-

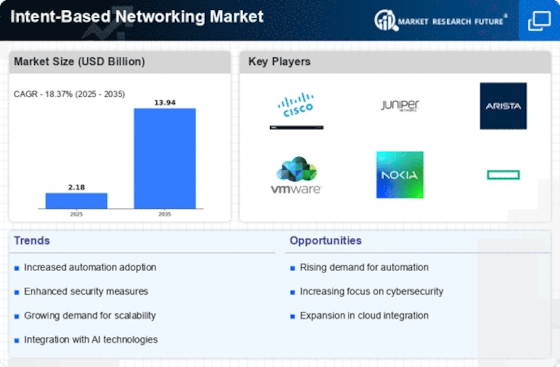

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining power of buyers

- Threat of substitutes

- Rivalry

- Bargaining Power of Suppliers

-

Value Chain/Supply Chain of Global Intent-based networking (IBN) Market

-

Market Overview of Global Intent-based networking (IBN) Market

-

Introduction

-

Growth Drivers

-

Impact Analysis

-

Market Challenges

-

Market Trends

-

Introduction

-

Growth Trends

-

Impact Analysis

-

Global Intent-based networking (IBN) Intent Based Networking Market, by Application

-

Introduction

-

Data Center

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Remote Offices

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Cloud

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Global Intent-based networking (IBN) Intent Based Networking Market, by Component

-

Introduction

-

Hardware

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

- Switches

- Routers

- Gateways

- Others

-

Software

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

- APIs

- SDKs

-

Service

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

- Managed Service

- Professional Service

-

Global Intent-based networking (IBN) Intent Based Networking Market, by End-User

-

Introduction

-

BFSI

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

IT & telecommunication

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Government

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Defense

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Healthcare

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Others

- Market Estimates & Forecast, 2024-2032

- Market Estimates & Intent Based Networking Market, by Region, 2024-2032

-

Global Intent-based networking (IBN) Intent Based Networking Market, by Region

-

Introduction

-

North America

- Market Estimates & Intent Based Networking Market, by Country 2024-2032

- Market Estimates & Intent Based Networking Market, by Application, 2024-2032

- Market Estimates & Intent Based Networking Market, by Component s, 2024-2032

- Market Estimates & Intent Based Networking Market, by End-User, 2024-2032

- US

- Mexico

- Canada

-

Europe

- Market Estimates & Intent Based Networking Market, by Country 2024-2032

- Market Estimates & Intent Based Networking Market, by Application, 2024-2032

- Market Estimates & Intent Based Networking Market, by Component s, 2024-2032

- Market Estimates & Intent Based Networking Market, by End-User, 2024-2032

- Germany

- France

- UK

-

Asia-Pacific

- Market Estimates & Intent Based Networking Market, by Country 2024-2032

- Market Estimates & Intent Based Networking Market, by Application, 2024-2032

- Market Estimates & Intent Based Networking Market, by Component s, 2024-2032

- Market Estimates & Intent Based Networking Market, by End-User, 2024-2032

- China

- India

- Japan

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Intent Based Networking Market, by Country 2024-2032

- Market Estimates & Intent Based Networking Market, by Application, 2024-2032

- Market Estimates & Intent Based Networking Market, by Component s, 2024-2032

- Market Estimates & Intent Based Networking Market, by End-User, 2024-2032

- Middle East & Africa

- Latin Countries

-

Company Profiles

-

Cisco Systems, Inc

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Apstra Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Huawei Technologies Co., Ltd

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Juniper Networks, Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Cerium Networks

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Pluribus Networks

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Forward Networks, Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Anuta Networks

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Indeni. Ltd.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Veriflow Systems

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

-

LIST OF TABLES

-

Table1 Global Intent-based networking (IBN) Intent Based Networking Market, By Country, 2024-2032

-

Table2 North America: Intent-based networking (IBN) Intent Based Networking Market, By Country, 2024-2032

-

Table3 Europe: Intent-based networking (IBN) Intent Based Networking Market, By Country, 2024-2032

-

Table4 Asia-Pacific: Intent-based networking (IBN) Intent Based Networking Market, By Country, 2024-2032

-

Table5 Latin America: Intent-based networking (IBN) Intent Based Networking Market, By Country, 2024-2032

-

Table6 North America: Intent-based networking (IBN) Intent Based Networking Market, By Country

-

Table7 North America: Intent-based networking (IBN) Intent Based Networking Market, By Application

-

Table8 North America: Intent-based networking (IBN) Intent Based Networking Market, By Component

-

Table9 North America: Intent-based networking (IBN) Intent Based Networking Market, By End-User

-

Table10 Europe: Intent-based networking (IBN) Intent Based Networking Market, By Country

-

Table11 Europe: Intent-based networking (IBN) Intent Based Networking Market, By Application

-

Table12 Europe: Intent-based networking (IBN) Intent Based Networking Market, By End-User

-

Table13 Europe: Intent-based networking (IBN) Intent Based Networking Market, By Component

-

Table14 Asia-Pacific: Intent-based networking (IBN) Intent Based Networking Market, By Country

-

Table15 Asia-Pacific Intent-based networking (IBN) Intent Based Networking Market, By Application

-

Table16 Asia-Pacific Intent-based networking (IBN) Intent Based Networking Market, By End-User

-

Table17 Asia-Pacific Intent-based networking (IBN) Intent Based Networking Market, By Component

-

Table18 Middle East & Africa: Intent-based networking (IBN) Intent Based Networking Market, By Country

-

Table19 Middle East & Africa: Intent-based networking (IBN) Intent Based Networking Market, By Application

-

Table20 Middle East & Africa: Intent-based networking (IBN) Intent Based Networking Market, By End-User

-

Table21 Middle East & Africa: Intent-based networking (IBN) Intent Based Networking Market, By Component

-

Table22 Latin America: Intent-based networking (IBN) Intent Based Networking Market, By Country

-

Table23 Latin America: Intent-based networking (IBN) Intent Based Networking Market, By Application

-

Table24 Latin America: Intent-based networking (IBN) Intent Based Networking Market, By End-User

-

Table25 Latin America: Intent-based networking (IBN) Intent Based Networking Market, By Component

-

-

LIST OF FIGURES

-

Global Intent-based networking (IBN) Market segmentation

-

Forecast Methodology

-

Porter’s Five Forces Analysis of Global Intent-based networking (IBN) Market

-

Value Chain of Global Intent-based networking (IBN) Market

-

Share of Intent-based networking (IBN) Intent Based Networking Market, by country (in %)

-

Global Intent-based networking (IBN) Market, 2024-2032

-

Share of Global Intent-based networking (IBN) Market by Industry, 2024-2032

-

Global Intent-based networking (IBN) Intent Based Networking Market, by Application, 2020

-

Share of Global Intent-based networking (IBN) Intent Based Networking Market, by Application, 2024-2032

-

Global Intent-based networking (IBN) Intent Based Networking Market, by Component, 2020

-

Share of Global Intent-based networking (IBN) Intent Based Networking Market, by Component, 2024-2032

-

Global Intent-based networking (IBN) Intent Based Networking Market, by End-User, 2020

-

Share of Global Intent-based networking (IBN) Intent Based Networking Market, by End-User, 2024-2032

Leave a Comment