Market Analysis

In-depth Analysis of InGaAs Camera Market Industry Landscape

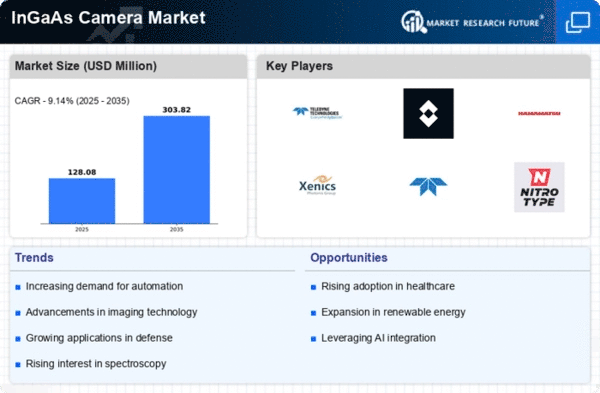

The rise of Industry 4.0 is a prevalent trend, propelling automation and data exchange across diverse manufacturing sectors. Within the manufacturing industry, the integration of InGaAs cameras has unlocked a multitude of possibilities for infrared imaging, particularly in applications related to industrial and security image processing. These cameras, designed specifically for short-wave infrared imaging, surmount the limitations inherent in traditional InGaAs camera technology, thereby enabling the generation of high-quality images. This technological advancement broadens the scope of machine vision systems by extending imaging capabilities beyond the visible spectrum, introducing novel applications in the process.

The deployment of short-wave infrared cameras proves instrumental in overcoming existing challenges, offering the ability to capture high-quality images that were previously difficult to attain. This breakthrough is made possible through the strategic utilization of filters and wavelength-optimized optics, facilitating the capture of distinct and measurable contrasts in inspected objects. Such capabilities find practical application in various inspection tasks across diverse industries, including food and beverage, woodworking, textile, and automotive manufacturing.

The adoption of InGaAs cameras for imaging applications not only addresses current industry challenges but also unveils lucrative opportunities for stakeholders in the global InGaAs camera market. This is especially true as the trend of embracing Industry 4.0 continues to gain momentum. With manufacturing processes increasingly incorporating automation and data exchange, there is a growing demand for advanced imaging solutions, such as those offered by InGaAs cameras. The symbiotic relationship between Industry 4.0 and InGaAs camera technology positions market players to capitalize on the expanding landscape, presenting numerous prospects for growth and innovation.

The intersection of Industry 4.0 and the application of InGaAs cameras in imaging showcases the transformative potential of these technologies. As industries evolve towards greater automation and connectivity, the role of InGaAs cameras in enhancing imaging capabilities becomes increasingly vital, presenting a pathway for continued advancements and success in the global market.

Leave a Comment