Market Share

Integrated Cardiology Devices Market Share Analysis

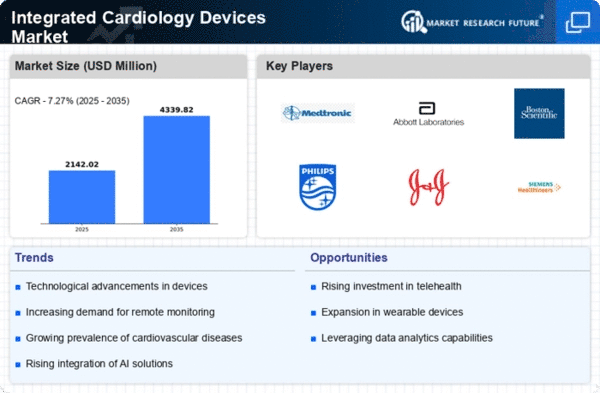

Market share positioning strategies in the Integrated Cardiology Devices Market play a crucial role in determining the success and growth of companies within the sector. Integrated cardiology devices encompass a wide range of products and solutions aimed at diagnosing and treating cardiovascular diseases. In this competitive landscape, companies employ various strategies to establish and enhance their market share.

One prominent strategy is product differentiation. Companies strive to differentiate their integrated cardiology devices from competitors by offering unique features, improved performance, or enhanced usability. By focusing on innovation, companies can attract healthcare providers and gain a competitive edge in the market. For example, companies may invest in research and development to introduce cutting-edge technologies such as advanced imaging capabilities or minimally invasive procedures, which appeal to both healthcare professionals and patients.

Another key strategy is pricing. Companies carefully analyze market trends, competitor pricing strategies, and customer preferences to determine optimal pricing strategies for their integrated cardiology devices. Some companies may adopt a premium pricing strategy, positioning their products as high-end solutions with superior quality and performance. Others may opt for a competitive pricing approach, offering more affordable alternatives to capture price-sensitive segments of the market. By strategically pricing their products, companies can effectively target different customer segments and maximize market share.

Furthermore, strategic partnerships and collaborations play a vital role in market share positioning within the integrated cardiology devices market. Companies often form alliances with healthcare institutions, research organizations, and other industry players to expand their reach and access new markets. Collaborations can facilitate product development, regulatory approvals, and market penetration, enabling companies to accelerate growth and gain a competitive advantage. Additionally, partnerships with distributors and channel partners help companies leverage existing networks and increase market presence in targeted regions.

Market segmentation is another crucial aspect of market share positioning strategies in the integrated cardiology devices market. Companies analyze demographic, geographic, and psychographic factors to identify distinct customer segments with unique needs and preferences. By tailoring their marketing efforts and product offerings to specific segments, companies can effectively address customer requirements and strengthen their market position. For instance, companies may develop specialized integrated cardiology devices for pediatric patients, elderly populations, or individuals with specific medical conditions, catering to diverse market segments and enhancing competitiveness.

Moreover, investment in marketing and promotional activities is essential for market share positioning in the integrated cardiology devices market. Companies employ various marketing channels such as digital advertising, professional conferences, and direct sales to raise awareness about their products and services. By effectively communicating the value proposition and benefits of their integrated cardiology devices, companies can attract healthcare providers, build brand recognition, and drive sales growth. Additionally, ongoing customer support and training programs help companies foster customer loyalty and satisfaction, further strengthening their market position over time.

Leave a Comment