Market Analysis

In-depth Analysis of Industrial Catalysts Market Industry Landscape

Market Dynamics of Industrial Catalysts Market:

Growing Industrial Activities: The industrial catalysts market is witnessing steady growth due to the increasing demand from various industrial sectors such as petrochemicals, chemicals, refining, and manufacturing. As industrial activities expand globally, the need for catalysts to facilitate crucial chemical reactions becomes more pronounced.

Petrochemical Industry Expansion: The petrochemical industry is a significant consumer of industrial catalysts, utilizing them in processes like catalytic cracking, hydroprocessing, and polymerization. With the rising demand for petrochemical products such as plastics, polymers, and specialty chemicals, the demand for catalysts in this sector continues to rise.

Environmental Regulations and Sustainability: Stringent environmental regulations aimed at reducing emissions and enhancing process efficiency drive the adoption of catalysts in industries. Catalysts enable cleaner and more sustainable production processes by facilitating reactions that minimize waste and pollutants.

Focus on Energy Efficiency: Industries are increasingly focusing on energy-efficient processes to reduce operational costs and environmental impact. Catalysts play a crucial role in energy-intensive processes such as refining and chemical synthesis by optimizing reaction kinetics and reducing energy consumption.

Technological Advancements: Continuous research and development efforts in catalyst technology lead to the development of advanced catalyst formulations with higher activity, selectivity, and durability. Innovations such as nano-catalysts and novel catalyst supports enhance process efficiency and open new avenues for application across industries.

Shift towards Renewable Feedstocks: The shift towards renewable feedstocks and sustainable manufacturing processes creates opportunities for catalyst manufacturers to develop specialized catalysts for biomass conversion, biofuel production, and other renewable energy applications.

Market Consolidation and Competition: The industrial catalysts market is characterized by intense competition among key players striving to innovate and expand their product portfolios. Mergers, acquisitions, and strategic collaborations are common strategies employed by companies to strengthen their market position and gain a competitive edge.

Global Economic Trends: Economic growth, particularly in emerging economies, drives industrialization and infrastructure development, leading to increased demand for industrial catalysts. However, economic fluctuations and geopolitical uncertainties may impact market dynamics and investment decisions.

Regional Market Dynamics: Market dynamics vary across regions, influenced by factors such as industrialization pace, regulatory environment, availability of raw materials, and technological infrastructure. Emerging economies exhibit high growth potential due to rapid industrialization and increasing investments in infrastructure development.

Raw Material Price Volatility: Fluctuations in the prices of raw materials such as metals, oxides, and precious metals, which are key components of catalyst formulations, impact production costs and pricing strategies of catalyst manufacturers.

Customization and Tailored Solutions: Increasing demand for specialized catalysts tailored to specific industrial processes and applications drives innovation in catalyst design and formulation. Manufacturers focus on providing customized solutions to meet the unique requirements of their clients and enhance process efficiency.

Health and Safety Regulations: Strict health and safety regulations governing the handling and use of catalysts in industrial processes drive the adoption of safer and environmentally friendly catalyst formulations. Manufacturers invest in research and development to develop catalysts with reduced toxicity and environmental impact.

Supply Chain Management: Efficient supply chain management is critical for ensuring timely availability of catalysts to industries. Manufacturers strive to optimize their supply chains and logistics networks to meet customer demand and minimize lead times.

Impact of COVID-19 Pandemic: The COVID-19 pandemic initially disrupted industrial activities and supply chains, leading to a slowdown in the industrial catalysts market. However, as economic activities resume and industries recover, the demand for catalysts is expected to rebound, driven by pent-up demand and infrastructure investments.

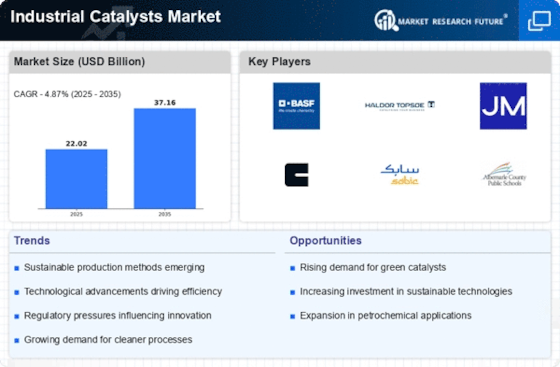

Future Growth Prospects: Despite short-term challenges, the industrial catalysts market exhibits promising long-term growth prospects, driven by increasing industrialization, technological advancements, and regulatory requirements for cleaner and sustainable manufacturing processes across industries.

Leave a Comment