In-Mold Coatings Market Summary

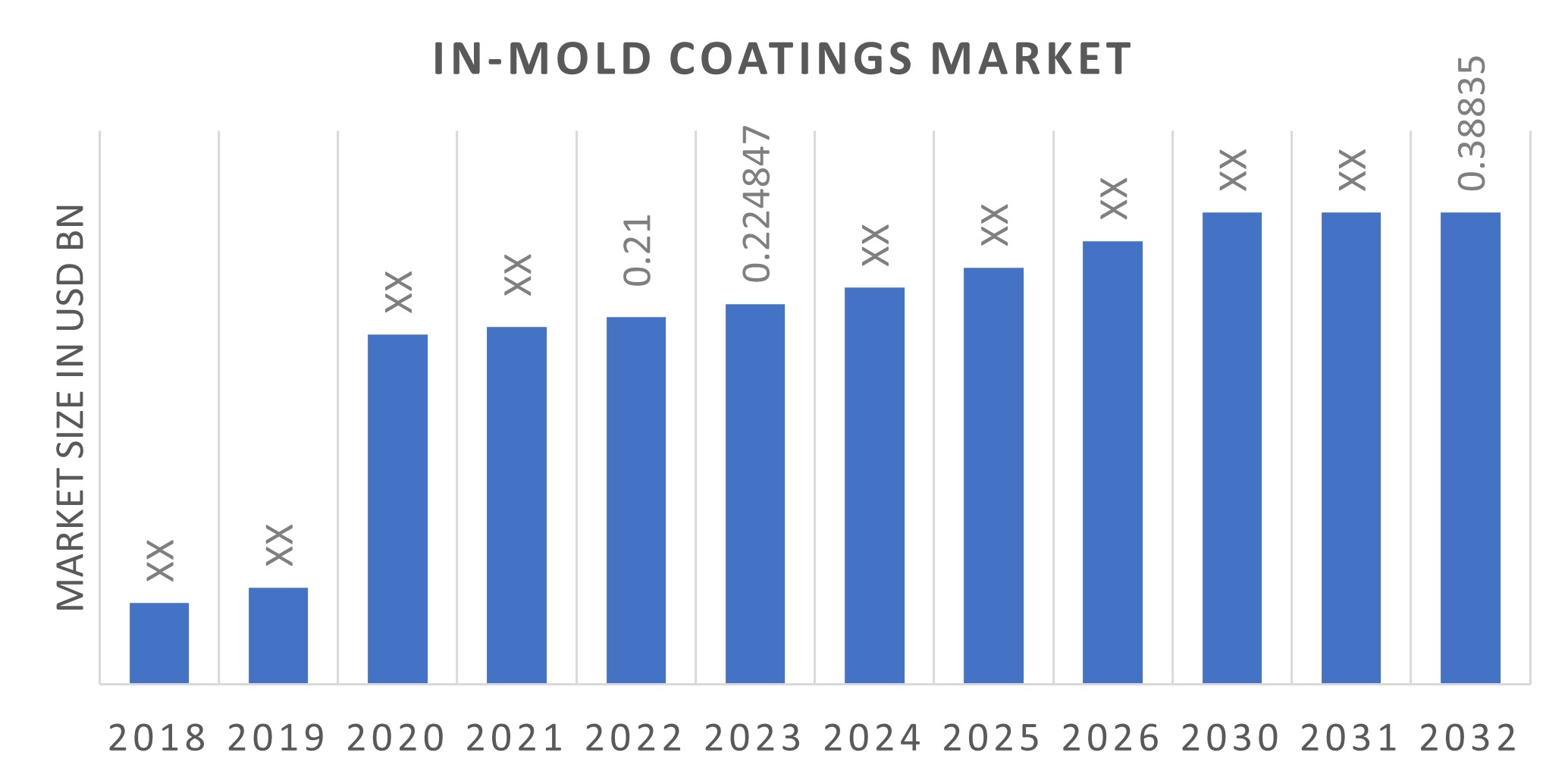

As per Market Research Future analysis, the In-Mold Coatings Market Size was estimated at 0.24 USD Billion in 2024. The In-Mold Coatings industry is projected to grow from USD 0.2524 Billion in 2025 to USD 0.4175 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.16% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The In-Mold Coatings Market is experiencing a dynamic shift towards sustainability and technological integration.

- The market is increasingly driven by a focus on sustainability and customization in product offerings.

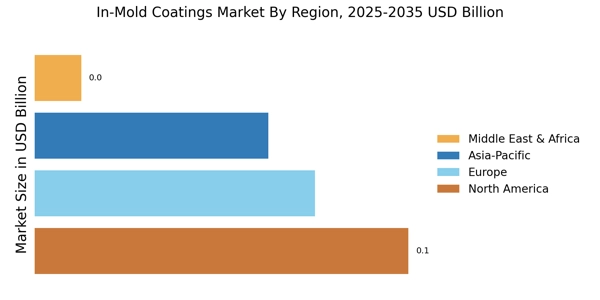

- North America remains the largest market, while Asia-Pacific is recognized as the fastest-growing region for in-mold coatings.

- Sheet Molding Compounds dominate the market, whereas Thermoplastic segments are witnessing rapid growth.

- Key drivers include the rising demand for lightweight materials and advancements in coating technologies, particularly in automotive and consumer goods sectors.

Market Size & Forecast

| 2024 Market Size | 0.24 (USD Billion) |

| 2035 Market Size | 0.4175 (USD Billion) |

| CAGR (2025 - 2035) | 5.16% |

Major Players

BASF SE (DE), PPG Industries Inc (US), Axalta Coating Systems Ltd (US), Kraton Corporation (US), Hexion Inc (US), Nippon Paint Holdings Co Ltd (JP), Sherwin-Williams Company (US), RPM International Inc (US), Sika AG (CH)