Hemp Based Products Size

Market Size Snapshot

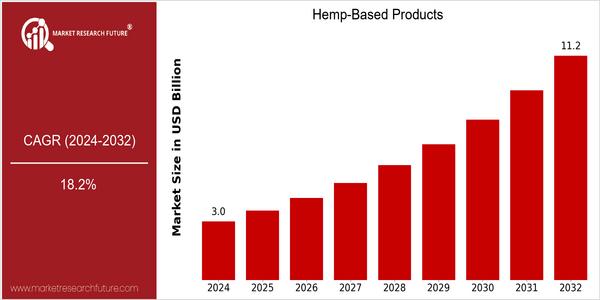

| Year | Value |

|---|---|

| 2024 | USD 2.95 Billion |

| 2032 | USD 11.25 Billion |

| CAGR (2024-2032) | 18.2 % |

Note – Market size depicts the revenue generated over the financial year

The hemp market is expected to grow from $2.95 billion in 2024 to $11.25 billion by 2032. This is a CAGR of 18.2 percent over the forecast period. The rise in this market is driven by a growing awareness of the health benefits of hemp and the acceptance of hemp in different industries. Moreover, the legalization of hemp production in several regions has opened up new opportunities for the development of new products and the expansion of the market. Also driving the growth of the market is the development of new extraction and processing methods that can produce high-quality hemp products that meet various customer needs. Also, the major players in the market, such as Charlotte's Web Holdings, Inc., Canopy Growth, Inc., and Aurora Cannabis, Inc., are engaged in strategic activities, such as collaborations and product launches, to strengthen their position in the market. For example, the recent collaborations to develop new hemp-based formulations and expand distribution channels indicate the dynamism of the competitive landscape and the readiness of these companies to take advantage of the growing demand for hemp-based products.

Regional Market Size

Regional Deep Dive

The market for hemp products is experiencing significant growth in several regions, mainly driven by the rising awareness of consumers about the health benefits of hemp-derived products and the shift towards sustainable and natural alternatives. In North America, particularly the United States, the market is gaining momentum from the easing of regulations and the growing acceptance of hemp in various industries, including food, cosmetics and textiles. In Europe, the demand for hemp products is increasing as a result of the stricter regulation of synthetic products and the trend towards organic and eco-friendly products. In Asia-Pacific, China and Australia are investing in hemp cultivation and product development, while in the Middle East and Africa, hemp is beginning to be seen as an important cash crop. In Latin America, the demand for hemp products is driven by both local demand and export opportunities, especially in the health and beauty sector.

Europe

- The European Union has implemented regulations that promote the use of hemp in food products, allowing for the sale of hemp seeds and oils, which has spurred innovation in the food and beverage sector.

- Countries like Germany and the Netherlands are leading the way in research and development of hemp-based textiles, with companies like HempFlax and Freudenberg developing sustainable fabric solutions.

Asia Pacific

- China is the largest producer of hemp globally, with significant investments in hemp cultivation and processing, leading to a robust supply chain for hemp-based products.

- Australia has recently relaxed its regulations on hemp cultivation, allowing for increased production and the development of a local market for hemp foods and cosmetics.

Latin America

- Countries such as Uruguay and Colombia are leading the way in hemp legislation, with regulatory frameworks that support the cultivation and commercialization of hemp products.

- Local companies are increasingly focusing on the production of hemp-based textiles and personal care products, tapping into both domestic and international markets.

North America

- The 2018 Farm Bill in the United States legalized hemp cultivation, leading to a rapid increase in the number of hemp farms and a diversification of hemp-based products available in the market.

- Major companies like Charlotte's Web and Canopy Growth are expanding their product lines to include CBD-infused foods and beverages, reflecting a growing consumer interest in wellness products.

Middle East And Africa

- Countries like South Africa are beginning to recognize the economic potential of hemp, with government initiatives aimed at promoting hemp cultivation for both local use and export.

- The UAE is exploring the use of hemp in construction materials, with projects like the Dubai Hemp House showcasing innovative applications of hemp in sustainable building.

Did You Know?

“Hemp can produce over 25,000 different products, ranging from textiles and biodegradable plastics to food and health supplements, showcasing its versatility as a raw material.” — Hemp Industries Association

Segmental Market Size

The hemp food sector plays an important role in the overall hemp market, which is currently experiencing a very positive development due to a growing awareness of the health benefits and a growing interest in plant-based nutrition. Moreover, the shift towards natural and organic food in the western world, which is supported by favorable legislation in North America and Europe, is causing an increase in demand. Manitoba Harvest and Nutiva are among the leading companies in this sector, and the products on offer range from hemp seed oil to hemp seed flour, to hemp milk, to hemp flakes and hemp snacks, and are available in all major retail chains. The main areas of application of hemp food are as a nutritional supplement, a source of protein and a functional food. Hemp seed is used in granola bars and hemp milk is used in smoothies. Also driving growth is the current trend towards clean labeling and sustainable production, as consumers are looking for more sustainable products. The technological development of the sector is also important for the further development of hemp food. The advanced extraction methods and the innovations in product development are enabling the companies to further increase the quality and diversity of their products and to respond to the changing preferences of health-conscious consumers.

Future Outlook

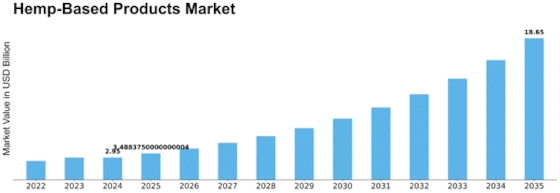

From 2024 to 2032, the market for hemp products is projected to grow from $ 3.1 billion to $ 11.2 billion, a CAGR of 18.2 percent. In this context, it is a question of increasing awareness of the health benefits of hemp-derived products, such as hemp-derived CBD and hemp seed oil, which are gaining traction in the health and personal care sectors. Among health-conscious consumers, the penetration of hemp-based products is expected to increase to more than 30 percent by 2032. The main drivers of this growth are regulatory changes and technological developments in hemp production and processing. In the long run, as governments worldwide continue to relax restrictions on hemp cultivation, the supply chain is expected to stabilize, resulting in lower production costs and greater availability. Meanwhile, innovations in extraction and formulation techniques are expected to improve the quality and effectiveness of hemp-based products and increase their range of applications in the food, cosmetics and pharmaceutical industries. The emerging trends of sustainable development and eco-conscious consumption will also boost the market for hemp-based products, as hemp is recognized for its low impact on the environment compared to other crops. In the end, the market for hemp-based products is destined to become a dynamic sector, driven by increasing demand from consumers, regulatory changes and technological developments.

Leave a Comment