Immunosuppressive Drugs Size

Immunosuppressive Drugs Market Growth Projections and Opportunities

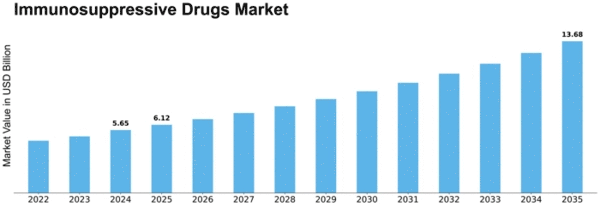

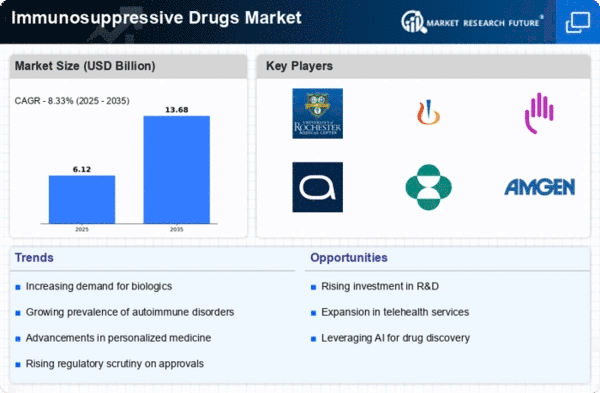

The Immunosuppressive Drugs Market is forecasted to reach a value of USD 9.98 Billion by 2032, with a CAGR of 7.5% the forecast period estimated to be running from 2023 to 2032. The Immunosuppressive Drugs Market is effected by a lot of factors, which interact and set the market dynamics landscape to stimulate growth in it. The main actor here is the growing acceptance of autoimmune disorders, organ transplants, and inflammatory conditions which need immunosuppressive therapies. The knowledge about the immune system becomes deeper, as a result, the use of powerful immunosuppressive drugs must be enhanced to manage immune responses and these health conditions. This trend is exactly the one that is also aggravated by the cutting edge in transplantation medicine through which life-saving immunosuppressive medications play a pivotal role in fighting graft rejection and ensuring the success of organ transplants.

Likewise the medicines safety and efficacy of the immunosuppressive drugs are ensured by the regulatory factors which have a major impact in the market. Severe regulations are implemented for approval, manufacturing, and use of immunosuppressive drugs, thus allowing for every party’s responsible practice and being able to ensure the patients’ well-being. Fulfillment of these regulations will improve the preservation of the safety and reliability of immunosuppressive drugs and thereby engender trust not just among health professionals but also patients who are using these drugs for different medical conditions.

Technological advances in drug development and research have a central role in the defining of the industry prospects. Continuous growth in development of novel immunosuppressive agents, drug delivery system advancements, and targeted therapies all shape the increasing diversity of treatment avenues. These technological innovations are conceived with the purpose of making immunosuppressive drugs more efficacious, lessen its side effects, and ultimately results to better patient outcomes, thus stirring the market up.

Economical factors are one of the main determining factors such as insurance coverage, healthcare budgets and reimbursement policies which affect the adoption of immunosuppressive drugs in the healthcare. The cost-effectiveness of the therapies together with their ability to improve patients’ quality of life and also long-term health result makes them appealing to healthcare providers as well as payers. Economic factors, including their impact on the availability of such innovations in the immunosuppressive treatment area, constitute an essential part of influencing market trends.

The current competitive landscape of the immunosuppressive drugs market is comprised of well-established pharmaceutical companies that are fighting for market share by infiltrating the market with drugs for a different medical needs. Intensity in competition of market environment encourages inventiveness: only drugs with a better mechanism of action, efficacy, and safety profile are further developed. This diversity allows professionals to match the certain immunosuppressive drug that work for specific patients which makes the market slightly more dynamic than what it was in the past.

Leave a Comment