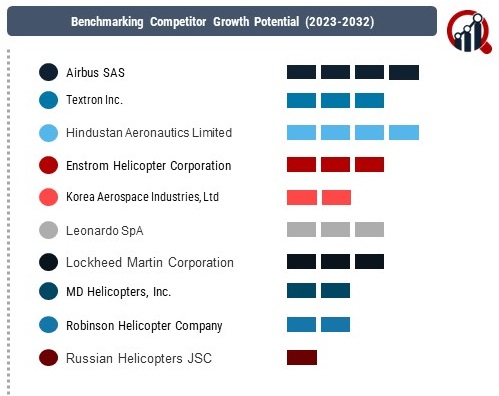

Top Industry Leaders in the Helicopters Market

Key players:

Airbus SAS

Textron Inc.

Hindustan Aeronautics Limited

Enstrom Helicopter Corporation

Korea Aerospace Industries, Ltd

Leonardo SpA

Lockheed Martin Corporation

MD Helicopters, Inc.

Robinson Helicopter Company

Russian Helicopters JSC

Aviation Industry Corporation of China

Boeing

Strategies Adopted

The competitive landscape of the helicopters market is characterized by a mix of established players, emerging companies, and continuous technological advancements. As the demand for helicopters continues to grow across various sectors, including defense, commercial aviation, and emergency medical services, companies are strategically positioning themselves to capitalize on these opportunities.

To maintain and enhance their market positions, these established players often adopt strategies such as product innovation, strategic partnerships, and mergers and acquisitions. Innovation plays a crucial role in gaining a competitive edge, with companies investing in research and development to introduce advanced technologies, improve fuel efficiency, and enhance overall performance. Strategic partnerships, both within the industry and with government entities, enable companies to access new markets and collaborate on cutting-edge projects.

In addition to the established players, there is a growing presence of new and emerging companies entering the helicopters market. These companies often focus on niche markets or specific technological advancements to differentiate themselves. One example is Kopter Group, a Swiss-based company that specializes in light and medium single-engine helicopters. As these emerging companies gain traction, they contribute to the diversification of the market, offering customers a broader range of choices and driving overall innovation.

Factors influencing market share analysis in the helicopters sector are multifaceted. Product performance, reliability, operational capabilities, and pricing all play critical roles. The ability to provide comprehensive solutions, including maintenance and support services, is becoming increasingly important. Customer relationships and after-sales service are crucial for customer retention and securing repeat business, especially in the context of long-term contracts with defense and government agencies.

Emerging Companies

Market share is also influenced by geographical presence, as companies strive to establish a strong foothold in key regions. Localized manufacturing and assembly facilities help reduce costs and enhance responsiveness to regional customer needs. Moreover, compliance with regulatory standards and certifications is pivotal for gaining market acceptance, especially in the defense sector where stringent quality and safety requirements prevail.

In terms of industry news, ongoing developments in electric and hybrid propulsion systems are garnering significant attention. With a global push toward sustainability and reduced environmental impact, companies are investing in the development of electric helicopters. Airbus, for instance, has been actively exploring eVTOL (electric vertical take-off and landing) concepts, reflecting a broader industry trend toward electrification. Such innovations are not only aimed at addressing environmental concerns but also at reducing operational costs and enhancing the versatility of helicopters.

Recent News

In a recent development, the helicopters market has witnessed strategic partnerships and significant contract agreements among key players. In June 2022, Airbus Helicopters SAS, a prominent player based in France, joined forces with KLK Motorsport and Modell- und Formenbau Blasius Gerg GmbH, both based in Germany. This collaboration is aimed at designing, developing, and manufacturing the rear structure of CityAirbus NextGen, an ongoing multinational project initiated by Airbus Helicopters. The focus of this partnership lies in creating an ultra-lightweight rear fuselage for the CityAirbus NextGen, highlighting the industry's commitment to innovation and cutting-edge technology.

In April 2021, Leonardo S.p.A, an Italian aerospace and defense company, made a significant move by acquiring Kopter Group AG, based in Switzerland. Following this acquisition, Leonardo rebranded the SH09 single-engine helicopter as AW09. This strategic integration aligns seamlessly with Leonardo's helicopters division portfolio, offering customers increased modularity and a diverse range of options. This move reflects the trend of companies expanding their product portfolios through acquisitions, enhancing their capabilities and market presence.

Another noteworthy development occurred in April 2022, where Bell Helicopter, a subsidiary of Textron Inc. based in the United States, entered into a purchase agreement with Karen SA from Switzerland. The agreement involved the procurement of two Bell 505 helicopters by Karen SA, intending to utilize them for VIP and commercial flights, as well as for providing pilot training courses. This contract underscores the demand for versatile and reliable helicopters for various applications, including luxury travel and training purposes.

Sikorsky, a Lockheed Martin company based in the United States, made headlines in June 2022 with the signing of a substantial 5-year contract with the United States government. The contract entails the delivery of a baseline of 120 H-60M Black Hawk helicopters on behalf of the US Army and Foreign Military Sales (FMS) customers. This long-term commitment underscores Sikorsky's position as a key player in the defense sector, providing advanced helicopter solutions to meet the evolving needs of military forces. Such contracts contribute significantly to the company's revenue stream and reinforce its standing in the global defense market.