Top Industry Leaders in the Intelligent Pumps Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Intelligent Pumps industry are:

ITT Corporation

Xylem

KSB Aktiengesellschaft

Emerson

Flowserve Corporation

ABB

Wilo SE

Grundfos Holding

Kirloskar

Quantumflo

Sulzer

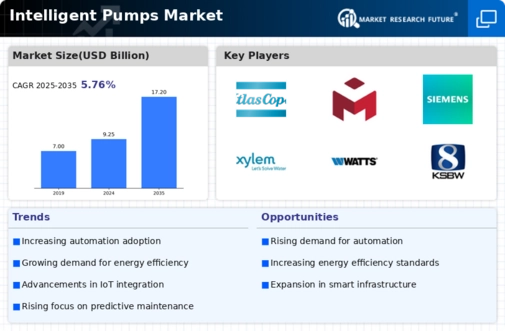

Flowing with Intelligence: Exploring the Competitive Landscape of the Intelligent Pump Market

Beneath the hum of industrial machinery and the gurgling of water in cities, a silent conductor orchestrates the flow of life-blood - the intelligent pump market. This multi-billion dollar space pulsates with activity, as established giants, nimble innovators, and regional specialists vie for a share in the technology that optimizes and automates fluid movement. Let's delve into the key strategies, market dynamics, and future trends shaping this vital landscape.

Key Player Strategies:

Global Titans: Companies like ABB, Grundfos, and Xylem leverage their extensive experience, diverse product portfolios, and global reach to maintain their dominance. They cater to major industrial and municipal clients, offering advanced intelligent pumps equipped with variable speed drives, intelligent sensors, and advanced control systems. Grundfos' E-Series pumps with Grundfos Demand Driven Control exemplify their focus on energy efficiency and smart operation.

Technology Disruptors: Startups like Amirix Systems and Fluid Technology Solutions are disrupting the market with cutting-edge features like artificial intelligence (AI)-powered predictive maintenance, cloud-based data analytics, and self-diagnosing capabilities. They cater to tech-savvy clients seeking proactive equipment management and real-time optimization. Amirix Systems' IntelliFlo pumps with smart analytics showcase their focus on AI-driven pump health and performance insights.

Cost-Effective Challengers: Chinese manufacturers like Wilo SE and Sun Hydraulics are making waves with competitively priced intelligent pumps, targeting budget-conscious projects in emerging markets. They focus on affordability and basic functionalities like variable speed control, offering alternatives to premium brands. Sun Hydraulics' VFD series pumps demonstrate their focus on cost-effective flow management solutions.

Niche Specialists: Companies like Flowserve Corporation and Sulzer excel in specific segments like high-pressure pumps for oil and gas or heavy-duty pumps for wastewater treatment. They leverage their deep understanding of specialized applications and offer tailored solutions with robust functionalities for demanding environments. Sulzer's CP range of pumps showcases their focus on high-performance fluid transfer in complex industrial settings.

Factors for Market Share Analysis:

Technology and Functionality: Offering advanced features like multi-stage hydraulics, energy-saving algorithms, and seamless integration with control systems caters to diverse operational needs and improves overall system efficiency. Companies with sophisticated functionalities gain an edge.

Data Management and Analytics: Providing secure cloud-based data storage, user-friendly analytics dashboards, and proactive maintenance insights derived from pump data attracts clients seeking operational transparency and optimized pump performance. Companies with strong data management and analytics solutions stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is crucial for mass adoption, particularly in cost-sensitive projects. Companies offering affordable intelligent pumps without compromising on basic functionalities gain market share.

Compliance and Standards: Adherence to strict regulatory standards, ensuring data security and pump reliability, and offering customized solutions for specific industries like food and beverage or pharma attracts regulators and specialized clients. Companies prioritizing compliance and tailored solutions gain an edge.

New and Emerging Trends:

Focus on Sustainability and Energy Efficiency: Developing high-efficiency intelligent pumps, minimizing energy consumption through data-driven optimization, and promoting integrated resource management solutions caters to increasing demand for greener industrial processes. Companies demonstrating sustainability commitment attract ethical investors and regulatory benefits.

Connected Infrastructure and IoT Integration: Integrating intelligent pumps with smart grids, industrial IoT platforms, and predictive maintenance networks offers real-time operational insights and seamless data exchange within smart infrastructure. Companies embracing IoT integration stand out.

Focus on Cybersecurity and Data Protection: Implementing robust cybersecurity measures to protect pump data from cyberattacks, ensuring secure cloud storage, and offering tamper-proof communication protocols are crucial as more pumps connect to the internet. Companies prioritizing cybersecurity gain trust and regulatory compliance.

Regional Customization and Regulatory Adaptation: Adapting intelligent pump designs and materials to cater to specific regional water conditions, adhering to diverse regulatory standards, and offering regional distribution networks attract local water treatment and industrial facilities. Companies with strong regional customization capabilities gain market share.

Overall Competitive Scenario:

The intelligent pump market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while technology disruptors introduce cutting-edge features and AI-powered solutions. Cost-effective challengers cater to budget-conscious buyers, and niche specialists excel in specific applications. Factors like technology, data management, affordability, and compliance play a crucial role in market share analysis. New trends like sustainability, IoT integration, cybersecurity, and regional customization offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse flow management needs, embrace sustainable practices, and explore data-driven solutions. By flowing with intelligence, adaptability, and responsibility, they can secure a dominant position in this vital landscape.

Latest Company Updates:

ITT Corporation:

- Date: November 2023 (Source: ITT Press Release)

- Development: Launched IntelliFlo® VS 500 Smart Pool Pump with integrated Wi-Fi and mobile app control for advanced automation and energy savings.

Xylem:

- Date: December 2023 (Source: Xylem Website)

- Development: Acquired Sanitaire, a leader in intelligent wastewater treatment solutions, strengthening its offering in smart water management.

KSB Aktiengesellschaft:

- Date: October 2023 (Source: KSB Website)

- Development: Unveiled Etaprime 2, a next-generation smart pump platform with integrated sensor technology and advanced connectivity features.

Emerson:

- Date: December 2023 (Source: Emerson Automation Solutions Website)

- Development: Introduced the SmartPak Intelligent Pumping System, a pre-engineered package with integrated intelligence for optimized water and wastewater treatment.