India Printing Inks Market Overview

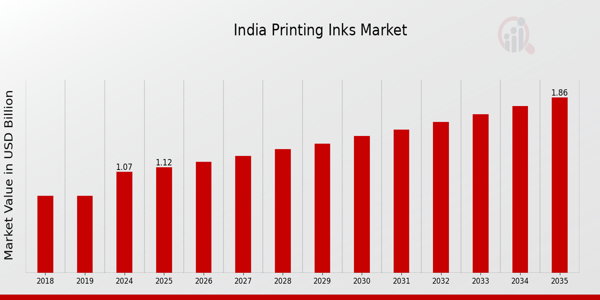

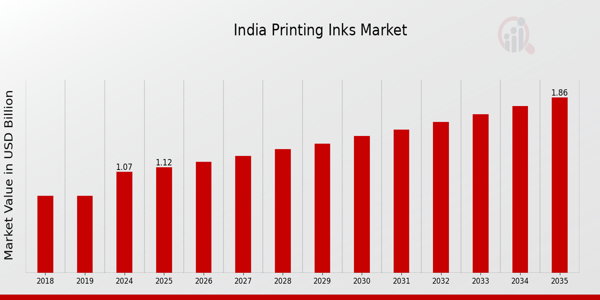

The India Printing Inks Market Size was estimated at 1.04 (USD Billion) in 2023. The India Printing Inks Market Industry is expected to grow from 1.07(USD Billion) in 2024 to 1.86 (USD Billion) by 2035. The India Printing Inks Market CAGR (growth rate) is expected to be around 5.136% during the forecast period (2025 - 2035).

Key India Printing Inks Market Trends Highlighted

The India Printing Inks Market is witnessing significant trends driven by various factors and opportunities. One prominent market driver is the rapid growth of the packaging industry, fueled by rising consumer demand and the expansion of e-commerce. In India, a vibrant packaging sector relies heavily on printing inks for branding and product visibility. Additionally, the increasing popularity of digital printing technologies is reshaping the ink landscape, allowing for faster production and customization and appealing to a diverse range of industries, from textiles to packaging.

Opportunities within the India Printing Inks Market are evident, particularly in the area of sustainable ink solutions.

The demand for eco-friendly pigments derived from renewable resources is on the rise as consumers and businesses become more cognizant of environmental issues. This trend is consistent with India's commitment to sustainability, as evidenced by initiatives such as the National Policy on Biofuels, which promote innovations that adhere to contemporary ecological standards. Manufacturers may investigate the potential of water-based and vegetable-based inks as viable alternatives. Additionally, there has been a recent trend toward smart inks and specialty inks, which provide distinctive features such as enhanced functionality and anti-counterfeiting capabilities.

Indian manufacturers are increasingly incorporating sophisticated technologies to produce inks that are tailored to specific application requirements, which is indicative of a shift toward higher-quality products and customization.

The India Printing Inks Market is poised for dynamic development, as it is able to meet both traditional and contemporary demands within the vibrant Indian economy, thanks to government initiatives and policies that support the manufacturing sector.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

India Printing Inks Market Drivers

Growing Packaging Industry

The India Printing Inks Market Industry is experiencing significant growth due to the expansion of the packaging sector. According to the Ministry of Commerce and Industry, the Indian packaging industry is projected to reach USD 73 billion by 2024, driven by the rising demand for packaged food and beverages, pharmaceuticals, and consumer goods. Major players like Uflex Limited and Amcor Flexibles have been investing in advanced printing technologies, thereby boosting the consumption of printing inks in various packaging applications.

This robust growth in the packaging sector directly correlates to the requirement for high-quality printing inks, hence driving market growth in the printing inks market in India.

Increase in E-commerce and Digital Printing

The rapid growth of the e-commerce sector in India has increased the demand for personalized packaging and labels, subsequently fueling the printing inks market. Statista reports indicate that India's e-commerce revenue is expected to reach USD 200 billion by 2026. Companies such as Flipkart and Amazon are significantly contributing to this surge, leading to a higher demand for innovative printing solutions. As e-commerce amplifies, the need for unique and eye-catching packaging rises, which catalyzes the demand for high-performance inks.

Digital printing, which offers customization and shorter printing runs, is also gaining popularity, pushing the India Printing Inks Market Industry forward.

Sustainability Trends in Printing

Sustainability is becoming a major driver in the India Printing Inks Market Industry as consumers and businesses seek environmentally-friendly products. The Government of India has set ambitious sustainability goals, including a push for recyclable and biodegradable materials. Several companies, including Sun Chemical and Hindustan Inks & Resins, are developing eco-friendly ink formulations. According to the Indian Ministry of Environment, Forest and Climate Change, sustainable printing practices can enhance the credibility and acceptance of products in the marketplace.

This growing emphasis on sustainability in printing is a key factor driving the adoption of innovative inks in the market.

India Printing Inks Market Segment Insights

Printing Inks Market Process Insights

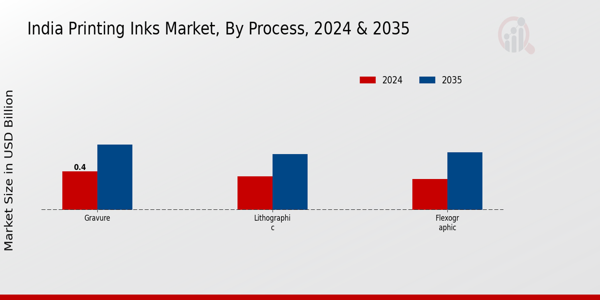

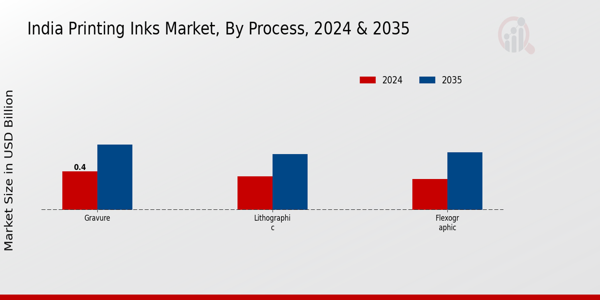

The Process segment of the India Printing Inks Market showcases a diverse landscape that includes various application techniques essential for numerous industries, such as packaging, publishing, and advertising. This segment experiences substantial demand due to the increasing consumption of printed materials, driven by the growing urban population and rising preferences for packaged products among consumers. Gravure printing, characterized by its high-quality output and ability to handle large runs, is particularly significant in the flexible packaging sector.

It serves a critical role in industries requiring high-speed printing and vibrant images. Additionally, lithographic printing, known for its cost-effectiveness in producing color-rich images, dominates the commercial printing market and is frequently utilized for magazines and brochures. Flexographic printing, on the other hand, has gained traction due to its suitability for printing on various substrates, especially in packaging applications where quick drying and versatility are paramount. The increasing focus on sustainable printing practices also enhances the opportunities for eco-friendly inks in these processes.

Major manufacturers are investing in innovations and Research and Development to create inks that meet stringent regulatory requirements and better accommodate varying substrate types. As India's economy continues to develop, the Process segment will play a crucial role in supporting the printing industry's growth trajectory by adapting to the evolving demands of consumers and businesses alike. Moreover, leveraging advancements in technology to increase efficiency and reduce waste will be vital for maintaining competitive advantage over the coming years, ensuring that the Process segment remains a focal point in the overall landscape of the India Printing Inks Market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Printing Inks Market Application Insights

The India Printing Inks Market, particularly within the Application segment, is characterized by diverse usage across various industries, contributing significantly to market growth. The Packaging and Labels segment plays a pivotal role in consumer goods, enhancing product visibility and brand recognition, which directly influences purchasing decisions. It is a dynamic area driven by the increasing demand for packaged products in the food, pharmaceuticals, and retail sectors. Furthermore, the growth in e-commerce has boosted the need for effective labeling solutions that convey important information efficiently.

On the other hand, the Corrugated Cardboards segment is dominant in the logistics sector, providing protective and sturdy packaging solutions while being an eco-friendly option that aligns with sustainability trends. The rising awareness regarding sustainable practices among consumers and businesses further strengthens the demand for these printing inks. Overall, these segments highlight the intertwining of technological advancements and consumer preferences, contributing to the evolving landscape of the India Printing Inks Market and its broad applications across various industries.

Printing Inks Market Resin Insights

The India Printing Inks Market is experiencing notable growth, with the resin segment playing a vital role in this expansion. Resins such as modified rosin and polyurethane are crucial components that ensure the performance and durability of printing inks. Modified rosin, derived from natural sources, offers excellent adhesion and emulsion stability, making it significant for various printing applications. Polyurethane, known for its flexibility and resistance properties, is widely used in high-quality printing solutions, catering to the demand for vibrant and long-lasting ink.

The rising demand for eco-friendly and sustainable printing solutions is further driving the adoption of these resins. As India continues to develop its graphics and packaging industries, the emphasis on advanced printing techniques will enhance the importance of these resin types. The market's growth is supported by a combination of increasing consumer preferences for high-performance inks and technological advancements in printing processes. Overall, the resin segment remains a critical driver of innovation within the India Printing Inks Market, adapting to changing consumer needs while contributing significantly to industry dynamics.

India Printing Inks Market Key Players and Competitive Insights

The India Printing Inks Market is characterized by a dynamic competitive landscape where various players strive to gain market share in a growing sector driven by vibrant demand from multiple industries, including packaging, publication, and commercial printing. The market is influenced by a combination of factors such as technological advancements, evolving customer preferences, and regulatory frameworks. These elements lead to constant innovation and a push for eco-friendly and sustainable ink solutions.

The competitive insights reveal a diverse range of companies, each bringing unique strengths and strategies to meet the needs of an expanding customer base that increasingly prioritizes quality, cost-effectiveness, and sustainability in printing inks.

Sakata Inx has established a solid presence in the Indian Printing Inks Market, characterized by its wide array of product offerings that cater to various printing applications, particularly in the packaging and commercial printing sectors. The company is renowned for its commitment to delivering high-quality ink solutions, which has enabled it to build strong relationships with major printing firms across India. Sakata Inx's strength lies in its extensive product range, including solvent-based inks, gravure inks, and water-based inks, which are tailored to meet the specific needs of different printing methods and environmental regulations.

The company's focus on innovation and R&D allows it to continuously enhance its product portfolio, ensuring it meets the latest standards and complies with local and international environmental policies, positioning it favorably within the competitive landscape of the market.

Flint Group holds a significant position in the India Printing Inks Market, offering a comprehensive portfolio that includes a variety of inks suitable for flexographic and gravure applications, primarily aimed at the packaging industry. The company's strengths stem from its dedicated approach to customer satisfaction, extensive technical support, and a robust distribution network that allows it to efficiently service its Indian clients. Flint Group's commitment to sustainability is evident through its investment in eco-friendly products and practices, which align with the growing demand for environmentally conscious solutions among Indian consumers.

The company has also engaged in several strategic mergers and acquisitions aimed at enhancing its product offerings and expanding its market reach in India. Such strategic movements, combined with a focus on innovation and product development, allow Flint Group to maintain a competitive edge and drive growth in the evolving Indian printing inks landscape.

Key Companies in the India Printing Inks Market Include

India Printing Inks Market Industry Developments

In the India Printing Inks Market, recent developments highlight a growing focus on sustainability and innovative products. Major players such as DIC India and Sun Chemical have been investing in eco-friendly technologies in response to increasing regulatory pressures and consumer demand for sustainable products. This shift is supported by the government's initiatives towards promoting green manufacturing practices. Additionally, Yasho Industries has expanded its production capabilities to meet the rising demand for specialty inks in food packaging and labels, indicative of the market's growth trajectory.

The market has also seen noteworthy mergers and acquisitions, with Flint Group acquiring a local manufacturer in May 2023 to enhance its operational reach in India. Furthermore, Sakata Inx reported significant revenue growth in July 2023, attributing this to its innovative product lines tailored for the digital printing segment. These dynamics reflect a proactive environment where major companies are adapting to changing market conditions and consumer preferences while reinforcing their market positions amplifying investment opportunities within the sector. In summary, the India Printing Inks Market is experiencing pivotal changes driven by innovation, sustainability, and strategic organizational adjustments.

Printing Inks Market Segmentation Insights

Printing Inks Market Process Outlook

Printing Inks Market Application Outlook

Printing Inks Market Resin Outlook

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

1.04(USD Billion)

|

|

Market Size 2024

|

1.07(USD Billion)

|

|

Market Size 2035

|

1.86(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

5.136% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Sakata Inx, Flint Group, Royal Color, Wikoff Color Corporation, Colorjet Printing, PRINTECH, T and K Toka, ICPA Health Products, Yasho Industries, Siegwerk, DIC India, Sun Chemical, Toyo Ink, Nazdar Ink Technologies, Asian Paints

|

|

Segments Covered

|

Process, Application, Resin

|

|

Key Market Opportunities

|

Rising demand for packaging inks, Growth in digital printing technologies, Eco-friendly ink innovations, E-commerce sector driving demand, Expansion of publishing industries

|

|

Key Market Dynamics

|

growing demand for packaging, increasing digital printing adoption, rise in eco-friendly inks, advancements in printing technology, expansion of e-commerce sector

|

|

Countries Covered

|

India

|

Frequently Asked Questions (FAQ):

The India Printing Inks Market is expected to be valued at 1.07 USD Billion in 2024.

By 2035, the market size is expected to reach 1.86 USD Billion.

The expected CAGR for the India Printing Inks Market from 2025 to 2035 is 5.136%.

Gravure is projected to dominate the market with a value of 0.4 USD Billion in 2024 and increasing to 0.68 USD Billion by 2035.

The lithographic printing segment is expected to be valued at 0.35 USD Billion in 2024.

The flexographic printing segment is expected to grow from 0.32 USD Billion in 2024 to 0.6 USD Billion by 2035.

Major players in the market include Sakata Inx, Flint Group, and Sun Chemical among others.

The growth drivers include increasing demand from various end-user industries and advancements in printing technology.

Emerging trends include the rise of eco-friendly inks and innovations in digital printing solutions.

Current market dynamics are expected to positively influence growth, driven by expanding packaging and publishing sectors.