Market Trends

Key Emerging Trends in the India Geothermal Energy Market

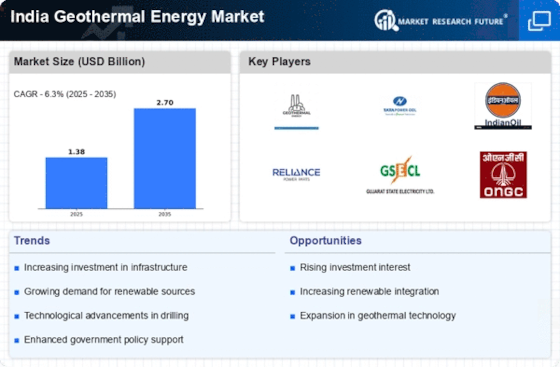

The Indian geothermal energy market has been witnessing notable trends in recent years, reflecting a growing interest in sustainable and clean energy sources. Geothermal energy, derived from the Earth's heat, is gaining traction as a viable alternative in India's diverse energy landscape. One prominent trend is the increasing recognition of geothermal energy's potential to contribute to the country's renewable energy goals. With India's commitment to achieving 40% of its total energy capacity from renewable sources by 2030, the geothermal sector has become a focal point for investors and policymakers alike.

Government initiatives and policies play a crucial role in shaping the market trends of India's geothermal energy sector. The Indian government has been actively promoting renewable energy through various programs, incentives, and regulatory frameworks. This includes the introduction of financial incentives, subsidies, and favorable tariffs for geothermal projects. Such support creates a conducive environment for both domestic and international investors, fostering the growth of the geothermal energy market in the country.

Moreover, technological advancements have played a pivotal role in driving market trends within the Indian geothermal energy sector. Innovations in drilling techniques, reservoir management, and power generation technologies have improved the efficiency and feasibility of harnessing geothermal energy. As these technologies become more accessible and cost-effective, they contribute to the overall growth and competitiveness of geothermal projects in India.

The exploration and identification of potential geothermal sites have become another crucial aspect of market trends in India. Ongoing geological surveys and studies are helping to pinpoint regions with high geothermal potential. The states of Himachal Pradesh, Jammu and Kashmir, and the northwestern regions of the country have shown promise as suitable locations for geothermal projects. This increased understanding of geothermal resources aids project developers and investors in making informed decisions, reducing risks associated with exploration and drilling activities.

Collaborations and partnerships are emerging as a significant trend in the Indian geothermal energy market. International collaborations bring in expertise, technology transfer, and financial support to accelerate the development of geothermal projects. Knowledge-sharing initiatives and joint ventures between Indian and foreign entities enhance the overall capacity of the geothermal sector and foster a global perspective in addressing the challenges and opportunities associated with geothermal energy.

The rising awareness and acceptance of geothermal energy as a sustainable and reliable power source among both the public and private sectors contribute to market trends in India. As the environmental and economic benefits of geothermal energy become more apparent, there is a shift in perception towards its potential to complement traditional energy sources. This changing mindset is reflected in increased investments, research activities, and public discourse surrounding geothermal energy, ultimately driving its market growth.

The market trends of the geothermal energy sector in India showcase a promising trajectory. With government support, technological advancements, exploration efforts, collaborative initiatives, and growing awareness, the geothermal energy market is poised for significant expansion. As India strives to achieve its renewable energy targets, geothermal energy is expected to play a pivotal role in diversifying the country's energy mix and contributing to a more sustainable and environmentally friendly future.

Leave a Comment