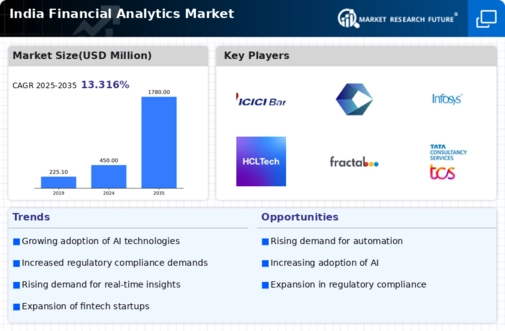

The financial analytics market in India is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for data-driven decision-making. Major players such as TCS (IN), Infosys (IN), and Wipro (IN) are strategically positioned to leverage their extensive expertise in IT services and analytics. TCS (IN) focuses on innovation through its AI-driven analytics solutions, while Infosys (IN) emphasizes partnerships with fintech firms to enhance its service offerings. Wipro (IN) is actively pursuing digital transformation initiatives, which collectively shape a competitive environment that is increasingly reliant on advanced analytics capabilities.

The market structure appears moderately fragmented, with a mix of established players and emerging startups. Key business tactics include localizing services to cater to regional needs and optimizing supply chains to enhance efficiency. The collective influence of these major players fosters a competitive atmosphere where agility and responsiveness to market demands are paramount.

In November 2025, TCS (IN) announced a strategic partnership with a leading fintech startup to co-develop innovative financial analytics solutions. This collaboration is expected to enhance TCS's capabilities in delivering tailored analytics services, thereby strengthening its market position. The strategic importance of this partnership lies in TCS's ability to integrate cutting-edge technology with industry-specific insights, potentially leading to increased market share.

In October 2025, Infosys (IN) launched a new suite of AI-powered financial analytics tools aimed at small and medium enterprises (SMEs). This initiative reflects Infosys's commitment to democratizing access to advanced analytics, allowing SMEs to harness data for better decision-making. The launch is significant as it positions Infosys as a leader in catering to the underserved SME segment, which is increasingly recognizing the value of data analytics.

In September 2025, Wipro (IN) expanded its analytics capabilities by acquiring a niche analytics firm specializing in risk management solutions. This acquisition is likely to enhance Wipro's portfolio, enabling it to offer comprehensive risk analytics services to its clients. The strategic move underscores Wipro's focus on strengthening its analytics offerings in response to growing regulatory demands in the financial sector.

As of December 2025, current trends in the financial analytics market include a pronounced shift towards digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the need for collaboration to drive innovation. Looking ahead, competitive differentiation is expected to evolve, with a greater emphasis on technological innovation and supply chain reliability, rather than solely on price-based competition. This shift suggests that companies that prioritize advanced analytics and strategic partnerships will likely emerge as leaders in the market.

Leave a Comment