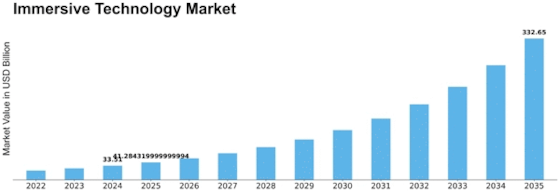

Immersive Technology Size

Immersive Technology Market Growth Projections and Opportunities

In recent years, the Immersive Technology market has grown and changed. Immersive technologies allow consumers to engage with digital information more realistically and immersively. Numerous variables affect Immersive Technology market dynamics.

The Immersive Technology market is growing due to rising user experience expectations. Immersive technologies place users in virtual worlds or overlay digital material on the actual world, providing unique experiences. Immersive technology might transform digital content consumption in gaming, entertainment, training, and education. Immersive technological solutions that improve user experiences are in demand.

The Immersive Technology market is also affected by hardware and software innovations. Better and cheaper VR headsets and AR glasses have made immersive technology more accessible. The immersive experience has also been boosted by technological advances like tracking and rendering. Hardware and software advances are pushing immersive technology usage in gaming, entertainment, healthcare, and manufacturing.

Increased use of immersive technology in training and simulation is changing the Immersive Technology market. Immersive technology allow realistic and interactive teaching. Immersive technology may safely and effectively teach and build skills, from pilot flight simulators to medical professionals' virtual surgical training. Immersive technology use in sectors that demand hands-on training and simulation has expanded, boosting market development.

Growing distant cooperation and communication is also affecting the Immersive Technology market. Companies are looking for solutions to help remote workers collaborate and communicate as firms globalize and remote work grows. Virtual meeting rooms from VR and MR allow distant teams to work and interact as if they were there. Increased usage of immersive remote collaboration technologies has driven market expansion.

Leave a Comment