Top Industry Leaders in the Hydrogenated Styrene Block Copolymers Market

Hydrogenated Styrene Block Copolymers (HSBCs), occupy a microscopic yet crucial niche in the polymer world. These versatile materials, created by hydrogenating SBS block copolymers, boast unique properties like elasticity, thermal stability, and oil resistance, making them highly sought-after across diverse industries. But beneath the seemingly homogenous surface lies a competitive landscape buzzing with innovation and strategic maneuvers, where established players and niche specialists fight for a share of the microscopic pie.

Hydrogenated Styrene Block Copolymers (HSBCs), occupy a microscopic yet crucial niche in the polymer world. These versatile materials, created by hydrogenating SBS block copolymers, boast unique properties like elasticity, thermal stability, and oil resistance, making them highly sought-after across diverse industries. But beneath the seemingly homogenous surface lies a competitive landscape buzzing with innovation and strategic maneuvers, where established players and niche specialists fight for a share of the microscopic pie.

Strategies Shaping the HSBC Market:

-

Product Diversification: Companies like Kraton Corporation, Asahi Kasei, and SEPS Corporation are constantly refining their offerings, developing HSBCs with tailored functionalities for specific applications. Think high-performance sealants for automotive engines and breathable membranes for hygienic products. -

Vertical Integration: Securing a reliable supply of styrene and hydrogenation technologies is key. Players like LG Chem and Jilin Chemical are investing in backward integration to gain control over the supply chain and optimize costs. -

Focus on Sustainability: Environmental concerns are shaping the market. Companies are adopting greener production processes, using recycled feedstocks, and developing bio-based HSBC alternatives to minimize their environmental footprint and cater to sustainability-conscious customers. -

Geographical Expansion: Emerging economies in Asia and Africa present immense growth potential, especially for applications like footwear and construction materials. Companies like Sinopec and Saudi Aramco are establishing production facilities and partnerships in these regions to capitalize on this rising demand.

Factors Influencing Market Share:

-

Automotive and Construction Demand: These industries remain the primary drivers, with HSBCs finding use in car interiors, tire treads, and building sealants. Technological advancements in these sectors create new opportunities for specialized HSBC solutions. -

Regulation and Environmental Impact: Stringent regulations on volatile organic compounds (VOCs) and emissions drive the demand for low-VOC HSBCs with superior properties. Companies compliant with these regulations gain a competitive edge. -

Innovation and Differentiation: Developing HSBCs with unique properties and tailored functionalities for specific applications is key to differentiation and customer retention. Think self-healing materials for medical devices and conductive composites for electronics. -

Supply Chain Disruptions: Geopolitical tensions and trade wars can disrupt the supply chain of key raw materials and finished products. Companies with flexible sourcing networks and agile production capabilities can weather such disruptions better.

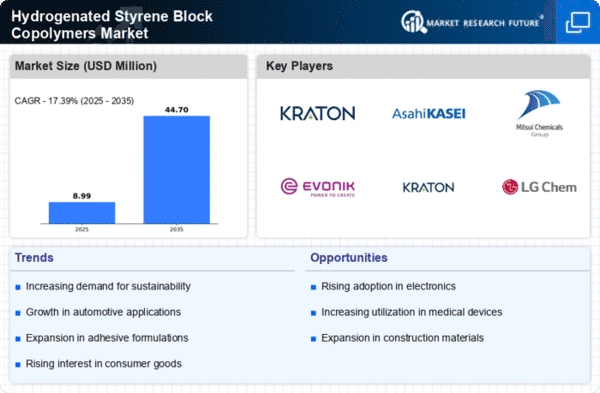

Key Players:

- Kraton Corporation (Japan)

- China Petrochemical Corporation (China)

- LYC GROUP (Taiwan)

- Grupo Dynasol (U.S.)

- The Hexpol group of companies (U.K.)

- Teknor Apex (U.S.)

Recent Developments

-

September 2023: The European Commission proposes stricter regulations on microplastics release from synthetic materials, prompting research into biodegradable and recyclable HSBC options. -

October 2023: Kraton Corporation announces plans to expand its HSBC production capacity in China, catering to the booming Asian market. -

November 2023: A consortium of leading research institutions and industry players launches a collaborative project to develop next-generation HSBCs with enhanced self-healing properties for use in medical and aerospace applications. -

December 2023: The HSBC market exhibits signs of stabilization following a period of price volatility, with cautious optimism for steady growth in 2024 driven by increasing demand and technological advancements.