- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

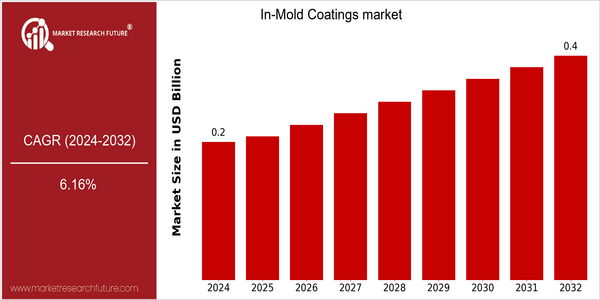

| Year | Value |

|---|---|

| 2024 | USD 0.24 Billion |

| 2032 | USD 0.39 Billion |

| CAGR (2024-2032) | 6.16 % |

Note – Market size depicts the revenue generated over the financial year

The In-Mold Coatings market is poised for significant growth, with a current market size of USD 0.24 billion in 2024 projected to expand to USD 0.39 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.16%. This upward trajectory indicates a robust demand for in-mold coatings, driven by their increasing application in various industries, particularly in automotive and consumer goods, where durability and aesthetic appeal are paramount. The growth trend is indicative of a broader shift towards advanced manufacturing techniques that enhance product quality and reduce production costs. Several factors are propelling this market expansion, including technological advancements in coating formulations that improve performance characteristics such as scratch resistance, UV stability, and environmental sustainability. Innovations in the production processes, such as the integration of smart manufacturing technologies, are also contributing to efficiency gains. Key players in the industry, such as BASF, PPG Industries, and AkzoNobel, are actively engaging in strategic initiatives, including partnerships and investments in R&D, to develop next-generation in-mold coatings. These efforts not only enhance their product offerings but also position them favorably in a competitive landscape, further driving market growth.

Regional Market Size

Regional Deep Dive

The In-Mold Coatings market is experiencing significant growth across various regions, driven by increasing demand for durable and aesthetically pleasing finishes in the automotive, consumer goods, and electronics sectors. Each region exhibits unique characteristics influenced by local manufacturing capabilities, regulatory frameworks, and consumer preferences. The market dynamics are shaped by technological advancements in coating formulations and application processes, as well as a growing emphasis on sustainability and eco-friendly products.

Europe

- Europe is at the forefront of sustainability initiatives, with many manufacturers focusing on bio-based and recyclable In-Mold Coatings. Companies such as AkzoNobel are leading the charge in developing eco-friendly products that comply with the EU's stringent environmental standards.

- The European market is also influenced by the automotive sector's push for electric vehicles, which require advanced coating solutions that enhance both performance and aesthetics, thereby creating new opportunities for In-Mold Coatings.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrialization and urbanization, leading to increased demand for In-Mold Coatings in various sectors, particularly automotive and consumer electronics. Major players like Nippon Paint and Kansai Paint are expanding their production capacities to cater to this growing demand.

- Government initiatives in countries like China and India aimed at boosting manufacturing capabilities are expected to further enhance the market for In-Mold Coatings, as local manufacturers seek to improve product quality and competitiveness.

Latin America

- Latin America is witnessing a gradual increase in the adoption of In-Mold Coatings, particularly in Brazil and Mexico, where the automotive and consumer goods sectors are expanding. Local companies are beginning to collaborate with international firms to enhance their product offerings.

- Economic factors, such as fluctuating currency values and trade agreements, are influencing the market dynamics, with manufacturers seeking to optimize costs while maintaining quality standards.

North America

- The North American market is witnessing a surge in demand for In-Mold Coatings due to the automotive industry's shift towards lightweight materials and enhanced surface finishes. Companies like PPG Industries and BASF are investing in R&D to develop innovative coatings that meet stringent environmental regulations.

- Recent regulatory changes, particularly in California, are pushing manufacturers to adopt low-VOC and water-based In-Mold Coatings, which are expected to drive innovation and market growth in the region.

Middle East And Africa

- In the Middle East and Africa, the In-Mold Coatings market is driven by the construction and automotive industries, with a growing emphasis on high-quality finishes. Companies such as Jotun and National Paints are expanding their product offerings to include advanced In-Mold Coatings tailored for local market needs.

- The region's unique climatic conditions necessitate the development of coatings that can withstand extreme temperatures and humidity, prompting innovation in formulation and application techniques.

Did You Know?

“In-Mold Coatings can significantly reduce the need for secondary finishing processes, which can save manufacturers time and costs while improving product durability.” — Industry reports and market analysis studies

Segmental Market Size

The In-Mold Coatings segment plays a crucial role in enhancing the aesthetic and functional properties of molded products, particularly in the automotive and consumer goods industries. This segment is currently experiencing stable growth, driven by increasing consumer demand for high-quality finishes and durability in products. Key factors propelling this demand include the rising emphasis on sustainability, as manufacturers seek eco-friendly solutions, and advancements in coating technologies that improve adhesion and performance. Currently, the adoption of In-Mold Coatings is in the scaled deployment stage, with companies like BASF and PPG Industries leading the charge in innovative applications. Notable regions such as Europe and North America are at the forefront, implementing these coatings in automotive interiors and exterior components. Primary use cases include automotive parts, household appliances, and electronic devices, where aesthetic appeal and protection against wear are paramount. Trends such as the push for lightweight materials and government regulations promoting sustainable practices further catalyze growth, while technologies like UV-curable coatings and advanced polymer formulations are shaping the segment's evolution.

Future Outlook

The In-Mold Coatings market is poised for significant growth from 2024 to 2032, with a projected market value increase from $0.24 billion to $0.39 billion, reflecting a robust compound annual growth rate (CAGR) of 6.16%. This growth trajectory is driven by the increasing demand for lightweight and durable materials across various industries, including automotive, consumer goods, and electronics. As manufacturers seek to enhance product aesthetics and performance while reducing production costs, the adoption of in-mold coatings is expected to rise, leading to greater market penetration. By 2032, it is anticipated that the usage rate of in-mold coatings in relevant applications could reach approximately 25% of the total coatings market, underscoring their growing importance in manufacturing processes. Key technological advancements, such as the development of eco-friendly and high-performance formulations, are expected to further propel market growth. Innovations in polymer chemistry and application techniques will enhance the efficiency and effectiveness of in-mold coatings, making them more appealing to manufacturers. Additionally, supportive government policies aimed at promoting sustainable manufacturing practices are likely to encourage the adoption of in-mold coatings, particularly those that minimize environmental impact. Emerging trends, including the increasing focus on customization and personalization in product design, will also play a crucial role in shaping the future of the in-mold coatings market, as companies strive to meet evolving consumer preferences and regulatory standards.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 0.21billion Billion |

| Market Size Value In 2023 | USD 0.224847billion Billion |

| Growth Rate | 7.07%(2023-2032) |

In-Mold Coatings Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.