Market Analysis

In-depth Analysis of Insulation Products Market Industry Landscape

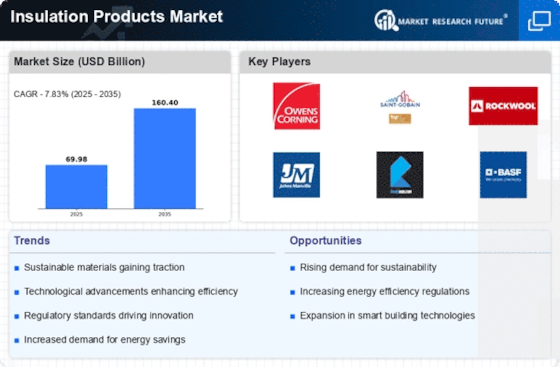

The global demand for insulation products is steadily increasing, mostly due to the building industry's desire for energy-efficient solutions. As governments and enterprises around the world prioritize energy conservation and sustainability, the need for insulation materials that improve thermal performance remains strong. The building industry is a primary driver of the insulating products market. The continuing rise of the building sector, notably in the residential, commercial, and industrial segments, generates a continual demand for insulating products. The emphasis on energy-efficient structures and compliance with building rules fuels the market's expansion. Stringent energy efficiency standards and building rules are influencing the dynamics of the insulation products market. Governments all over the world are passing laws to improve building energy efficiency, which is pushing the use of high-performance insulation materials. Compliance with these requirements becomes an important consideration when deciding on insulation solutions for construction projects. Continuous advances in material technology contribute to the expansion of the insulation products industry. Innovations in manufacturing processes, the development of sustainable materials, and the introduction of high-performance solutions such as aerogel insulation and smart insulation systems all help to improve the overall market picture. These technological advances address the growing demand for more effective and diverse insulating solutions. As public awareness of fire safety grows, so does the demand for fire-resistant insulating solutions. This is especially the case in industrial and commercial buildings with strict fire safety regulations. Thermally efficient and fire-resistant insulating materials are gaining traction in the market.

The need for insulation solutions has gone up as a result of the retrofitting and refurbishing of existing residential structures. Homeowners are enhancing their insulation to boost energy efficiency, lower electricity bills, and improve overall comfort. This action modifies market dynamics, opening up new prospects for insulation product manufacturers. The market dynamics of insulation products vary by area due to factors such as climate, construction techniques, and economic situations. In colder areas, insulation is prioritized for thermal efficiency, whereas in warmer climes, materials with reflecting and heat-resistant qualities are in demand. Understanding regional variations is critical for market participants wanting a comprehensive market strategy. The market for insulating products appears to be defined by an intense competitive landscape, with the biggest players contending for market share. A prominent development is industry consolidation through mergers, acquisitions, and alliances. This consolidation allows businesses to pool resources, enhance product portfolios, and increase market competitiveness. Since its advent, COVID-19 has caused uncertainty and disruption in the insulation materials industry. Fluctuations in construction activity, supply chain disruptions, and economic concerns have all altered market dynamics. The emphasis on resilient and energy-efficient buildings, on the other hand, has remained a driving factor, influencing recovery trends.

Leave a Comment