Rise of Mobile Banking Solutions

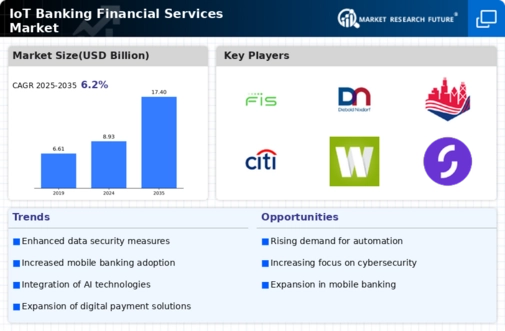

The rise of mobile banking solutions is significantly influencing the IoT Banking Financial Services Market. With the increasing penetration of smartphones, more consumers are opting for mobile banking applications that offer convenience and accessibility. According to recent statistics, mobile banking users are expected to surpass 2 billion by 2025. This shift towards mobile platforms is prompting banks to invest in IoT technologies that enhance user experience, such as biometric authentication and personalized financial advice. Consequently, the integration of IoT devices with mobile banking applications is likely to create a seamless banking experience, fostering customer loyalty and engagement. As banks adapt to this trend, the IoT Banking Financial Services Market is poised for substantial growth.

Integration of Advanced Analytics

The integration of advanced analytics within the IoT Banking Financial Services Market appears to be a pivotal driver. Financial institutions are increasingly leveraging data analytics to gain insights into customer behavior and preferences. This trend is evidenced by the projected growth of the analytics market, which is expected to reach USD 274 billion by 2025. By utilizing predictive analytics, banks can enhance their service offerings, thereby improving customer satisfaction and retention. Furthermore, the ability to analyze vast amounts of data in real-time allows for more informed decision-making, which is crucial in a competitive landscape. As a result, the adoption of advanced analytics is likely to propel the IoT Banking Financial Services Market forward, enabling institutions to tailor their products and services more effectively.

Adoption of Artificial Intelligence

The adoption of artificial intelligence (AI) technologies is emerging as a significant driver in the IoT Banking Financial Services Market. AI enables banks to automate processes, enhance customer service, and improve risk management. For instance, chatbots powered by AI are increasingly being utilized to provide 24/7 customer support, thereby reducing operational costs. The AI market in financial services is projected to grow to USD 22.6 billion by 2025, indicating a strong trend towards automation and efficiency. Additionally, AI can analyze customer data to identify patterns and predict future behaviors, allowing banks to offer personalized services. As such, the integration of AI into IoT banking solutions is likely to transform the landscape of the IoT Banking Financial Services Market.

Regulatory Compliance and Data Security

Regulatory compliance and data security are becoming increasingly critical in the IoT Banking Financial Services Market. As financial institutions adopt IoT technologies, they must navigate a complex landscape of regulations designed to protect consumer data. The implementation of stringent data protection laws, such as the General Data Protection Regulation (GDPR), necessitates that banks invest in robust security measures. This investment is projected to reach USD 150 billion by 2025, as institutions seek to safeguard sensitive information from cyber threats. Moreover, compliance with these regulations not only protects customers but also enhances the reputation of financial institutions. Therefore, the focus on regulatory compliance and data security is likely to drive innovation and investment within the IoT Banking Financial Services Market.

Growing Demand for Personalized Services

The growing demand for personalized services is a key driver in the IoT Banking Financial Services Market. Consumers are increasingly expecting tailored financial products that meet their specific needs and preferences. This trend is reflected in the rise of fintech companies that leverage IoT technologies to offer customized solutions. Research indicates that 80% of consumers are more likely to engage with brands that provide personalized experiences. As banks recognize the importance of personalization, they are investing in IoT-enabled platforms that allow for real-time data collection and analysis. This capability enables financial institutions to deliver targeted marketing and product recommendations, thereby enhancing customer satisfaction. Consequently, the emphasis on personalized services is likely to propel growth within the IoT Banking Financial Services Market.