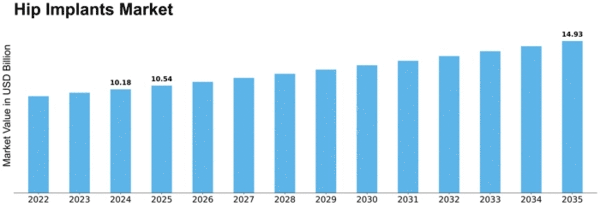

Hip Implants Size

Hip Implants Market Growth Projections and Opportunities

The growing global older populace is a full-size market factor for hip implants. As human beings age, the chance of hip-associated troubles, which include osteoarthritis and hip fractures, rises, driving the demand for hip alternative surgeries and implants. Advances in clinical technology have led to the development of revolutionary hip implant materials and designs. Enhanced durability, decreased put and tear, and progressed surgical techniques contribute to the market increase as patients and surgeons seek more powerful and long-lasting solutions. The availability of health insurance for orthopedic strategies, which includes hip implant surgeries, has a right-away impact on the market boom. As more individuals gain access to coverage plans protecting such surgical procedures, the demand for hip implants may be thrust upward. Stringent regulations and standards set by fitness authorities affect the market dynamics. Compliance with regulatory necessities is vital for manufacturers to ensure the safety and efficacy of hip implants, affecting product improvement and market access. Affordability is a key consideration for both patients and healthcare providers. The value of hip implants and associated surgical methods can affect market growth, with fee sensitivity affecting adoption costs in unique regions. Economic situations impact the purchasing strength of individuals and healthcare institutions. Economic balance and growth contribute to elevated healthcare spending, positively influencing the hip implant market. Intense competition amongst hip implant producers drives innovation and product differentiation. Companies try to increase implants with advanced functions, higher overall performance, and aggressive pricing to benefit market share. Changing life, which includes a focus on fitness and energy growing old, impacts patient options for hip implant solutions. Implants that support an energetic way of life and offer fast healing are in high demand, shaping the market landscape. The availability and high quality of postoperative rehabilitation services are essential for the general fulfillment of hip implant surgical procedures. The rise of scientific tourism, in which people tour other international locations for less costly and extraordinary scientific treatments, influences the global distribution of the hip implant market. Countries with advanced healthcare centers emerge as attractive locations for hip implant surgical procedures.

Leave a Comment