Global Insurance Fraud Detection Market Overview:

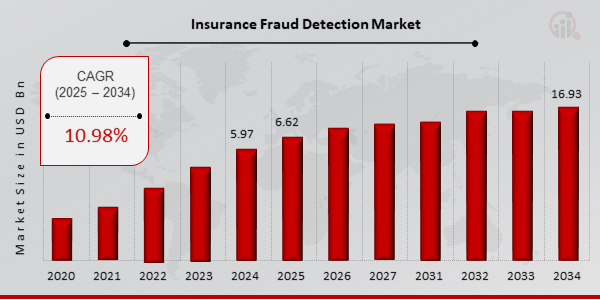

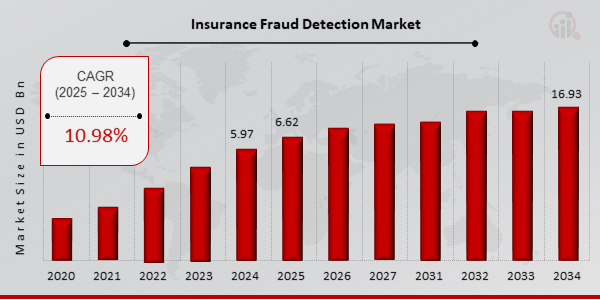

Insurance Fraud Detection Market Size was estimated at 5.97 (USD Billion) in 2024. The Insurance Fraud Detection Market Industry is expected to grow from 6.62 (USD Billion) in 2025 to 16.93 (USD Billion) till 2034, exhibiting a compound annual growth rate (CAGR) of 10.98% during the forecast period (2025 - 2034).

Key Insurance Fraud Detection Market Trends Highlighted

It is projected that the insurance fraud detection market worldwide will be greatly developed in the nearest time. The primary factors supporting this development include growing prevalence of insurance fraud, advancements in technology and increasing awareness among insurers.

In order to identify fraudulent activity, artificial intelligence (AI) and machine learning algorithms should be integrated into fraud detection systems. They allow insurers to analyze large amounts of data, discover patterns and identify fraudulent claims more accurately and smoothly.

Current developments within the industry are seen through data analytics and predictive modeling becoming increasingly important for fighting off insurance frauds. Insurers use data analytics to pinpoint high-risk policies and predict potential acts of fraud. Furthermore, there has been higher adoption rate of blockchain technology because it provides a secure and immutable record of transactions which minimizes chances of fraud.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Insurance Fraud Detection Market Drivers

Rising Incidence of Insurance Fraud

Insurance fraud is a serious problem that robs the world’s insurance industry of billions of dollars every year. The mounting rates of insurance fraud seem to be the major factor that contributes to the increase in the size of the insurance fraud detection market. The variety of tools used for committing fraud in respect of insurance, the fact that fraudsters become increasingly more cunning, and the escalations in the sources of technology that can be used for fraud are some of the reasons why insurance providers now invest increasingly more in fraud detecting tools.

Increasing Regulatory Compliance

The insurance fraud detection market is driven by the growing regulatory compliance requirements for insurance companies to ensure fraud detection. Regulators are mandating insurance companies to deploy fraud detection systems to safeguard the interests of consumers and sustain the integrity of insurance markets. There is increased demand for insurance companies to invest in fraud detection solutions.

Advancements in Technology

New technologies are also one of the main drivers of the growth of insurance fraud detection in the market. New types of technologies, such as artificial intelligence and machine learning, help to develop more sophisticated fraud detection solutions. The new solutions can take in large amounts of data and differentiate the patterns and anomalies that lead to fraud. The adoption by insurance companies of new, more advanced technologies, therefore, helps to increase the fraud detection market growth.

Insurance Fraud Detection Market Segment Insights:

Insurance Fraud Detection Market Fraud Type Insights

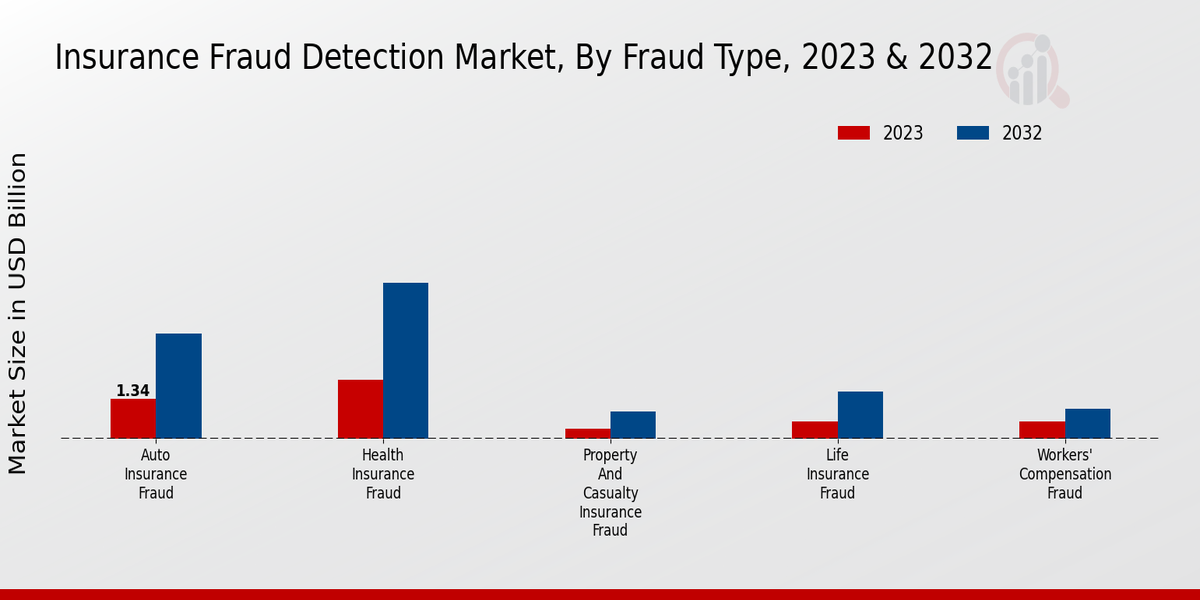

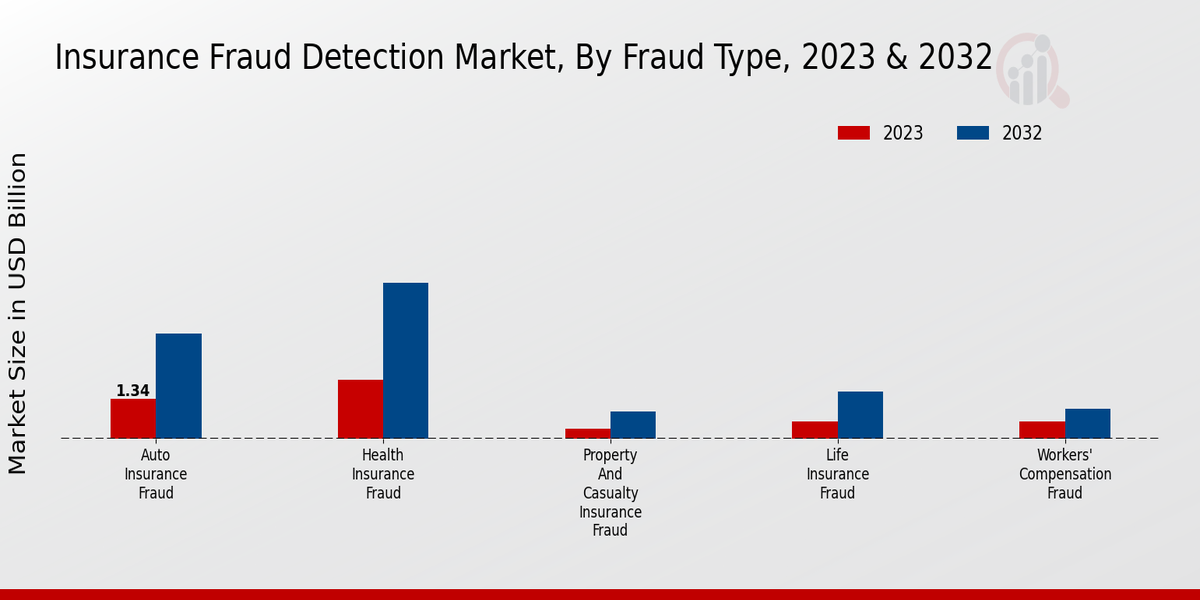

Fraud Type The Insurance Fraud Detection Market is segmented by fraud type into auto insurance fraud, health insurance fraud, property and casualty insurance fraud, life insurance fraud, and workers’ compensation fraud. Among these, auto insurance fraud accounted for the largest market share in 2023, and it is projected to continue its dominance throughout the forecast period. The high incidence of auto insurance fraud can be attributed to the ease of committing such frauds and the relatively low risk of detection.

Health insurance fraud is another major segment of the market, and it is expected to grow significantly in the coming years due to the rising cost of healthcare and the increasing number of fraudulent claims. Property and casualty insurance fraud is also a significant segment of the market, and it is expected to grow steadily over the forecast period. The market growth is primarily driven by the increasing incidence of insurance fraud, the rising cost of insurance premiums, and the growing adoption of advanced fraud detection technologies.

The market is also expected to benefit from the increasing awareness of insurance fraud and the growing number of regulations aimed at combating it. Key Insights Auto insurance fraud is the most prevalent type of insurance fraud, accounting for over 40% of the global market share. The rising cost of healthcare is driving the growth of health insurance fraud.

Property and casualty insurance fraud is also a significant segment of the market, with a growing number of fraudulent claims being reported each year. Life insurance fraud and workers’ compensation fraud are relatively smaller segments of the market, but they are expected to grow at a healthy pace in the coming years. Advanced fraud detection technologies are playing a key role in combating insurance fraud. The growing awareness of insurance fraud is also helping to reduce the incidence of such fraud.

The increasing number of regulations aimed at combating insurance fraud is also expected to contribute to the growth of the market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Insurance Fraud Detection Market Detection Method Insights

The Insurance Fraud Detection Market is segmented by detection method to Artificial Intelligence (AI) and Machine Learning, Data Analytics and Business Intelligence, Rule-Based Systems, Text Analytics and Natural Language Processing, and Image and Video Analysis. Among these, AI and ML are expected to be the highest growing segment due to the ability of these technologies to detect complex patterns and identify anomalies in large datasets.

Data Analytics and Business Intelligence are also expected to grow significantly because insurers are deploying advanced analytics to identify patterns that match suspicious claims. In addition, Rule-Based Systems, Text Analytics and Natural Language Processing, and Image and Video Analysis are also expected to add to the growth of the Insurance Fraud Detection Market because they have been developed to detect insurance fraud of different types.

Insurance Fraud Detection Market Deployment Model Insights

The Insurance Fraud Detection Market Segmentation by Deployment Model consists of On-Premise, Cloud-Based, Hybrid, Software-as-a-Service (SaaS), and Platform-as-a-Service (PaaS). The Cloud-Based segment is projected to grow at the highest CAGR during 2024-2032. It is anticipated to reach a market valuation of USD 5.89 Billion by 2032 from USD 2.15 Billion in 2023. The rising adoption of cloud-based solutions by insurance companies to improve operational efficiency and reduce costs drives the growth of this segment.

Cloud-based deployment offers scalability, flexibility, and access to advanced analytics capabilities, making it an attractive option for insurers. Additionally, the increasing adoption of Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models is expected to further fuel the growth of the Cloud-Based segment.

Insurance Fraud Detection Market Industry Vertical Insights

The Insurance Fraud Detection Market is segmented vertically by industry into insurance companies, government agencies, law enforcement, healthcare providers, and financial institutions. Among these segments, Insurance Companies held the largest market share in 2023, accounting for around 45% of the total market revenue. The high prevalence of insurance fraud, coupled with the increasing adoption of advanced fraud detection technologies, is driving the growth of this segment.

Government Agencies and Law Enforcement are also expected to witness significant growth in the coming years due to the rising focus on combating insurance fraud and protecting consumers. The Insurance Fraud Detection Market is expected to reach a value of USD 12.4 billion by 2032, exhibiting a CAGR of 10.98% during the forecast period. The increasing incidence of insurance fraud, advancements in technology, and growing regulatory compliance are key factors propelling the market growth.

Insurance Fraud Detection Market Component Insights

Software is the largest component segment in the Insurance Fraud Detection Market due to the increasing adoption of advanced analytics and machine learning algorithms for fraud detection. The software segment is expected to grow to a market size of USD 7.5 billion by 2024, driven by the need for insurers to improve their fraud detection capabilities. Services is the second largest component segment and is expected to grow to a market size of USD 4.5 billion by 2024.

The growth of the services segment is being driven by the increasing demand for managed fraud detection services from insurers. Hardware is the smallest component segment and is expected to grow to a market size of USD 2.5 billion by 2024. The growth of the hardware segment is being driven by the increasing adoption of specialized hardware for fraud detection, such as deep learning accelerators.

Insurance Fraud Detection Market Regional Insights

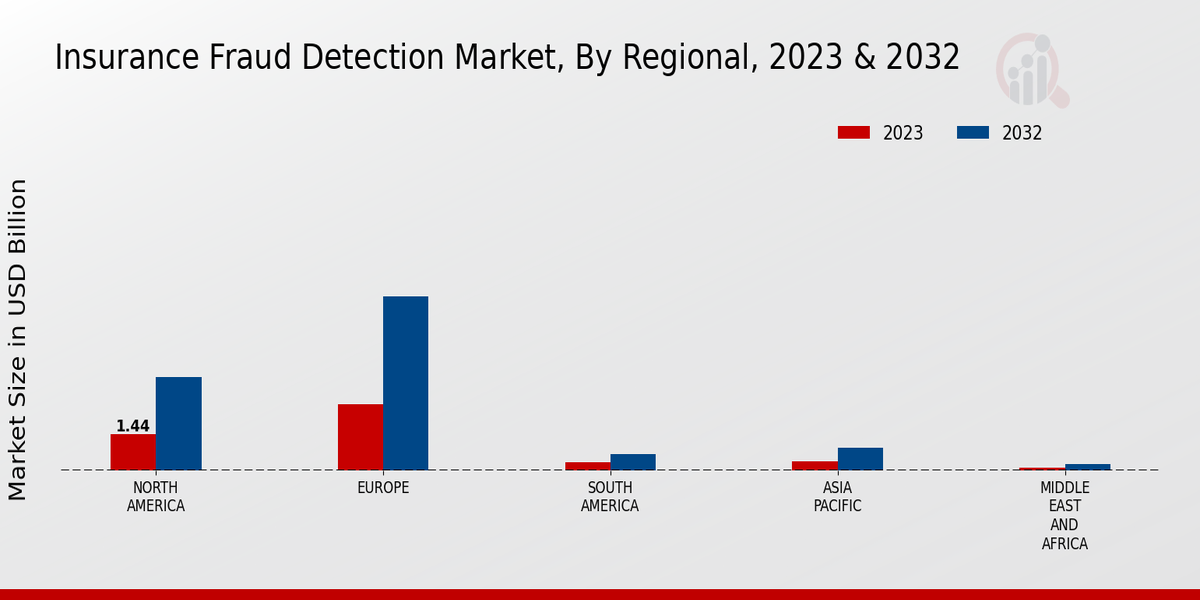

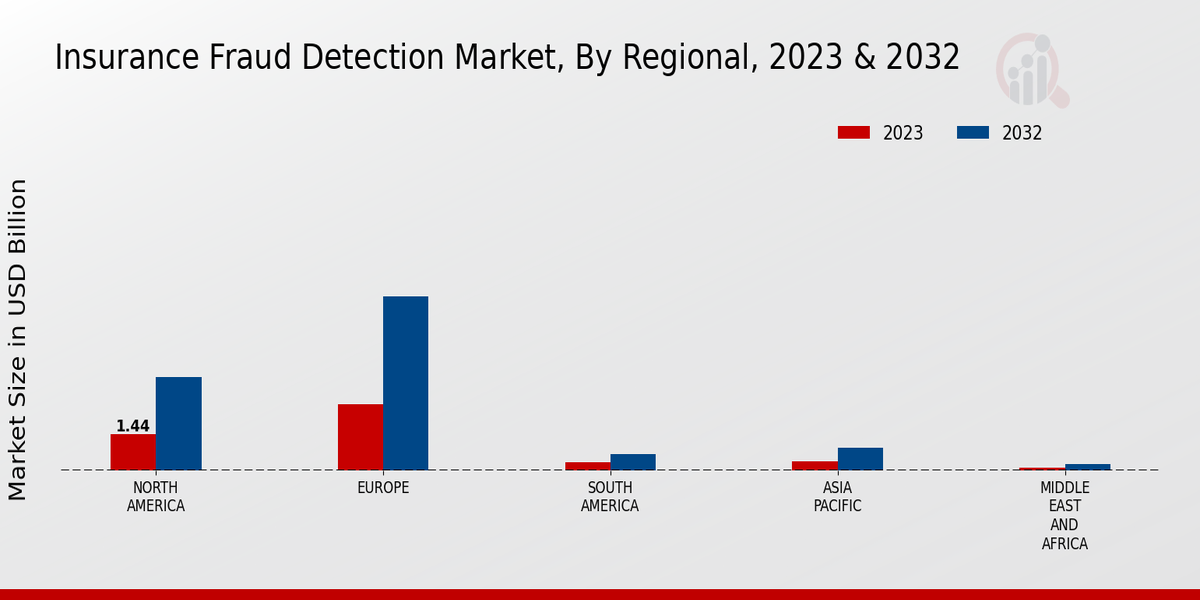

The regional segmentation of the Insurance Fraud Detection Market offers valuable insights into the geographical distribution of market growth and opportunities. North America dominates the market with a significant share, driven by factors such as advanced insurance infrastructure, high rates of insurance penetration, and stringent regulatory frameworks. Europe follows closely, exhibiting steady growth due to increasing awareness of insurance fraud and the adoption of advanced fraud detection technologies.

The APAC region is projected to witness the fastest growth over the forecast period, supported by the rapid expansion of the insurance industry, rising disposable income, and government initiatives to combat fraud. South America and MEA also present promising growth prospects, with increasing insurance penetration and the need for fraud prevention solutions. As per reliable market research, the Insurance Fraud Detection Market is anticipated to reach a valuation of approximately USD 6.5 billion by 2024, driven by the growing prevalence of insurance fraud, technological advancements, and regulatory mandates.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Insurance Fraud Detection Market Key Players And Competitive Insights:

The Insurance Fraud Detection Market is a highly competitive space with a mixture of established and emerging players. Leading players within the market include SAS Institute, LexisNexis Risk Solutions, NICE Actimize, FRISS, and SAS Institute. These companies provide the market with a wide range of solutions that cater to all of the insurance industry’s needs, whether fraud detection, fraud prevention, claims investigation, or claims mitigation. As the insurance fraud detection market grows, more and more players are entering the market, driving the market growth.

Factors driving the Insurance Fraud Detection Market are increasing insurance fraud, current enabling technologies, and growing fraud awareness. Thus, major players within the market are increasingly investing in the development of innovative solutions to address the varied and evolving needs of the insurance industry.

One of the leading players in the Insurance Fraud Detection Market is SAS Institute. SAS has developed a wide range of fraud detection and prevention solutions that rely on the advanced analytics and machine learning technologies developed by the company. SAS Institute’s solutions cover the insurance industry. Today, many insurance companies around the world are using SAS solutions to detect and mitigate fraud, from property and casualty insurance to health insurance. With a reputation for innovation, investment, and customer satisfaction, SAS is a market leader in the Insurance Fraud Detection Market.

One of the key players in the Insurance Fraud Detection Market is LexisNexis Risk Solutions, which competes with SAS. LexisNexis solutions have been adopted by insurance companies around the world to detect and deter fraud from the start of the insurance cycle to the end of the claim. With a data-driven approach and close customer ties, LexisNexis is a strong competitor in the market. In addition, the company is likely to strengthen its market position as it continues to invest in innovation and expand its range of solutions.

Key Companies in the Insurance Fraud Detection Market Include:

Insurance Fraud Detection Market Developments

-

Q2 2024: As Execs Eye AI for Fraud Detection, Deloitte Predicts Billions in Savings for Insurers A June 2024 Deloitte survey found that 35% of insurance executives identified fraud detection as a top area for generative AI development, with insurers increasingly investing in AI-driven fraud detection technologies to reduce fraudulent claims and improve efficiency.

Insurance Fraud Detection Market Segmentation Insights

Insurance Fraud Detection Market Fraud Type Outlook

Insurance Fraud Detection Market Detection Method Outlook

Insurance Fraud Detection Market Deployment Model Outlook

Insurance Fraud Detection Market Industry Vertical Outlook

Insurance Fraud Detection Market Component Outlook

Insurance Fraud Detection Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 5.97 Billion |

| Market Size 2025 |

USD 6.62 Billion |

| Market Size 2034 |

USD 16.93 Billion |

| Compound Annual Growth Rate (CAGR) |

10.98% (2025-2034) |

| Base Year |

2024 |

| Market Forecast Period |

2025-2034 |

| Historical Data |

2020-2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Oracle, NICE Systems, FICO, Shift Technology, Verisk Analytics, Experian, LexisNexis Risk Solutions, FRISS, Equifax, TransUnion, SAS, BAE Systems Applied Intelligence, Guidewire Software, IBM, SAS Institute |

| Segments Covered |

Fraud Type, Detection Method, Deployment Model, Industry Vertical, Component, Regional |

| Key Market Opportunities |

AIpowered fraud detectionRealtime data analyticsCloud-based fraud detection systemsAutomation of fraud investigationsPredictive modeling for fraud prevention |

| Key Market Dynamics |

Growing insurance premiumsTechnological advancementsIncreasing regulatory mandatesRising incidence of insurance fraudCollaboration between insurers and technology providers |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Insurance Fraud Detection Market is expected to reach a valuation of USD 16.93 billion by 2034, exhibiting a CAGR of 10.98% during the forecast period (2025-2034).

North America is expected to dominate the Insurance Fraud Detection Market, accounting for a significant share of the market in 2023. The region's dominance can be attributed to the presence of advanced insurance fraud detection technologies, a high prevalence of insurance fraud, and stringent regulations.

The increasing incidence of insurance fraud, the rising adoption of digital technologies in the insurance sector, and the growing awareness of fraud detection solutions are the primary growth drivers of the Insurance Fraud Detection Market.

The claims management segment is anticipated to hold the largest market share in the Insurance Fraud Detection Market. The segment's growth is driven by the need to detect and prevent fraudulent claims, which account for a substantial portion of insurance losses.

Key competitors in the Insurance Fraud Detection Market include SAS Institute, LexisNexis Risk Solutions, FRISS, Verisk Analytics, IBM, NICE Actimize, Experian, TransUnion, and FICO.

Emerging trends in the Insurance Fraud Detection Market include the adoption of artificial intelligence (AI), machine learning (ML), and data analytics to enhance fraud detection capabilities, the use of blockchain technology to improve data security and transparency, and the growing focus on predictive analytics to identify potential fraud risks.

The Insurance Fraud Detection Market faces challenges such as the evolving nature of fraud schemes, the lack of standardized data formats, and the need for skilled professionals to operate and interpret fraud detection systems.

Insurance companies can leverage fraud detection solutions to identify and investigate fraudulent claims, reduce operational costs, improve customer trust, and enhance their overall profitability.

Regulatory compliance plays a crucial role in the Insurance Fraud Detection Market. Governments worldwide are implementing regulations to combat insurance fraud, which drives the demand for fraud detection solutions.

The future growth prospects of the Insurance Fraud Detection Market are positive. The market is expected to witness continued growth due to the increasing adoption of advanced technologies, rising awareness of fraud detection solutions, and stringent regulatory mandates.