High Molecular Weight Polyisobutylene Size

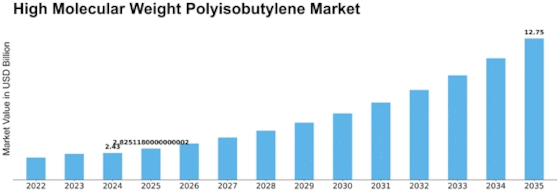

High Molecular Weight Polyisobutylene Market Growth Projections and Opportunities

The High Molecular Weight Polyisobutylene (HM PIB) market is influenced by several market factors that play a pivotal role in determining its growth trajectory. Understanding these factors is crucial for businesses and investors seeking to navigate this specialized segment of the chemical industry. Here are key market factors shaping the High Molecular Weight Polyisobutylene market, presented in a concise pointer format: Automotive Industry Demand: The demand for High Molecular Weight Polyisobutylene is significantly driven by its applications in the automotive sector. HM PIB is used in the production of tire inner liners, sealants, and lubricant additives, addressing key performance requirements in vehicles. The growth of the automotive industry directly impacts the HM PIB market. Tire Manufacturing: A major driver for HM PIB is its role in tire manufacturing. As tire makers seek materials that enhance durability, improve air retention, and provide better resistance to wear and tear, High Molecular Weight Polyisobutylene becomes a preferred choice for tire inner liners, contributing to the overall performance of tires. Increasing Focus on Fuel Efficiency: The automotive industry's emphasis on fuel efficiency and reducing emissions has led to the adoption of advanced materials. HM PIB's contribution to tire efficiency, including reduced rolling resistance, aligns with the industry's goals, driving its use in tire formulations aimed at improving fuel economy. Adhesives and Sealants Industry: HM PIB finds extensive applications in the adhesives and sealants industry. Its excellent properties, such as adhesion, flexibility, and resistance to moisture, make it a key ingredient in various adhesive formulations. The growth of construction and automotive industries directly influences the demand for HM PIB-based adhesives and sealants. Growing Construction Activities: The construction sector's expansion drives the demand for sealants and adhesives, where HM PIB plays a vital role. As construction activities increase globally, the need for reliable and long-lasting sealants contributes to the growth of the HM PIB market. Chemical and Industrial Applications: HM PIB is utilized in various chemical and industrial applications, including lubricant additives, fuel additives, and anti-corrosion coatings. The versatility of HM PIB in enhancing the performance of different products contributes to its demand in a wide range of industrial applications. Technological Advancements: Ongoing technological advancements in the production processes of High Molecular Weight Polyisobutylene influence the efficiency and cost-effectiveness of manufacturing. Companies investing in research and development to enhance production methods and product performance gain a competitive edge in the market. Stringent Regulatory Standards: Compliance with regulatory standards, particularly in the automotive and chemical industries, is a critical factor in the HM PIB market. Adherence to standards related to product safety, environmental impact, and performance specifications is essential for market acceptance and growth. Globalization of Supply Chains: The globalization of supply chains in the chemical industry impacts the HM PIB market. Companies involved in the production and distribution of HM PIB must navigate international trade dynamics, addressing factors such as tariffs, logistics, and regional variations in demand. Raw Material Availability and Pricing: The availability and pricing of raw materials, especially isobutylene, directly influence the production costs of HM PIB. Fluctuations in raw material prices can impact the overall competitiveness of HM PIB-based products in the market.

Leave a Comment