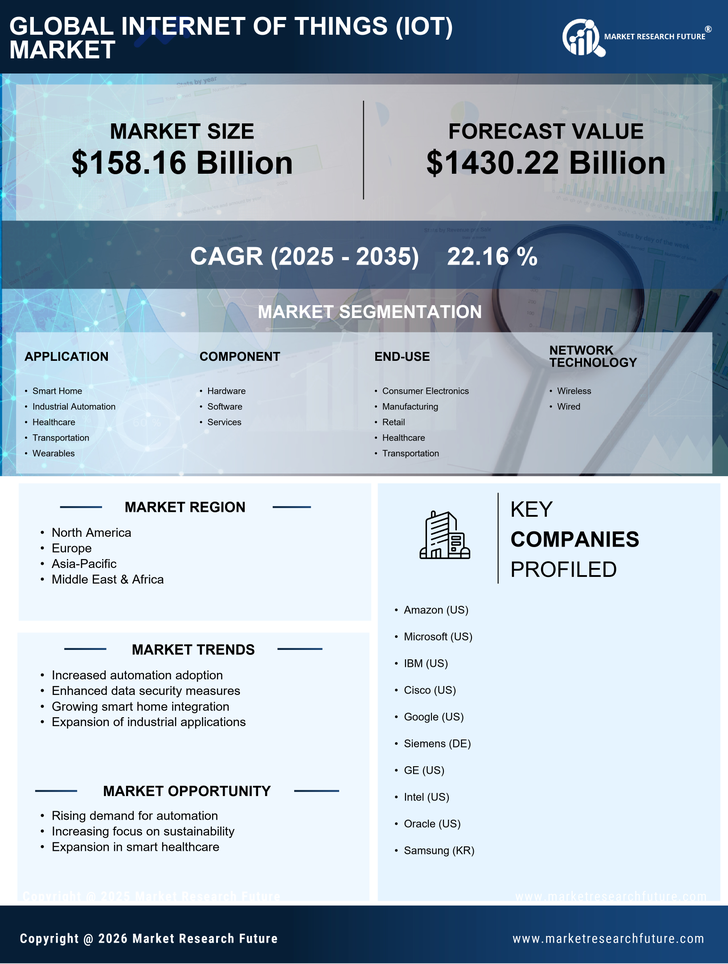

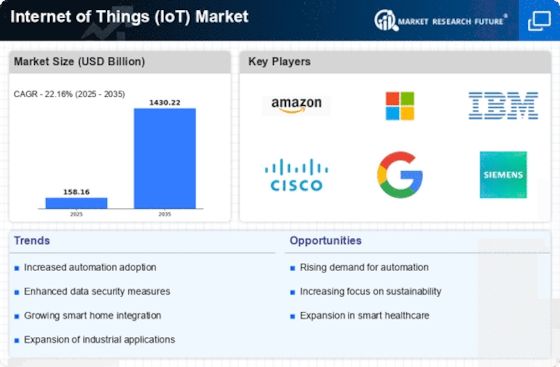

The competitive insights of the Internet of Things Market (IoT) Market reveal a dynamic landscape characterized by rapid technological advancement and a surge in adoption across various sectors.

As IoT continues to grow, marked by the integration of devices, services, and applications, it fosters an ecosystem where diverse industries can optimize operations, enhance customer experiences, and implement data-driven strategies. Companies are integrating IoT technology in smart devices to enable predictive maintenance and real-time monitoring. AWS, Microsoft, and IBM are developing IoT analytics platforms to enhance IoT and data analytics capabilities for industrial and consumer applications. The deployment of IoT connected devices in smart factories, transportation, and healthcare continues to accelerate.

Companies vying for market leadership strive to innovate and differentiate their offerings, thereby catering to the increasing demand for connected solutions. The competitive interplay among key players is underscored by significant investment in research and development, strategic partnerships, and an emphasis on scalability and security.

The holistic view of the competitive landscape provides insights into emerging trends, capabilities, and strategies that delineate the strengths and weaknesses of various market participants.

Huawei is strategically positioned in the Internet of Things Market (IoT) Market, boasting a comprehensive portfolio that emphasizes connectivity, infrastructure, and integrated solutions. The company's strengths lie in its robust research and development capabilities, which empower it to produce cutting-edge IoT technologies and solutions.

Huawei leverages its extensive experience in telecommunications to provide reliable IoT frameworks, facilitating seamless connectivity between devices and platforms. With a focus on scalability, the company's solutions are tailored to industries such as manufacturing, smart cities, and automotive, establishing a formidable presence across global markets.

Moreover, Huawei's commitment to innovation is evident in its partnerships and collaborations, which further solidify its reputation as a leader in the IoT space.

General Electric holds a prominent position in the Internet of Things Market (IoT) Market, characterized by its pioneering advancements in industrial IoT solutions. The company's strengths are particularly visible through its key products and services, which focus on enhancing operational efficiency, predictive maintenance, and data analytics.

General Electric's IoT platform, coupled with its robust analytics capabilities, allows industries to move towards digitization and smart factory implementations.

The company's global presence is bolstered by strategic mergers and acquisitions that expand its technological capabilities and market reach, enabling it to provide comprehensive solutions tailored to different sectors, including energy, healthcare, and transportation.

General Electric's emphasis on innovation, data-driven insights, and industry partnerships highlights its unwavering commitment to lead in the IoT domain, driving transformational change across the global landscape.