Market Share

India Automotive Door Seals Market Share Analysis

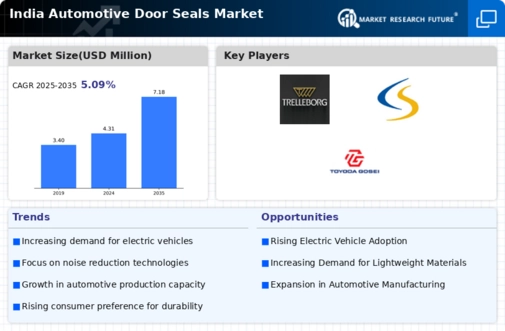

The automotive industry is experiencing a paradigm shift, propelled by technological advancements that extend to every facet of vehicle design. Among these innovations, Automotive Door Seals are emerging as a crucial element, seamlessly integrating comfort, efficiency, and quality in the passenger experience. This comprehensive review delves into the dynamic landscape of the Automotive Door Seal market, examining market drivers, technological trends, and customer awareness that collectively shape the trajectory of this critical automotive component. Automotive Door Seals have evolved significantly to fulfill a vital role in enhancing passenger comfort. These seals bridge the gap between doors, effectively minimizing vibrations and contributing to an overall smoother ride. Market players are strategically allocating funds for the development of high-performance Automotive Door Seals, with a focus on delivering top-notch products to end-users. This commitment to technological advancement is a driving force behind the robust growth of the Automotive Door Seal market. A notable trend contributing to the burgeoning demand for Automotive Door Seals is the heightened awareness among customers. Modern consumers prioritize comfort and efficiency, displaying a keen awareness of their vehicles' performance. Unlike earlier times, today's customers are well-informed, placing increased importance on Automotive Door Seals due to their pivotal role in the finished product delivered to end-users. The significance of door seals cannot be overstated, as any installation or design flaws in these components can lead to vehicle inefficiency and a reduction in passenger comfort. The rising demand for Automotive Door Seals is intricately linked to customers' priorities for comfort and efficiency. These seals serve as more than mere accessories; they are integral to ensuring a smooth and enjoyable ride for passengers. By minimizing vibrations and creating a barrier against external elements, Automotive Door Seals contribute significantly to the overall comfort of the vehicle's interior. The increasing awareness among customers has translated into a surge in demand for high-quality Automotive Door Seals. Customers are now actively seeking products that not only meet but exceed their expectations for comfort and performance. This heightened demand has spurred market players to invest in research and development, driving innovations that elevate the standards of Automotive Door Seals. In response to the evolving landscape of customer preferences and technological possibilities, market players are strategically allocating funds for research and development. The goal is to stay at the forefront of innovation, consistently introducing high-performance Automotive Door Seals that align with the changing dynamics of the automotive industry. The Automotive Door Seal market is poised for sustained growth, fueled by a confluence of factors such as technological advancements, heightened customer awareness, and an unyielding commitment to delivering superior products. As market players continue to invest in innovation, the future promises an even more sophisticated and efficient breed of Automotive Door Seals. These components will play a pivotal role in shaping the future of automotive design, with a focus on delivering unparalleled comfort and performance for the discerning modern customer. The Automotive Door Seal market is not just a witness to technological advancements but an active participant in shaping the future of vehicular comfort. As customer expectations continue to evolve, market players are rising to the occasion, driving the Automotive Door Seal market toward a future defined by excellence, efficiency, and unwavering commitment to passenger satisfaction.

Leave a Comment