Top Industry Leaders in the Industrial IoT Platform Market

Competitive Landscape of the Industrial IoT Platform Market

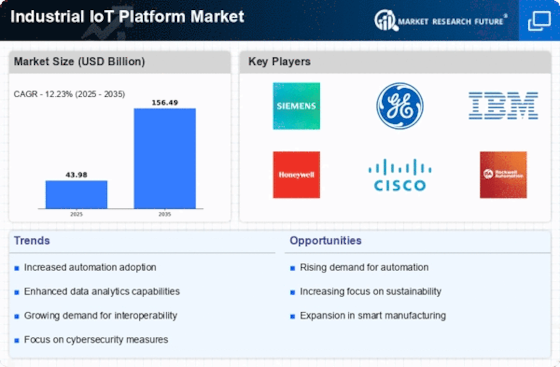

The Industrial Internet of Things (IIoT) platform market is a rapidly evolving segment within the broader IoT landscape, this growth is fueled by the relentless pursuit of operational efficiency, predictive maintenance, and data-driven insights across various industrial sectors. Navigating this dynamic market requires a close understanding of the competitive landscape, key players, and strategic trends shaping its future.

Key Players:

- Intel Corporation (US)

- General Electric (US)

- Amazon Web Services Inc. (US)

- Google Inc. (US)

- International Business Machine (IBM) Corporation (US)

- Microsoft Corporation (US)

- Cisco Systems, Inc. (US)

- SAP SE (Walldorf, Germany)

- Oracle Corporation (US)

- PTC Inc. (US)

- Hewlett-Packard Enterprise (US)

- Bosch Software Innovation GmbH (Stuttgart, Germany)

Strategic Maneuvers for Market Share Dominance

In this competitive landscape, success hinges on strategic agility and targeted value propositions. Major players are pursuing acquisitions and partnerships to bolster their portfolios and expand their reach. Microsoft's acquisitions of C3 IoT and Relayr, for example, demonstrate their focus on building a comprehensive IIoT ecosystem. Similarly, Siemens' partnership with Accenture strengthens their consulting and implementation capabilities.

Another key strategy is platform specialization. GE Predix's focus on the oil & gas sector and Rockwell Automation's deep-rooted presence in discrete manufacturing are prime examples. Additionally, platforms are evolving to encompass artificial intelligence (AI) and machine learning (ML) capabilities, enabling predictive maintenance, process optimization, and autonomous operations.

Metrics for Market Share Analysis: Beyond the Obvious

While market share analysis traditionally focuses on revenue and customer base, a nuanced approach is crucial in the IIoT space. Factors like platform functionality, industry-specific features, partner ecosystems, and customer support play a significant role in influencing user adoption. Analysing platform capabilities through features like data storage and analytics, device management, and security protocols provides a deeper understanding of competitive positioning.

Additionally, tracking platform deployments across diverse industries and use cases sheds light on real-world adoption trends. Assessing a platform's partner network, including technology partners, system integrators, and domain experts, reveals its potential for comprehensive solutions and industry reach.

Investment Trends: Where Dollars Meet Data

Venture capital and private equity firms are recognizing the immense potential of the IIoT platform market, leading to significant investments in both established and emerging players. In 2023 alone, over $8 billion was invested in IIoT companies, with a focus on platforms supporting edge computing, AI/ML integration, and industrial automation.

Investments are also flowing towards platforms addressing specific industry needs, like agricultural IoT and smart cities. This influx of capital fuels research and development, accelerating platform evolution and bringing innovative solutions to market faster.

Latest Company Updates:

January 8, 2024: Bosch and Shell partner to deploy an IIoT platform for remote wind farm management, aiming to improve operational efficiency and optimize energy production.

December 19, 2023: GE Predix and Schlumberger collaborate on digital oilfield solutions, leveraging Predix's analytics capabilities to enhance reservoir management and production optimization.