Market Share

Industrial Fermentation Chemicals Market Share Analysis

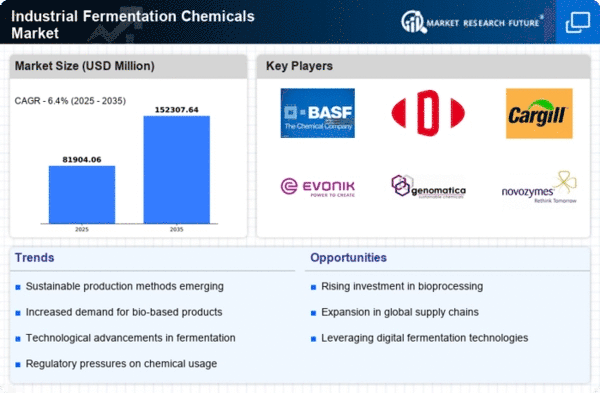

The Industrial Fermentation Chemicals market, a significant player in the biotechnology and chemical industries, employs a range of market share positioning strategies to navigate the competitive landscape effectively. A foundational strategy centers on product diversification and innovation. Companies in the Industrial Fermentation Chemicals market invest heavily in research and development to advance the design and functionality of their fermentation chemicals. By introducing innovative formulations, improving fermentation processes, and expanding the applications of these chemicals, these companies distinguish themselves in the market, attracting clients seeking cutting-edge solutions for various industrial processes, including biofuels, pharmaceuticals, and food production.

Cost leadership is another pivotal strategy employed by Industrial Fermentation Chemicals manufacturers to gain a competitive edge. Through optimizing fermentation processes, achieving economies of scale, and strategic sourcing of raw materials, companies can lower production costs. This cost efficiency allows them to offer competitive pricing for their industrial fermentation chemicals, making them more appealing to cost-conscious customers across various industries. Cost leadership is particularly crucial in markets where production costs significantly influence purchasing decisions, and companies that can provide reliable and cost-effective fermentation chemicals position themselves favorably.

Market segmentation plays a crucial role in the market share positioning of Industrial Fermentation Chemicals manufacturers. Recognizing the diverse needs of different industries, such as bioenergy, pharmaceuticals, and food and beverages, companies tailor their fermentation chemical solutions to specific requirements. For example, the fermentation needs for bioethanol production may differ significantly from those for antibiotic manufacturing. This strategic segmentation allows companies to effectively penetrate multiple markets, addressing the unique fermentation demands of each segment and solidifying their presence in various industrial sectors.

Geographical expansion is another key aspect of market share positioning in the Industrial Fermentation Chemicals market. Companies strategically expand their operations to key markets where industrial activities and demand for fermentation chemicals are high. This expansion may involve setting up production facilities, establishing distribution networks, or forming partnerships with local entities. By positioning themselves strategically in regions with robust demand for Industrial Fermentation Chemicals, companies can tap into new customer bases and adapt to regional variations in industrial practices, contributing to overall market share growth.

Moreover, a commitment to sustainability and environmentally friendly practices is gaining prominence in the Industrial Fermentation Chemicals market. Companies are increasingly focusing on developing fermentation processes that minimize environmental impact, reduce waste, and utilize renewable resources. This commitment not only aligns with the growing environmental consciousness of customers but also positions companies as responsible contributors to sustainable industrial practices. It can lead to increased brand loyalty and preference among environmentally conscious industries, contributing to long-term market share growth.

Leave a Comment