Hematology Analyzers Market Summary

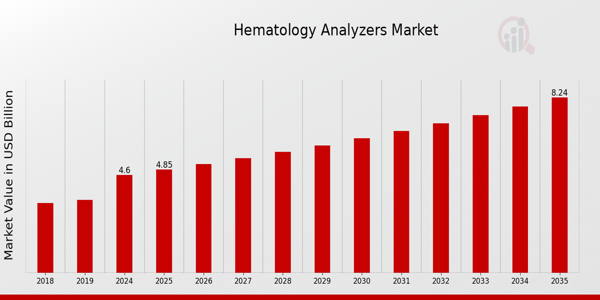

As per Market Research Future Analysis, the Hematology Analyzers Market was valued at 4.6 USD Billion in 2024 and is projected to grow to 8.2 USD Billion by 2035, reflecting a CAGR of 5.44% from 2025 to 2035. The market is driven by the rising incidence of blood disorders and technological advancements in diagnostic tools.

Key Market Trends & Highlights

The Global Hematology Analyzers Market is experiencing significant trends influenced by technology and healthcare demands.

- The market is expected to reach 4.83 USD Billion in 2025.

- Automated Hematology Analyzers are projected to grow from 2.58 USD Billion in 2024 to 4.54 USD Billion by 2035.

- The demand for personalized medicine is expected to create a market valued at approximately 2.45 trillion USD by 2024.

- North America is anticipated to lead the market with a valuation of 2.1 USD Billion in 2024.

Market Size & Forecast

2024 Market Size: USD 4.6 Billion

2035 Market Size: USD 8.2 Billion

CAGR (2025-2035): 5.44%

Largest Regional Market Share in 2024: North America

Major Players

Key players include Abbott Laboratories, ChemoMetec A/S, Diatron, Thermo Fisher Scientific, Sysmex Corporation, Horiba Ltd, Roche Diagnostics, Agilent Technologies, CellaVision AB, Nihon Kohden Corporation, BioRad Laboratories, PerkinElmer, Mindray Medical International, Siemens Healthineers, and Beckman Coulter.

Key Hematology Analyzers Market Trends Highlighted

The Hematology Analyzers Market is experiencing several significant trends that are shaping its landscape. Key market drivers include the increasing prevalence of blood disorders, a growing aging population, and advancements in technology that enhance diagnostic accuracy. The rise in routine health check-ups and preventive healthcare initiatives also plays a crucial role, as healthcare providers and patients increasingly seek precise hematological analysis for early detection and management of diseases.

Opportunities to be explored or captured lie in the development of compact, user-friendly analyzers that can be used in point-of-care settings.As healthcare systems around the world work to make diagnostic services easier to access, portable hematology analyzers can help people in rural and underserved areas a lot. Recent trends show that labs are moving toward more automation and integration. Many healthcare facilities are choosing automated hematology analyzers because they can make processes more efficient and lower the risk of human error.

There is also a greater focus on connectivity features, like linking analyzers to laboratory information systems (LIS), which makes data management easier and speeds up workflows. The market is also seeing a rise in the need for systems that can do full analyses with higher throughput, in order to keep up with the growing number of tests being done around the world. This trend fits with the fact that healthcare practices are becoming more global, with labs in developing areas improving their abilities to meet international standards.

The hematology analyzers market is likely to change even more as the focus shifts to personalized medicine. This will lead to new ideas and investments in cutting-edge technology.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Hematology Analyzers Market Drivers

Increasing Incidence of Hematological Disorders

The Hematology Analyzers Market is experiencing significant growth due to the rising prevalence of hematological disorders such as anemia, leukemia, and other blood-related diseases. According to the World Health Organization (WHO), approximately 1.6 billion people are affected by anemia globally, highlighting a substantial demand for hematology analyzers to diagnose and monitor these conditions.

The presence of established organizations like the American Society of Hematology is promoting awareness and advancing research in this field, leading to an urgent need for advanced diagnostic tools.The growth in this area is also reinforced by government health initiatives focused on improving healthcare infrastructure and disease management, emphasizing the importance of accurate hematological assessments in clinical settings.

Technological Advancements in Hematology Analyzers

Innovations and advancements in technology are significantly driving the Hematology Analyzers Market. Enhanced features such as automation, integration with laboratory information systems, and advanced data analytics are making hematology analyzers more efficient and user-friendly. Major companies like Siemens Healthineers and Abbott Laboratories are investing in Research and Development to enhance their product offerings, facilitating accurate and timely blood analysis.

Moreover, the introduction of point-of-care testing options is expected to expand the usage of hematology analyzers in various healthcare settings, contributing to an increased market share.

Rising Geriatric Population

The Hematology Analyzers Market is positively influenced by the increasing geriatric population, which is more susceptible to various blood disorders. It is projected that by 2050, the global population aged 60 years and older will reach 2.1 billion, as per the United Nations data. This demographic shift necessitates regular health screenings and diagnostics, including hematological assessments. As organizations such as AARP (American Association of Retired Persons) engage in awareness campaigns regarding healthy aging, there will be a growing demand for hematology analyzers to monitor the health of the elderly, ensuring continuous market growth.

Growing Demand for Blood Donation and Screening

The Hematology Analyzers Market is driven by the increasing emphasis on blood donation and screening programs, which are essential for public health. The World Blood Donor Day, celebrated annually, aims to encourage voluntary blood donation and educate communities about the importance of safe blood. This initiative is backed by governmental health organizations globally, highlighting the need for precise hematological evaluations.

According to the Global Status Report on Blood Safety and Availability by WHO, it has been noted that blood donations have increased by 10% over the last five years in various countries.The rising awareness and national health campaigns will bolster the need for hematology analyzers in blood banks and laboratories, thereby enhancing market growth.

Hematology Analyzers Market Segment Insights

Hematology Analyzers Market Product Type Insights

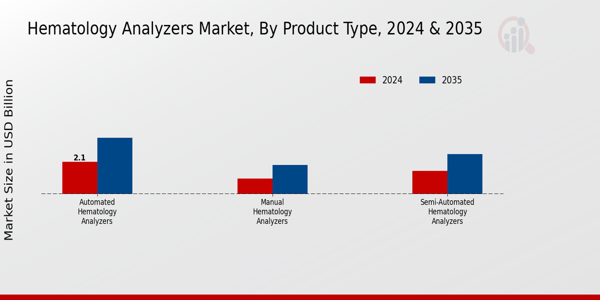

The Hematology Analyzers Market is projected to exhibit notable growth, with segmentations that shed light on the varying types of products available. The market's overall valuation reached 4.6 billion USD in 2024, reflecting a robust demand for hematology analyzers in clinical laboratories and diagnostic centers. Within this segment, Automated Hematology Analyzers are anticipated to dominate, showing a valuation of 2.1 billion USD in 2024 and are expected to grow to 3.7 billion USD by 2035.

This substantial market share is attributed to the high efficiency, accuracy, and speed that automated systems provide in processing blood samples, significantly reducing the time taken for diagnosis.Following this, Semi-Automated Hematology Analyzers hold a significant position with a valuation of 1.5 billion USD in 2024, projected to increase to 2.6 billion USD by 2035. These analyzers offer a balance between manual and automated approaches, making them appealing to laboratories with moderate workloads that require operator involvement but still benefit from digital assistance.

On the other hand, Manual Hematology Analyzers, valued at 1.0 billion USD in 2024 and expected to reach 1.9 billion USD by 2035, are witnessing a slower growth trajectory.Although they serve specific niches where automation may not be justified, their relevance is diminishing in comparison to more advanced systems. The significant holding of Automated Hematology Analyzers in the market underscores the ongoing trend towards automation and efficiency in laboratory practices globally.

The overall market statistics demonstrate a clear shift towards innovation and technology adoption in the hematology sector, converging on the need for speedy diagnostics in the face of rising health concerns and increasing laboratory demands.Growth drivers include an increase in the prevalence of blood disorders, advancements in technology, and the need for more efficient diagnostic tools, while challenges may involve costs related to upgrading existing systems and training personnel. The opportunities for growth abound in the varied applications of hematology analyzers across research and clinical diagnostics, positioning the Hematology Analyzers Market as a vital component of modern healthcare industry dynamics.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Hematology Analyzers Market Technology Insights

The Hematology Analyzers Market is projected to reach a value of 4.6 USD billion by 2024, with significant growth anticipated in the coming years. Within this market, the Technology segment is integral, utilizing advanced methodologies to enhance diagnostic accuracy and efficiency. Notably, Flow Cytometry has emerged as a vital technology in hematology, allowing for precise cell analysis and significantly contributing to the diagnosing of hematologic diseases.

Electrical Impedance and Optical Technology also play crucial roles; Electrical Impedance is widely recognized for its ability to provide reliable cell counts, while Optical Technology is known for generating detailed morphological information, making it significant for laboratories worldwide.Collectively, these technologies are enhancing the capabilities of hematology analyzers, responding to the increasing global demand for accurate and efficient blood diagnostics. The ongoing developments and research within these technological approaches are driving the market growth, enabling healthcare professionals to make informed decisions based on precise hematological data.

Moreover, as global healthcare standards rise, there is a growing opportunity for innovation and integration within the Hematology Analyzers Market, further solidifying the importance of the Technology segment.

Hematology Analyzers Market End User Insights

The Hematology Analyzers Market, valued at 4.6 billion USD in 2024, showcases significant growth driven by various end users, including hospitals, diagnostic laboratories, research laboratories, and blood banks. Hospitals play a crucial role as they are primary users of hematology analyzers due to the high volume of tests required for patient diagnosis and management.

Diagnostic laboratories are also pivotal in this market, catering to various external clients and providing specialized testing services, while research laboratories enhance the understanding of hematology through advanced analytics, which aids in new therapeutic developments.Blood banks are essential as they ensure a safe blood supply by utilizing hematology analyzers for blood grouping and compatibility testing. The increasing prevalence of blood disorders and the need for timely and accurate diagnostic tools stimulate market growth, while the rising demand for automated systems presents opportunities and challenges in terms of balancing cost and performance.

With the Hematology Analyzers Market expected to expand further by 2035, the importance of these end users remains significant in meeting healthcare requirements globally.

Hematology Analyzers Market Application Insights

The Hematology Analyzers Market, particularly in the Application segment, showcases significant growth potential, with the market expected to reach a valuation of 4.6 billion USD by 2024 and further grow to 8.2 billion USD by 2035. This growth is driven by advancements in technology and an increasing prevalence of blood-related diseases, enhancing the demand for accurate and efficient diagnostic tools.

Within this segment, Complete Blood Count (CBC) applications are critical, as they provide essential insights into overall health and detect a variety of conditions such as anemia and infection.Hemoglobin Testing plays a pivotal role by assessing oxygen-carrying capacity, which is crucial for diagnosing hemoglobin disorders. Additionally, Platelet Counting stands out as a vital process for monitoring blood clotting conditions and managing diseases like thrombocytopenia. The dominance of these applications within the Hematology Analyzers Market is evident as they fulfill the essential needs of healthcare providers and laboratories, enabling comprehensive patient care and management.

This market is characterized by innovative technological solutions that promise improved effectiveness and accuracy in hematological diagnostics on a global scale.

Hematology Analyzers Market Regional Insights

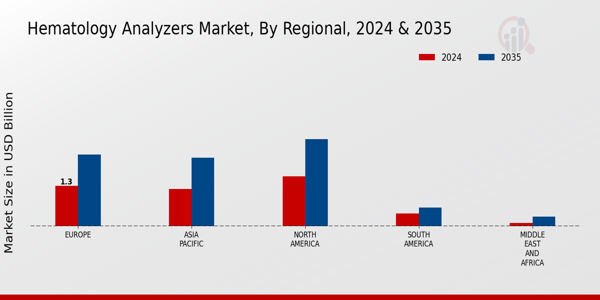

The Hematology Analyzers Market demonstrates varied valuations across regional segments, specifically projected at 4.6 billion USD in 2024 and expected to reach 8.2 billion USD by 2035. North America leads this market with a value of 1.6 billion USD in 2024, increasing to 2.8 billion USD by 2035, indicating its dominance in the healthcare infrastructure and high demand for advanced diagnostic tools.

Europe follows closely with a valuation of 1.3 billion USD in 2024, anticipated to grow to 2.3 billion USD by 2035, showcasing significant investment in Research and Development.The Asia Pacific region is valued at 1.2 billion USD for 2024, expected to rise to 2.2 billion USD, reflecting its growing healthcare sector and increasing patient population. South America, though smaller, shows steady growth from 0.4 billion USD to 0.6 billion USD, indicating an emerging opportunity.

The Middle East and Africa represent the least value at 0.1 billion USD in 2024, growing to 0.3 billion USD, suggesting potential for development in this underrepresented market. As regional dynamics evolve, factors such as technological advancements, growing prevalence of blood disorders, and increased healthcare spending drive the Hematology Analyzers Market revenue in all segments.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Hematology Analyzers Market Key Players and Competitive Insights

The Hematology Analyzers Market is characterized by intense competition, driven by a surge in demand for diagnostic solutions and technological advancements. This market encompasses a diverse range of products used for analyzing blood samples to detect various diseases and health conditions. Various manufacturers are continuously striving to innovate and enhance their product offerings to capture significant market share.

The competitive landscape is shaped by the entry of new players and strategic partnerships among established firms, which are increasingly focusing on research and development to expand their capabilities. The adoption of automation and digital technologies in hematology analyzers is also reshaping competition, leading to improved efficiency and accuracy in patient care.

Beckman Coulter holds a prominent position in the Hematology Analyzers Market, leveraging its extensive expertise in laboratory diagnostics to provide advanced hematology solutions. The company is well-known for its innovative products that combine speed and accuracy, thereby meeting the evolving needs of healthcare providers.

Beckman Coulter's strengths lie in its broad product portfolio, which includes advanced analyzers capable of handling high volumes of samples while ensuring reliable results. The company's strong global presence is further supported by its commitment to customer service and its solid reputation in the industry. With a strong focus on continuous improvement and adaptation to emerging healthcare trends, Beckman Coulter continues to be a formidable competitor in the market for hematology analyzers.Provenia S.A. is another key player in the Hematology Analyzers Market, known for its commitment to delivering high-quality solutions that enhance laboratory efficiency and accuracy.

The company offers a range of products tailored to meet the needs of various healthcare settings, prioritizing user-friendly designs and innovative technology. Provenia S.A. has established a solid market presence, thanks in part to its ongoing focus on research and development to expand its product line.

The company is also recognized for strategic mergers and acquisitions that have bolstered its capabilities and market share on a global scale. With a strong emphasis on quality and reliability, Provenia S.A. continues to develop key products and services that cater to the demands of the global healthcare community, positioning itself as a reputable competitor in the hematology assessment landscape.

Key Companies in the Hematology Analyzers Market Include

- Beckman Coulter

- Provenia S.A.

- Diatron

- Roche Diagnostics

- Siemens Healthineers

- HemoCue AB

- Horiba Ltd

- Sysmex Corporation

- Mindray Medical International

- Nihon Kohden Corporation

- Ortho Clinical Diagnostics

- Abbott Laboratories

- Bio-Rad Laboratories

Hematology Analyzers Market Developments

Recent changes in the Hematology Analyzers Market show that major players are making big strides and changing their strategies. Beckman Coulter and Roche Diagnostics are still at the forefront of innovation by making cutting-edge hematology analyzers that make lab work easier and more accurate. In February 2024, Sysmex Corporation made a strategic alliance with CellaVision to improve its research and development in hematology imaging and analysis technologies.

The goal of this partnership is to speed up the spread of integrated solutions in hematology labs around the world.

In April 2024, Mindray Medical International released its BC-700 Series hematology analyzers. These are made for small to mid-sized labs and combine CBC and ESR testing to make clinical work more efficient and speed up the process of diagnosing patients.

The value of the Hematology Analyzers Market has been rising steadily, mostly because more diagnostic labs are using them, there is more focus on patient-centered care, and healthcare budgets are growing around the world. In the last few years, companies like Siemens Healthineers have also talked about working with healthcare systems to make it easier to use advanced hematology technologies in everyday clinical practice. These new technologies and strategic partnerships are expected to help established companies stay on top, support the trend toward more automated labs, and meet the changing needs of healthcare providers around the world.

Hematology Analyzers Market Segmentation Insights

Hematology Analyzers Market Product Type Outlook

- Automated Hematology Analyzers

- Semi-Automated Hematology Analyzers

- Manual Hematology Analyzers

Hematology Analyzers Market Technology Outlook

- Flow Cytometry

- Electrical Impedance

- Optical Technology

Hematology Analyzers Market End User Outlook

- Hospitals

- Diagnostic Laboratories

- Research Laboratories

- Blood Banks

Hematology Analyzers Market Application Outlook

- Complete Blood Count

- Hemoglobin Testing

- Platelet Counting

Hematology Analyzers Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

4.38 (USD Billion)

|

|

Market Size 2024

|

4.6 (USD Billion)

|

|

Market Size 2035

|

8.2 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

5.44% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Beckman Coulter, Provenia S.A., Diatron, Hematology Innovations, Roche Diagnostics, Siemens Healthineers, HemoCue AB, Horiba Ltd, Sysmex Corporation, Mindray Medical International, Nihon Kohden Corporation, Ortho Clinical Diagnostics, Abbott Laboratories, BioRad Laboratories

|

|

Segments Covered

|

Product Type, Technology, End User, Application, Regional

|

|

Key Market Opportunities

|

Rising demand for point-of-care testing, Technological advancements in automation, increasing prevalence of blood disorders, growing investments in research and development, and Expansion of healthcare infrastructure in emerging markets

|

|

Key Market Dynamics

|

Technological advancements, increasing prevalence of blood disorders, rising elderly population, growing demand for point-of-care testing, and Enhanced healthcare infrastructure

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Frequently Asked Questions (FAQ):

The Hematology Analyzers Market is expected to be valued at 4.6 USD Billion in 2024.

By 2035, the Hematology Analyzers Market is anticipated to reach a value of 8.2 USD billion.

The expected compound annual growth rate (CAGR) for the Hematology Analyzers Market during this period is 5.44%.

North America is expected to dominate the Hematology Analyzers Market, valued at 1.6 USD Billion in 2024.

By 2035, the Asia Pacific region is projected to contribute approximately 2.2 USD Billion to the Hematology Analyzers Market.

The market value of Automated Hematology Analyzers is expected to reach 3.7 USD billion by 2035.

Major players in the market include Beckman Coulter, Roche Diagnostics, Siemens Healthineers, and Sysmex Corporation.

The market value of Semi-Automated Hematology Analyzers is forecasted at 1.5 USD Billion in 2024.

Manual Hematology Analyzers are anticipated to reach a market size of 1.9 USD billion by 2035.

Challenges may include regulatory hurdles, technological advancements, and competition from emerging players in the market.