-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce Merchants

- Application

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Intensity of Competitive Rivalry

-

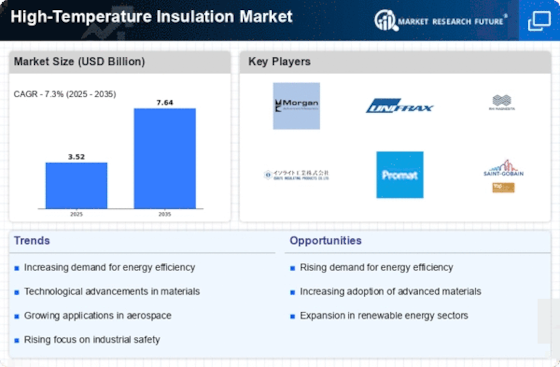

Industry Overview of the Global High Temperature Insulation Market

-

Introduction

-

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

Market Trends

-

Introduction

-

Growth Trends

-

Impact Analysis

-

High Temperature Insulation Market, by Product

-

Introduction

-

Insulating Firebrick

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Ceramic Fiber

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Calcium Silicate

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Others

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

High Temperature Insulation Market, by Application

-

Introduction

-

Petrochemicals

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Refractory

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Iron & Steel

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Cement

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Aluminum

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Glass

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

Others

- Market Estimates & Forecast, 2023-2032

- Market Estimates & High Temperature Insulation Market, by Region, 2023-2032

-

High Temperature Insulation Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Product , 2023-2032

- Market Estimates & Forecast by Application, 2023-2032

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Product , 2023-2032

- Market Estimates & Forecast by Application, 2023-2032

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Netherlands

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Product , 2023-2032

- Market Estimates & Forecast by Application, 2023-2032

- China

- India

- Japan

- Australia

- Malaysia

- South Korea

- Rest of Asia-Pacific

-

9.4.10.5Market Estimates & Forecast by Application, 2023-2032

-

9.4.12.5Market Estimates & Forecast by Application, 2023-2032

-

Middle East & Africa

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Product , 2023-2032

- Market Estimates & Forecast by Application, 2023-2032

- Saudi Arabia

- UAE

- Africa

- Rest of the Middle East & Africa

-

9.5.8.5Market Estimates & Forecast by Application, 2023-2032

-

Latin America

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Product , 2023-2032

- Market Estimates & Forecast by Application, 2023-2032

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Competitive Landscape

-

Introduction

-

Market Key Strategies

-

Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

Company Profiles

-

3M Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Dyson Group

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hi-Temp Insulation Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Insulcon Group

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Isolite Insulating Products Company Ltd.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Pacor Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Promat International NV

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Pyrotek

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Skamol

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Unifrax

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Thermal Ceramics

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Conclusion

-

LIST OF TABLES

-

High Temperature Insulation Market, by Region, 2023-2032

-

North America: High Temperature Insulation Market, by Country, 2023-2032

-

Europe: High Temperature Insulation Market, by Country, 2023-2032

-

Asia-Pacific: High Temperature Insulation Market, by Country, 2023-2032

-

Middle East & Africa: High Temperature Insulation Market, by Country, 2023-2032

-

Latin America: High Temperature Insulation Market, by Country, 2023-2032

-

High Temperature Insulation Product High Temperature Insulation Market, by Region, 2023-2032

-

North America: High Temperature Insulation Product High Temperature Insulation Market, by Country, 2023-2032

-

Europe: High Temperature Insulation Product High Temperature Insulation Market, by Country, 2023-2032

-

Asia-Pacific: High Temperature Insulation Product High Temperature Insulation Market, by Country, 2023-2032

-

Middle East & Africa: High Temperature Insulation Product High Temperature Insulation Market, by Country, 2023-2032

-

Latin America: High Temperature Insulation Product High Temperature Insulation Market, by Country, 2023-2032

-

High Temperature Insulation Market, by Region, 2023-2032

-

North America: High Temperature Insulation Market, by Country, 2023-2032

-

Europe: High Temperature Insulation Market, by Country, 2023-2032

-

Asia-Pacific: High Temperature Insulation Market, by Country, 2023-2032

-

Middle East & Africa: High Temperature Insulation Market, by Country, 2023-2032

-

Latin America: High Temperature Insulation Market, by Country, 2023-2032

-

Global High Temperature Insulation Product High Temperature Insulation Market, by Region, 2023-2032

-

High Temperature Insulation Market, by Region, 2023-2032

-

North America: High Temperature Insulation Market, by Country, 2023-2032

-

North America: High Temperature Insulation Market, by Product , 2023-2032

-

North America: High Temperature Insulation Market, by Application, 2023-2032

-

High Temperature Insulation Market, by Country, 2023-2032

-

Europe High Temperature Insulation High Temperature Insulation Market, by Product , 2023-2032

-

Europe High Temperature Insulation High Temperature Insulation Market, by Application, 2023-2032

-

Asia-Pacific High Temperature Insulation High Temperature Insulation Market, by Country, 2023-2032

-

Asia-Pacific High Temperature Insulation High Temperature Insulation Market, by Product , 2023-2032

-

Asia-Pacific High Temperature Insulation High Temperature Insulation Market, by Application, 2023-2032

-

Middle East & Africa: High Temperature Insulation High Temperature Insulation Market, by Country, 2023-2032

-

Middle East & Africa: High Temperature Insulation High Temperature Insulation Market, by Product , 2023-2032

-

Middle East & Africa: High Temperature Insulation High Temperature Insulation Market, by Application, 2023-2032

-

Latin America: High Temperature Insulation High Temperature Insulation Market, by Country, 2023-2032

-

Latin America: High Temperature Insulation High Temperature Insulation Market, by Product , 2023-2032

-

Latin America: High Temperature Insulation High Temperature Insulation Market, by Application, 2023-2032

-

LIST OF FIGURES

-

High Temperature Insulation Market Segmentation

-

Forecast Methodology

-

Porter’s Five Forces Analysis of High Temperature Insulation Market

-

Supply Chain of High Temperature Insulation Market

-

Share of High Temperature Insulation High Temperature Insulation Market, by Country, 2020 (%)

-

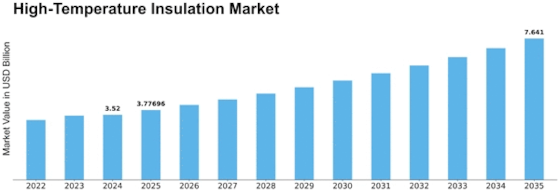

Global High Temperature Insulation Market, 2023-2032

-

Sub Segments of Product

-

High Temperature Insulation High Temperature Insulation Market, by Product , 2020 (%)

-

Share of High Temperature Insulation High Temperature Insulation Market, by Product , 2023-2032

-

Sub Segments of Application

-

High Temperature Insulation High Temperature Insulation Market, by Application, 2020 (%)

-

Share of High Temperature Insulation High Temperature Insulation Market, by Application, 2023-2032

Leave a Comment