Market Analysis

In-depth Analysis of Industrial Ethernet Switch Market Industry Landscape

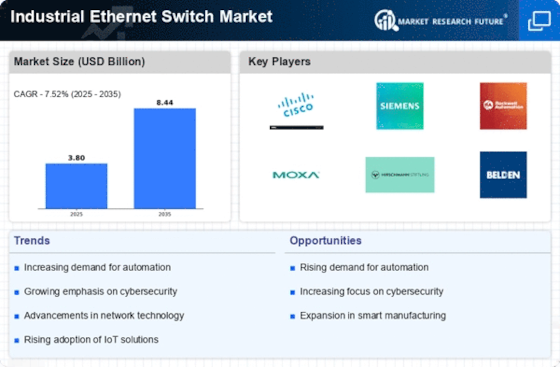

The market for industrial Ethernet switches is undergoing dynamic changes at the moment due to a combination of factors including the development of industrial automation, the necessity for continuous communication in industrial settings, and technical improvements. The increasing use of digital transformation by enterprises globally has made Industrial Ethernet Switches indispensable for enabling effective data exchange and communication inside industrial networks. The increasing use of Industry 4.0 principles is a significant factor influencing market dynamics. To improve operational efficiency, industries are progressively incorporating smart technologies, such as machine-to-machine (M2M) communication and the Internet of Things (IoT). In this environment, industrial Ethernet switches are essential because they offer dependable, fast communication networks that facilitate real-time data transfer and decision-making. The necessity for strong and durable network infrastructures that can manage the complexity of contemporary industrial processes is driving the demand for these switches. Furthermore, the continued development of industrial automation has an impact on the need for industrial Ethernet switches. With more companies automating their operations in an effort to increase productivity and decrease human interference, a strong and expandable network infrastructure is essential. Industrial Ethernet switches facilitate smooth communication between different factory floor devices by providing the connection needed to enable automation systems. This tendency is especially noticeable in industries where automation is quickly taking over, such manufacturing, automotive, and energy. The industrial Ethernet switch market is also being shaped by the growing emphasis on cybersecurity in industrial networks. Industrial companies are giving the deployment of safe and reliable network solutions first priority due to the increase in cyberattacks that target vital infrastructure. Demand for industrial Ethernet switches with integrated security features—like access restrictions and sophisticated encryption—is rising as businesses want to protect their industrial networks from possible cyberattacks. The increasing range of uses for Industrial Ethernet switches also affects market dynamics. These switches, which were first made for basic data transfer, may now be used for a variety of purposes, such as power-over-Ethernet (PoE) functions, video surveillance, and voice-over-IP (VoIP) communication. Because of their adaptability, Industrial Ethernet Switches are becoming more and more popular in a variety of industrial sectors, which is helping to increase their market share.

Leave a Comment