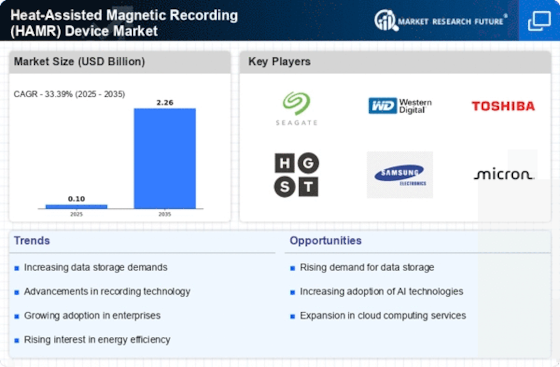

The ever-growing digital universe demands increasingly sophisticated data storage solutions. In this arena, Heat-Assisted Magnetic Recording (HAMR) technology emerges as a promising contender, offering higher data densities on hard disk drives (HDDs) compared to conventional methods. This has ignited a fierce competitive landscape, with established players and emerging challengers vying for market dominance.

Some of the Heat-Assisted Magnetic Recording Device companies listed below:

- Western Digital Corporation

- Seagate Technology LLC

- Toshiba Corporation

- TDK Corporation

- Transcend

- ADATA Technology Co., Ltd.

- Cyxtera Technologies.

- Digital Ocean, LLC.

- Linode LLC.

- Equinix, Inc.

Factors Shaping Market Share Analysis:

Analyzing market share in the HAMR landscape requires a nuanced approach, considering various factors beyond just sales figures. These include:

- Technology Leadership: Companies with advanced HAMR technology, faster data transfer rates, and lower power consumption hold an edge.

- Production Capacity and Cost Efficiency: Efficient manufacturing processes and lower production costs are crucial for wider adoption, especially in cost-sensitive segments.

- Market Penetration and Partnerships: Strong partnerships with key OEMs, cloud providers, and data centers facilitate market penetration and drive demand.

- Product Portfolio and Diversification: Offering a diverse range of HAMR drives catering to different storage needs (e.g., nearline, enterprise) expands market reach.

- Post-Sales Support and Reliability: Providing robust after-sales support and ensuring data reliability are essential for building customer trust.

Emerging Players and Disruptive Potential:

While established players hold sway, the HAMR market is witnessing the emergence of new, agile companies with disruptive potential. Startups like Adata Technology and InnoDisk are focusing on niche segments like high-performance computing and gaming, offering specialized HAMR drives with unique features. Additionally, research institutions and universities are actively involved in developing next-generation HAMR technologies, posing potential threats to established players if successfully commercialized.

Latest Company Updates:

On Oct. 22, 2023, Seagate Technology Holdings plc, a leading global data storage company, announced that it is all set to ramp up production of its Heat Assisted Magnetic Recording (HAMR) HDDs in early 2024. The company has been sampling its 32TB HAMR HDDs at the 2023 International Broadcasting Conference in Amsterdam. Seagate's 30TB HAMR drives are in evaluation with potential customers and will be shipping in their Corvault Storage systems by the end of 2023.

On Feb.09, 2022, Toshiba announced that its 30TB disk drive would arrive by 2024. The company plans to leverage its proprietary recording technologies, like FC-MAMR, MAS-MAMR, and disk stacking tech, to enhance HDD capacities to 30TB by the end of March 2024.

Toshiba revealed it in a chart presented to analysts over two investor relations in Tokyo ahead of its Q3 results for fiscal 2021, which ended on Dec. 31, 2021. The chart also shows that it is introducing Heat-Assisted Magnetic Recording (HAMR) alongside MAS MAMR drives in its fiscal 2025. Both drives are at the 35TB level and are scheduled to expand beyond the 40TB level in Toshiba's fiscal 2026.

On Jan.29, 2022, Seagate, a leading global hard drive manufacturer, announced that it has started shipping enormous 22TB hard drives to some of its customers. The company uses shingled magnetic recording (SMR) technology to squeeze more terabytes out of its biggest drives. These highest-capacity drives provide better random read and write speeds than SMR disks but at a lower density.

Seagate has continually worked on heat-assisted magnetic recording (HAMR) drives for more dramatic capacity boosts. Also, the company has been testing with some of its customers for a few years now. Seagate was aiming for 30TB drives by 2023, 50TB drives in 2026, and 100TB drives by 2030.