Industrial Rubber Size

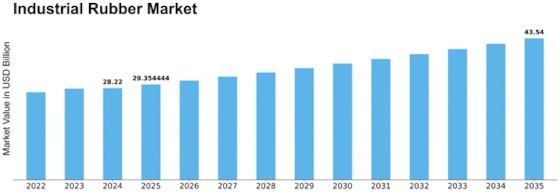

Industrial Rubber Market Growth Projections and Opportunities

The Industrial Rubber Market is significantly influenced by various market factors that shape its growth, trends, and competition. One of the primary factors driving this market is the rapid industrialization and urbanization witnessed globally. As industries expand and urban areas grow, there is an increasing demand for industrial rubber products across sectors such as automotive, construction, manufacturing, and transportation. Industrial rubber is essential for various applications, including seals, gaskets, hoses, belts, tires, and vibration isolation mounts, due to its properties like flexibility, durability, resilience, and resistance to abrasion and chemicals. Companies in the Industrial Rubber Market respond to this demand by offering a diverse range of rubber products tailored to the specific requirements of different industries and applications. A milky latex textured hydrocarbon polymer available in the sap of various plants makes natural rubber. Rubber can be manufactured chemically as well, which are Synthetic rubbers. Rubber is highly used in industries such as electronics, electrical, automotive, industrial manufacturing, building, construction, and others because of its physical properties like tear resistance, abrasion resistance, compression set, tensile modulus, elongation, hardness, strength, and others.

Another key factor influencing the Industrial Rubber Market is the growth of the automotive industry. Rubber is a critical component in the manufacturing of automotive parts such as tires, hoses, belts, seals, and gaskets. As the automotive industry continues to expand globally, driven by factors such as increasing vehicle production, rising disposable income, and technological advancements, the demand for industrial rubber products is expected to rise correspondingly. Companies in the Industrial Rubber Market are leveraging this trend by developing innovative rubber formulations and products to meet the evolving needs of the automotive sector.

Furthermore, technological advancements play a significant role in shaping the Industrial Rubber Market. Advances in rubber compounding, processing techniques, and material science have led to the development of high-performance rubber materials with improved properties and functionalities. Innovations such as synthetic rubbers, reinforced rubber composites, and specialty rubber additives enhance the strength, durability, and performance of industrial rubber products, expanding their applications and market potential. Companies that invest in research and development to innovate and differentiate their rubber products can gain a competitive edge and capitalize on emerging opportunities in the market.

Moreover, regulatory standards and safety requirements are crucial factors in the Industrial Rubber Market. Government regulations related to product safety, environmental impact, and workplace health and safety impact the design, manufacturing, and use of industrial rubber products. Companies must comply with these regulations to ensure the quality, safety, and environmental sustainability of their rubber products. As a result, there is a growing focus on developing rubber formulations that meet regulatory standards, address health and safety concerns, and support sustainable manufacturing practices. Additionally, consumer preferences for eco-friendly materials are driving demand for sustainable rubber products made from recycled or bio-based sources.

Supply chain dynamics also influence the Industrial Rubber Market. Factors such as raw material availability, production capacity, transportation networks, and geopolitical factors impact the supply and pricing of rubber raw materials and finished products. Companies must optimize their supply chain processes to ensure a steady supply of raw materials, minimize costs, and maintain product quality. Fluctuations in natural rubber prices, synthetic rubber production, and trade policies can also influence production costs and pricing strategies within the market, requiring companies to remain agile and responsive to market dynamics.

Furthermore, shifting consumer preferences and industry trends impact the demand for industrial rubber products. As consumers and industries seek products that offer durability, performance, and sustainability, there is a growing demand for rubber-based materials in various applications. Rubber's versatility, resilience, and ability to withstand harsh conditions make it suitable for a wide range of industrial applications. Companies that innovate and differentiate themselves through product design, customization options, and sustainability initiatives can succeed in capturing market share and maintaining a competitive position in the Industrial Rubber Market.

Leave a Comment