Market Trends

Key Emerging Trends in the Hydraulic Fluid Market

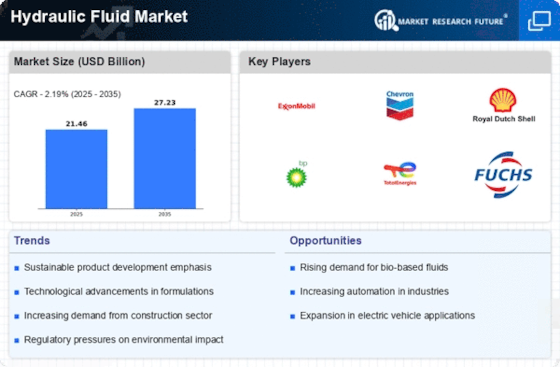

The hydraulic fluid market has seen significant shifts in recent years, driven by evolving industrial needs, technological advancements, and environmental concerns. One notable trend is the increasing demand for environmentally-friendly hydraulic fluids. With growing awareness about climate change and sustainability, industries are actively seeking alternatives to traditional petroleum-based fluids. Bio-based hydraulic fluids, derived from renewable sources such as vegetable oils, are gaining traction due to their lower environmental impact and biodegradability.

The Covid19, which started in China, has radically spread in many nations across the globe. With many states announcing crisis and complete lockdown, many industries are impacted by this, such as hydraulic fluid, tourism sector, transportation sector, and many others. Among many segments which are getting affected extremely in numerous countries, hydraulic fluid is one of them. In fact, hydraulic fluid is a huge sector and comprises the transports sector, manufacturing industries. The work capacity is also fairly great in this sector, and with the pronouncing of the lockdown in many countries, it has been relentlessly affected.

Moreover, there's a notable emphasis on efficiency and performance enhancement within the hydraulic fluid market. Manufacturers are developing innovative formulations to improve the overall efficiency of hydraulic systems, thereby reducing energy consumption and operational costs. Advanced additives and synthetic base oils are being incorporated to enhance thermal stability, oxidation resistance, and lubrication properties, thereby extending the lifespan of hydraulic equipment and minimizing downtime.

Another key trend is the adoption of fire-resistant hydraulic fluids, particularly in high-risk environments such as steel mills, foundries, and mining operations. Fire-resistant fluids offer increased safety by reducing the risk of catastrophic fires in case of hydraulic system failure or leakage. Water-glycol, phosphate ester, and synthetic fluids are among the commonly used fire-resistant options, each offering varying degrees of performance and compatibility with different hydraulic systems.

Additionally, the rapid growth of industrial automation and the Internet of Things (IoT) is driving the demand for specialized hydraulic fluids capable of meeting the stringent requirements of modern hydraulic systems. These fluids must possess superior anti-wear properties, corrosion resistance, and compatibility with advanced filtration systems to ensure optimal performance in automated manufacturing processes.

Furthermore, globalization and the expansion of manufacturing activities across emerging economies are fueling the demand for hydraulic fluids. Developing regions such as Asia-Pacific and Latin America are witnessing robust industrial growth, particularly in sectors such as construction, automotive, and aerospace, driving the need for reliable hydraulic systems and compatible fluids.

However, the market also faces challenges, including volatile raw material prices and regulatory uncertainties. Fluctuations in the prices of base oils and additives can significantly impact the manufacturing costs of hydraulic fluids, thereby affecting pricing strategies and profit margins for manufacturers. Moreover, stringent environmental regulations aimed at reducing emissions and promoting sustainable practices are prompting manufacturers to invest in research and development to develop eco-friendly formulations while ensuring compliance with regulatory standards.

Leave a Comment