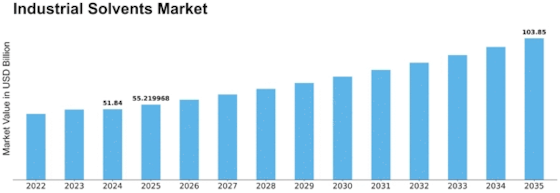

Industrial Solvents Size

Industrial Solvents Market Growth Projections and Opportunities

The industrial solvents market is influenced by several key market factors that shape its dynamics and growth trajectory. These factors encompass a range of economic, regulatory, technological, and environmental aspects, which collectively impact the demand, supply, and pricing of industrial solvents worldwide.

Certain factors drive the solvent market, including growing demand for solvents in the construction industry, increased usage of solvents in the medical area, and increased use of solvents in pharmaceuticals, sealants, adhesives, and printing inks.

One of the primary market factors driving the industrial solvents market is the industrial activities across various sectors. Solvents are integral to numerous industrial processes, including manufacturing, painting, cleaning, and chemical production. As industries expand and evolve, the demand for solvents to facilitate these processes grows correspondingly. Industries such as automotive, pharmaceuticals, electronics, and construction heavily rely on solvents, thereby influencing market trends.

Moreover, regulatory policies play a significant role in shaping the industrial solvents market. Governments around the world enforce regulations pertaining to environmental protection, occupational health, and safety standards, which directly impact the production, distribution, and usage of solvents. Stringent regulations aimed at reducing emissions of volatile organic compounds (VOCs) have prompted industries to adopt eco-friendly solvents and alternative technologies, thereby driving innovation in the market.

Furthermore, market factors such as raw material availability and pricing exert a considerable influence on the industrial solvents market. Solvents are derived from various feedstocks, including petroleum, natural gas, and bio-based sources. Fluctuations in the prices of crude oil and other raw materials directly affect the production costs of solvents, subsequently influencing their pricing in the market. Additionally, concerns regarding the sustainability and environmental impact of petroleum-based solvents have led to a growing interest in bio-based alternatives.

Technological advancements also play a crucial role in shaping the industrial solvents market landscape. Continuous research and development efforts have led to the introduction of new solvent formulations, improved manufacturing processes, and novel applications. Innovations such as green chemistry, which focuses on the development of safer and more sustainable solvents, are driving market growth and fostering greater adoption of environmentally friendly alternatives.

Moreover, market dynamics are influenced by global economic factors such as GDP growth, industrialization trends, and trade policies. Economic expansions typically lead to increased industrial activities, thereby boosting the demand for solvents. Conversely, economic downturns or trade disputes can adversely impact market growth by constraining industrial spending and disrupting supply chains.

Environmental awareness and sustainability concerns are increasingly influencing consumer preferences and industry practices. With growing awareness about the environmental impact of traditional solvents, there is a rising demand for eco-friendly and low-toxicity alternatives. This shift towards greener solvents is driving market players to invest in research and development of sustainable solutions and adopt cleaner production processes.

Additionally, market consolidation and competitive landscape significantly shape the dynamics of the industrial solvents market. Mergers, acquisitions, and strategic partnerships among key players influence market competitiveness, pricing strategies, and product offerings. Moreover, the presence of stringent entry barriers such as high capital requirements and regulatory compliance further intensifies competition within the market.

Leave a Comment