Top Industry Leaders in the IP Multimedia Subsystem Market

The Competitive Landscape of the IP Multimedia Subsystem Market

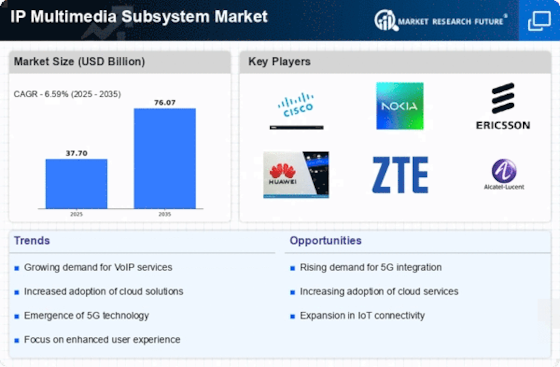

The IP Multimedia Subsystem (IMS) market is thriving, driven by the escalating demand for next-generation communication services like Rich Communication Services (RCS), Voice over LTE (VoLTE), and video conferencing. This burgeoning landscape is rife with competition, with established players jostling for market share alongside nimble newcomers. To navigate this dynamic environment, understanding the competitive landscape is crucial.

Some of the IP Multimedia Subsystem companies listed below:

- Allot Communication

- LM Ericsson

- Ascom Holdings AG

- Oracle

- Huawei Technologies Co. Ltd.

- Bradford Networks, Inc.

- Nokia Corporation (Finland)

- HP

- Alcatel-Lucent

- Cisco Systems, Inc.

- IBM Corporation

- Brocade Communications Systems, Inc.

Strategies Adopted by Leaders:

- Technology Powerhouse Approach: Giants like Ericsson, Huawei, and ZTE leverage their R&D prowess to offer comprehensive IMS solutions encompassing core network elements, middleware, and value-added services. This one-stop-shop approach caters to large-scale deployments and complex network environments.

- Agility and Niche Expertise: Start-ups and smaller players inject agility into the market, specializing in specific areas like session border controllers, integrated communication platforms, or cloud-native IMS solutions. This targeted approach allows them to address niche requirements and compete on cost-effectiveness.

- Ecosystem Collaboration: Openness and collaboration are becoming key differentiators. Companies like Metaswitch and Athonet foster open IMS platforms, enabling rapid innovation and integration with third-party applications. This collaborative approach attracts service providers seeking flexibility and customization.

Factors for Market Share Analysis:

- Geographical Footprint: Presence in key regions like North America, Europe, and Asia-Pacific, where IMS adoption is accelerated by 5G rollouts, holds significant weight. Companies like Nokia and Cisco, with established networks and partnerships, hold an advantage.

- Portfolio Breadth: Offering a diverse range of solutions catering to varied operator needs – mobile, fixed, and converged – is crucial. Players like Oracle and Radisys, with diverse portfolios encompassing core IMS, VoLTE, and messaging solutions, stand out.

- Pricing and Commercial Models: Flexible pricing models like subscription-based or pay-as-you-grow options become attractive differentiators, especially for smaller operators. Additionally, companies offering managed services and cloud-based deployments gain traction.

New and Emerging Companies:

- Cloud-Native IMS Solutions: The surge in cloud adoption paves the way for cloud-native IMS solutions offered by companies like Ribbon Communications and Cirpack. These offer faster deployment, scalability, and cost-efficiency, appealing to operators with limited resources.

- Open Source Technologies: The rise of open-source IMS platforms like FreeDiameter and Open IMS Core fuels innovation and cost-reduction. This empowers smaller players and fosters a more collaborative ecosystem.

- Integration with AI and Analytics: As operators seek to personalize user experiences and optimize network performance, companies embedding AI and analytics into their IMS solutions gain traction. Players like Dialogic and CommVerge Solutions are at the forefront of this trend.

Latest Company Updates:

November 2023- The Austrian telecom provider Magenta Telekom has implemented Mavenir's complete cloud-native IMS (IP Multimedia Subsystem) solution to facilitate software-defined voice services for Magenta Telekom's network users. Mavenir's fully cloud-native IMS solution will be leveraged by Magenta Telekom to offer Voice over LTE (VoLTE) and Voice over Wi-Fi (VoWi-Fi) services to its customers. This will establish the groundwork for Magenta Telekom's future rollout of Voice over New Radio (VoNR) offerings, including 5G Voice and Web Real-Time Communication (WebRTC).

October 2023- Mavenir, a Network Software Provider building future networks with cloud-native solutions operable on any cloud, and Ice Norway, the third largest mobile operator in the country, have fully deployed Mavenir’s end-to-end Cloud-Native IMS (IP Multimedia Subsystem) solution. This strategic project expansion, delivered together with Red Hat, establishes Mavenir as the comprehensive data and voice core partner for Ice Norway. Ice Norway had previously chosen Mavenir’s Converged Packet Core solution to enable its 4G and 5G Network and is leveraging Mavenir’s Webscale Platform (MWP) for fast and agile delivery of new applications.

June 2023- AT&T and Cisco have unveiled an updated version of Webex Go that boosts mobility for today's workforce. At the Cisco Live event, AT&T and Cisco announced a new iteration of Webex Go that enables corporate AT&T phone plans to seamlessly integrate with Webex Calling plans. This provides Webex users with a unified identity based on their AT&T mobile phone number. Since this solution is built into AT&T's IP Multimedia Subsystem, which is part of its mobile core network, Webex Calling users will have one phone number that works on their AT&T mobile phone, Webex desk phone, and the Webex app on PCs and tablets.