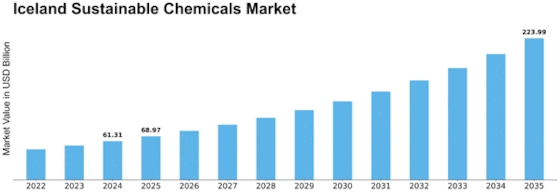

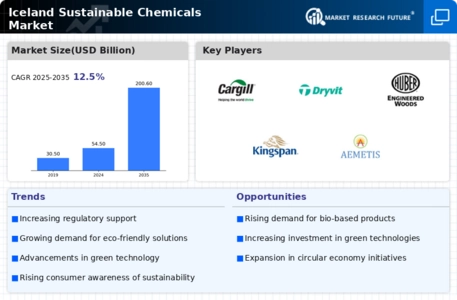

Iceland Sustainable Chemicals Size

Iceland Sustainable Chemicals Market Growth Projections and Opportunities

The Icelandic sustainable chemicals market is affected by various market determinants that shape its dynamics. One of the key propellers is the country's strong commitment to environmental sustainability. Driven by abundant renewable energy resources such as geothermal and hydroelectric power, Iceland has always been at the forefront of adopting green practices. Moreover, governmental policies and regulations play a significant role in shaping the sustainable chemicals market in Iceland. In fact, the Icelandic government has enacted strict environmental laws and standards, thus promoting favorable settings for the adoption of green practices and products through which these incentives are an impetus for businesses to invest in and develop sustainable chemical solutions that can adhere to national eco-friendly efforts. Consumer outlook also contributes significantly to the sustainable chemicals market in Iceland. There is an increasing demand for goods with minimal ecological impact because Icelanders are environmentally conscious people. As consumers' choices become more aligned with their sustainability goals, companies are encouraged to provide innovative alternatives that are gentle to the environment. Furthermore, Iceland's natural geography and ecosystem contribute to its sustainable chemistry sector as a major market determinant. The country's untainted natural setting creates a strong sense of responsibility among people living there about their local ecosystems, hence resulting in preservation that involves their businesses. This intrinsic connection between man and nature, therefore, necessitates sustainable actions, including chemical manufacturing with low levels of impact on the environment. The economic landscape also plays a role in influencing the sustainable chemicals market in Iceland. Evidently, as businesses wake up to realize the economic dividends associated with sustainability, they begin to embrace eco-friendly alternatives more willingly in the future than before. Not only does the integration of sustainable chemicals conform with global sustainability goals, but it also positions Icelandic enterprises as competing entities within international markets frequented by such environmentally sensitive consumers or partners as it is today since this objective will be achieved by attracting environmentally conscious customers from across the globe who loathe using stuff that may not meet today's world requirements over time hence it befits these players in the industry. In addition, sustainable chemistry market growth is facilitated by collaborations and partnerships involving various players such as governments, corporate entities, and academic institutions. Consequently, when different players join hands to investigate, develop, and introduce sustainable solutions, it creates an ecosystem for collaboration that hastens the sustainability transition; hence, on this note, these linkages are platforms for innovation as well as knowledge sharing, which facilitate continuous improvement of sustainable chemical technologies and practices.

Leave a Comment