India Green Hydrogen Size

Market Size Snapshot

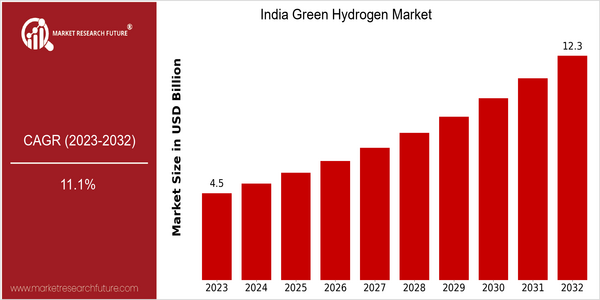

| Year | Value |

|---|---|

| 2023 | USD 4.53 Billion |

| 2032 | USD 12.33 Billion |

| CAGR (2023-2032) | 11.1 % |

Note – Market size depicts the revenue generated over the financial year

The global green hydrogen market is currently valued at approximately USD 4.53 billion in 2023 and is projected to expand significantly, reaching USD 12.33 billion by 2032. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 11.1% over the forecast period from 2023 to 2032. Such an upward trend underscores the increasing recognition of green hydrogen as a pivotal component in the transition towards sustainable energy systems, driven by the urgent need to reduce carbon emissions and combat climate change.

Several factors are propelling this market growth, including advancements in electrolyzer technologies, declining costs of renewable energy sources, and supportive government policies aimed at promoting clean energy solutions. The integration of green hydrogen into various sectors, such as transportation, industrial processes, and energy storage, is further enhancing its market appeal. Key players in the industry, such as Siemens Energy, Air Products and Chemicals, and Nel ASA, are actively engaging in strategic initiatives, including partnerships and investments in research and development, to innovate and scale up green hydrogen production. These efforts are crucial in addressing the challenges of hydrogen storage and distribution, thereby facilitating broader adoption and market penetration.

Regional Market Size

Regional Deep Dive

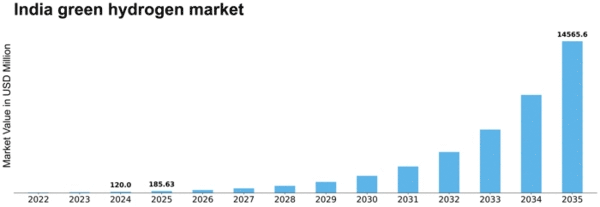

The India Green Hydrogen Market is poised for significant growth, driven by the country's commitment to achieving net-zero emissions by 2070 and its ambitious National Hydrogen Mission. The market dynamics are characterized by increasing investments in renewable energy, technological advancements in electrolysis, and supportive government policies aimed at fostering a sustainable hydrogen economy. Key characteristics include a diverse range of stakeholders, from government bodies to private enterprises, all working towards establishing a robust green hydrogen infrastructure across various sectors, including transportation, industrial applications, and energy storage.

Europe

- The European Union has set ambitious targets for hydrogen production, with initiatives like the European Hydrogen Strategy influencing global standards and practices, which India may adopt to align with international benchmarks.

- Companies like Siemens and Air Liquide are actively investing in green hydrogen projects in India, showcasing the potential for European expertise to accelerate the development of India's hydrogen infrastructure.

Asia Pacific

- Countries like Japan and South Korea are leading in hydrogen technology and have established frameworks for hydrogen trade, which could serve as a model for India as it develops its own green hydrogen market.

- Collaborations between Indian companies and Asian firms, such as the partnership between NTPC and Japan's Marubeni Corporation, are paving the way for technology exchange and investment in green hydrogen projects.

Latin America

- Latin American countries are exploring their potential for green hydrogen production due to abundant renewable resources, which could lead to collaborative projects with India focused on sustainable energy solutions.

- Brazil's investments in hydrogen technology and infrastructure development may inspire similar initiatives in India, fostering a regional approach to green hydrogen production and utilization.

North America

- The U.S. Department of Energy has launched initiatives to promote green hydrogen production, including funding for research and development projects that focus on innovative electrolysis technologies, which could influence India's approach to hydrogen production.

- Several American companies, such as Plug Power and Bloom Energy, are exploring partnerships with Indian firms to expand their green hydrogen capabilities, indicating a growing interest in cross-border collaborations that could enhance technology transfer and market growth.

Middle East And Africa

- The Middle East is witnessing a surge in green hydrogen projects, with countries like Saudi Arabia investing heavily in hydrogen production, which could create opportunities for India to engage in hydrogen trade and technology sharing.

- The UAE's commitment to becoming a global hub for hydrogen production may influence India's strategic partnerships in the region, particularly in terms of sourcing technology and expertise.

Did You Know?

“India aims to produce 5 million tons of green hydrogen annually by 2030 as part of its National Hydrogen Mission, positioning itself as a key player in the global hydrogen economy.” — Ministry of New and Renewable Energy, Government of India

Segmental Market Size

The India Green Hydrogen Market is experiencing significant growth, driven by increasing energy demands and a strong push towards decarbonization. Key factors propelling this segment include government initiatives like the National Hydrogen Mission, which aims to promote hydrogen as a clean energy source, and the rising need for sustainable energy solutions among industries. Additionally, advancements in electrolyzer technology are making green hydrogen production more efficient and cost-effective.

Currently, the market is in the pilot phase, with notable projects such as the NTPC's green hydrogen plant in Andhra Pradesh and Reliance Industries' initiatives in Gujarat leading the way. Primary applications include industrial processes, transportation, and energy storage, with companies like Tata Motors exploring hydrogen fuel cell vehicles. Macro trends such as global climate agreements and local sustainability mandates are accelerating growth, while technologies like proton exchange membrane (PEM) electrolyzers and renewable energy integration are shaping the segment's evolution.

Future Outlook

The India Green Hydrogen Market is poised for significant growth from 2023 to 2032, with the market value projected to increase from USD 4.53 billion to USD 12.33 billion, reflecting a robust compound annual growth rate (CAGR) of 11.1%. This growth trajectory is underpinned by a confluence of favorable government policies, technological advancements, and increasing investments in renewable energy infrastructure. The Indian government has set ambitious targets for hydrogen production as part of its National Hydrogen Mission, aiming to achieve 5 million tonnes of green hydrogen production by 2030. This policy framework is expected to catalyze the adoption of green hydrogen across various sectors, including transportation, industrial processes, and energy storage, thereby enhancing market penetration significantly over the next decade.

Key technological drivers, such as advancements in electrolysis and fuel cell technologies, are anticipated to lower production costs and improve efficiency, making green hydrogen a more viable alternative to fossil fuels. Additionally, the growing emphasis on decarbonization and sustainability among industries is likely to spur demand for green hydrogen as a clean energy source. Emerging trends, including the integration of green hydrogen into existing energy systems and the development of hydrogen-based mobility solutions, will further shape the market landscape. As India positions itself as a leader in the global green hydrogen economy, the market is expected to witness a surge in both domestic and international collaborations, fostering innovation and accelerating the transition towards a sustainable energy future.

Leave a Comment