Market Analysis

In-depth Analysis of Hosting Infrastructure Services Market Industry Landscape

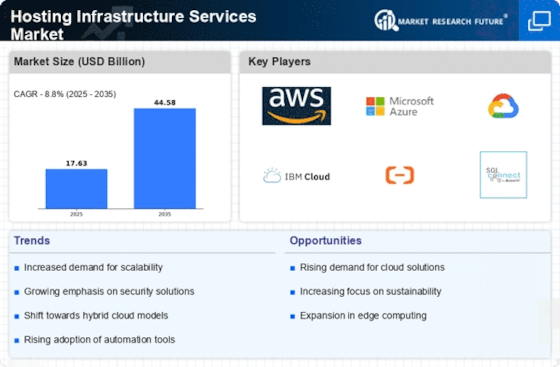

The Hosting Infrastructure Service market is a dynamic and consistently developing region that assumes a widespread element within the automated scenario. As corporations progressively shift towards online stages, the demand for hosting offerings has flooded, riding the market's improvement. The factors of this market are stricken by some key elements that shape its direction. The extreme scenario is one extra primary part of market elements. Various website hosting providers, going from international monsters to unique gamers, attempt to gain market share. Serious competition cultivates advancement and fee talent as companies' enterprise to separate themselves and deal convincing gives. Moreover, consolidations and acquisitions are normal events, reshaping the critical scenario and impacting the elements of the market. Vital groups and coordinated efforts likewise expect a vital component as providers attempt to enhance their administration portfolios and grow their market reach. Client requests and inclinations essentially affect market elements. Organizations are steadily centered around customer revel in, execution, and unwavering first-class, using website hosting providers to improve their infrastructure and services constantly. The demand for specific custom hosting arrangements designed for explicit agencies or programs, such as online enterprises or fact examination, adds intricacy to the market. Security and consistency are important concerns in the Hosting Infrastructure Services market. With the growing recurrence and refinement of virtual risks, organizations are aware of secure website hosting solutions to protect their facts and applications. Consistency with administrative stipulations, mainly in ventures, for instance, cash and medical offerings, affects the selection of website hosting suppliers. Market elements are formed by the ceaseless endeavors of providers to improve protection efforts, collect essential affirmations, and showcase consistency with enterprise pointers. Worldwide monetary circumstances and factors likewise affect the Hosting Infrastructure Services market. Financial slumps may lead businesses to reevaluate their IT spending, influencing the demand for hosting services. International activities can acquaint vulnerabilities associated with data sway and effect picks on choosing web hosting providers with a strong global presence or explicit local attention. Suppliers want to discover those outside factors and modify their methodologies to hold up with versatility in a converting economic and worldwide scenario. Besides, herbal supportability has arisen as a big notion within the Hosting Infrastructure Services market. With a developing awareness of the herbal effect of server farms, suppliers are progressively embracing eco-accommodating practices, for instance, strength-gifted infrastructure and sustainable electricity resources. Market factors reflect a shift in the direction of manageability, with clients displaying an inclination for website hosting suppliers with a promise to natural duty.

Leave a Comment