- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

The global demand for isocyanates is strongly influenced by the increasing need for both rigid and flexible polyurethane foam (PU) across various applications. Rigid polyurethane foam is particularly sought after for its widespread use in the building and construction industries, where its excellent insulating properties and ability to maintain uniform temperatures make it highly valuable. Meanwhile, flexible polyurethane foam is witnessing a rise in demand for diverse applications like furnishings, flooring, automotive, and packaging, owing to its outstanding qualities, including being lightweight, durable, comfortable, and resilient.

The flourishing building and construction industry, driven by the growing demand for modern residential architecture and increased government spending on construction projects, is a significant factor fueling the demand for polyurethane foam and, consequently, isocyanates. Additionally, there is a notable shift towards energy-efficient buildings to minimize carbon emissions, further boosting the demand for rigid polyurethane foam at a substantial rate throughout the review period.

The automotive sector is experiencing notable growth due to the escalating demand for energy-efficient vehicles to comply with emission standards set by environmental regulatory agencies such as the US Environmental Protection Agency and European Environment Agency. Global automobile manufacturers, including Nissan, Hyundai, Volkswagen AG, Kia, and Tesla, are focusing on the production of electric and plug-in vehicles to meet these emission standards. For example, in August 2018, Jaguar Land Rover Classic initiated the production of the E-Type Zero car in the US. This surge in electric and plug-in vehicle manufacturing has led to an increased demand for polyurethane foam, as it contributes to reducing the weight of vehicles while providing comfort, corrosion resistance, excellent insulation, and sound absorption. PU foam finds applications in various parts of automobiles, including seats, bumpers, interior headline ceilings, car bodies, spoilers, doors, and windows.

Covered Aspects:

| Report Attribute/Metric | Details |

|---|---|

| Segment Outlook | Type, Application, End Use, and Region |

Isocyanate Market Highlights:

Global Isocyanates Market Overview

Isocyanates Market Size was valued at USD 31.4 Billion in 2023. The Isocyanates industry is projected to grow from USD 33.61 Billion in 2024 to USD 54.0 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.11% during the forecast period (2024 - 2032). Polyurethane foam is being used more and more frequently, industrialization in Asia and the Pacific is stepping up, and demand from the building sector is rising, are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst ReviewIsocyanates Market Trends

-

Growing demand in the construction industry is driving the market growth

To make isocyanate, amines are treated with phosgene. The construction industry's increasing need for its highly reactive chemical property is a key driver of market growth. These are utilised in rigid foams, adhesives, and coatings. These are used in the automotive industry as car exteriors to lighten automobiles and as insulators in the electrical industry. Consumer and industrial applications are projected to drive the market in the near future as polyurethane consumption continues to rise. Due to escalating demand from the furniture industry, which includes items like carpet cushions and mattress padding, the market for isocyanates is expanding rapidly. Since crude oil is essential to the manufacture of MDI and TDI, the price of crude oil has a considerable impact on the oil market. The extremely volatile price of crude oil is causing a growth in the market for isocyanates. Future expansion of the isocyanates market will be significantly influenced by the development of bio-based isocyanates.

It is anticipated that the expansion of the worldwide isocyanate industry will be considerably aided by the rising demand for upholstered furniture and other forms of furniture. Paints and varnishes frequently include isocyanates. The isocyanate market is significantly more constricted than the market for conventional mineral oil due to the unstable prices and raw material availability as well as the extremely toxic and dangerous properties of isocyanate compounds. With the proliferation of sealants, adhesives, and elastomers, the need for metered-dose inhalers, which is the main factor driving isocyanate demand and driving the market towards significant growth, is predicted to climb over time.

The prospective application of these products in end-use industries like automotive and electronics is anticipated to boost their demand throughout the projection period. They are used as insulators in the electrical industry and as car exteriors in the automotive business to reduce vehicle weight. Rising polyurethane use in a range of consumer and industrial applications is predicted to enhance the market during the coming years. The development of bio-based isocyanates is predicted to further fuel market expansion on a scale. The primary driver of the market is the growth of the end-use markets for the polyurethane sector. Isocyanates are frequently used in paints and varnishes, flooring, and decorations in the housing industry. The isocyanate market is expected to expand significantly over the course of the forecast period due to rising demand from the furniture industry for mattress padding and carpet cushions. Thus, driving the Isocyanates market revenue.

September 2023

For the past century and a half, DENSO Group Germany has established quality benchmarks on innumerable pipeline projects across the globe with its diverse corrosion protection systems. DENSO Group Germany is extending its product portfolio to incorporate high-performance epoxy coatings under the brand FORTIDE®.

In order to address the varied and continuously expanding requirements of pipeline construction, FORTIDE® provides long-lasting corrosion protection for an extensive array of applications amid severe conditions. For optimal performance, FORTIDE®-HT can withstand operating temperatures of up to +150°C. Additional iterations of FORTIDE® are engineered specifically for use on damp surfaces or as internal coatings for conduits or containers. The following characteristics unify all FORTIDE® products: adherence to the global standard ISO 21809-3 and the DENSO quality guarantee Made entirely in Germany.

As a whole pipe coating, FORTIDE® is appropriate for pipeline rehabilitation; it can also be applied to welded connections and intricate geometries. The products are distinguished by their exceptional indentation strength and coating hardness. Even in dense layers, they are applied to the surface in a single operation whether in the form of a mist or brush coating. Isocyanates and volatile solvents are absent from FORTIDE®.

Isocyanates Market Industry Insights

Isocyanates Type Insights

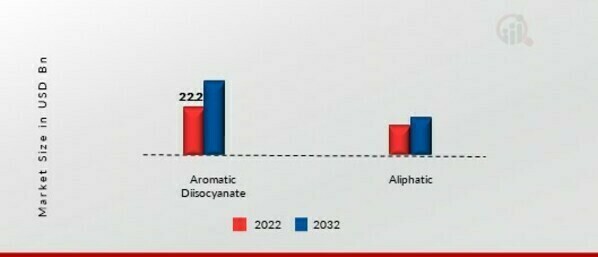

The Isocyanates market segmentation, based on Type, includes Aromatic Diisocyanate and Aliphatic. Aromatic diisocyanate segment dominated the market in 2022. MDI is the main subgroup of the isocyanates type. Formaldehyde and aniline interact to generate diphenylmethanediamine (MDA). When MDA is exposed to phosgene, MDI is created. Hard foams are the main product of MDI production. The MDI utility market is anticipated to grow fast in the next years because to its use in refrigerators, freezers, and the manufacture of seats and automobile interiors.

Figure 1: Isocyanates Market, by Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Isocyanates Application Insights

The Isocyanates market segmentation, based on Application, includes Rigid Foam, Flexible Foam, Paints and Coatings, Adhesives and Sealants, Elastomers, Binders, and Others. Flexible foam segment dominated the market in 2022. It is projected that the extensive usage of flexible foams in the cushion, bedding, furniture, and packaging sectors would further support the growth of the isocyanates market. Coatings provide protection against corrosion and UV radiation. The extensive use of adhesives and sealants, such as wood rocking glue, is anticipated to promote market growth ly throughout the course of the forecast period.

Isocyanates End Use Insights

The Isocyanates market segmentation, based on End Use, includes Building & Construction, Furniture, Automotive, Electronics, Packaging, Footwear, and Others. Building & construction segment dominated the Isocyanates market in 2022. Isocyanates are primarily used in the building and construction industry for a variety of home, industrial, and commercial applications. One of the most popular isocyanates for use in insulation for walls, roofs, insulated panels, and gaps around doors and windows is rigid PU foam.

Isocyanates Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America Isocyanates Market dominated this market in 2022 (45.80%). This is a result of increased regulatory action from organisations like the EPA over the negative impacts of MDI and TDI on the environment and human health. Further, the U.S. Isocyanates market held the largest market share, and the Canada Isocyanates market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: ISOCYANATES MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Isocyanates market accounted for a healthy market share in 2022. This is due to the slow growth of end-use industries and the rigorous environmental regulations. Further, the German Isocyanates market held the largest market share, and the U.K Isocyanates market was the fastest growing market in the European region

The Asia Pacific Isocyanates market is expected to register significant growth from 2023 to 2032. Expanding end-use industries like construction, electronics, and automotive in developing countries like China and India are expected to promote market expansion in the Asia Pacific region over the course of the projected decade. Moreover, China’s Isocyanates market held the largest market share and the Indian Isocyanates market was the fastest growing market in the Asia-Pacific region.

Isocyanates Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Isocyanates market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Isocyanates End Use must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Isocyanates End Use to benefit clients and increase the market sector. In recent years, the Isocyanates End Use has offered some of the most significant advantages to medicine. Major players in the Isocyanates market, including Asahi Kasei Corporation, Metsui Chemicals America, Inc., Evonik Industries AG, LANXESS, DowDuPont, Inc., Tosoh Corporation, Covestro AG, BASF SE, Wanhua Chemical Group Co. Ltd, Huntsman International LLC, Vencorex, Cangzhua Dahua Group Co. Ltd, Komho Mitsui Chemicals Corp, China National Bluestar (Group) Co., Ltd, and Anderson Development, are attempting to increase market demand by investing in research and development Types.

BASF SE (BASF) is a company that produces chemicals. It manufactures, markets, and sells chemicals, polymers, crop protection products, and performance items. The company's product line includes solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, paints, food additives, fungicides, and herbicides. The company works with a wide range of industries, including those related to building, woodworking, agriculture, electronics and electrical, paints and coatings, transportation, home care, nutrition, and chemicals. In partnership with international customers, partners, and researchers, BASF carries out R&D. The company's operations are supported by a network of production facilities. It can be found all over the world, including in North America, Europe, Asia, South America, Africa, and the Middle East. The BASF corporate headquarters are in Ludwigshafen, Germany. In July 2022, work will start on the last phase of the expansion project for the methylene diphenyl diisocyanate (MDI) facility at BASF's Verbund site in Geismar, Louisiana. The business started the growth project in 2018, using a staggered approach and three investment rounds. The final expansion phase, which spans 2022 to 2025, will require a total expenditure of USD 780 million.

Lanxess AG (Lanxess) is a producer of specialty chemicals. Plastics, specialty chemicals, additives, and chemical intermediates are all created, produced, and sold by this company. The company's products are used in a variety of industries, including agrochemicals, automotive, construction, aromas and flavours, pharmaceuticals, tyre chemicals, electrical, electronics, leather processing, and water treatment. To do R&D, it works with research institutes and universities. Among its well-known brands are Rhenogran, Aktiplast, Aflux, Vulcuren, Perkalink, and Rhenoshape. The company's operations are supported by a network of production facilities. Latin America, North America, Europe, and the Asia-Pacific region are all home to it. Lanxess has its headquarters in Cologne, North Rhine-Westphalia, Germany. In November 2019, Lanxess introduced a new line of low free (LF) isocyanate-urethane prepolymers that may be converted into resins for additive manufacturing (additive 3D printing). These high-performance resins, which are based on the prepolymer Adiprene LF PPDI (p- phenylene diisocyanate), are easy to use and secure for industrial manufacturers as well as for homes, offices, and infrequent retail customers.

Key Companies in the Isocyanates market include

- Asahi Kasei Corporation

-

Metsui Chemicals America, Inc. - Evonik Industries AG

- LANXESS

- DowDuPont, Inc.

- Tosoh Corporation

- Covestro AG

- BASF SE

- Wanhua Chemical Group Co. Ltd

- Huntsman International LLC

- Vencorex

- Cangzhua Dahua Group Co. Ltd

- Komho Mitsui Chemicals Corp

- China National Bluestar (Group) Co., Ltd

- Anderson Development

Isocyanates End Use Developments

February 2022: As part of the growth of the methylene diphenyl diisocyanate (MDI) product line, BASF introduced Lupranat ZERO (Zero Emission, Renewable Origin), the first aromatic isocyanate with no net emissions of greenhouse gases.

April 2021: Specialty chemical producer Lanxess is growing its popular line of trixene aqua blocked water-based isocyanate dispersions. To widen applications and meet the most demanding client requirements, new brands have been added to the product line.

Isocyanates Market Segmentation

Isocyanates Type Outlook

- Aromatic Diisocyanate

- Aliphatic

Isocyanates Application Outlook

- Rigid Foam

- Flexible Foam

- Paints and Coatings

- Adhesives and Sealants

- Elastomers

- Binders

- Others

Isocyanates End Use Outlook

- Building & Construction

- Furniture

- Automotive

- Electronics

- Packaging

- Footwear

- Others

Isocyanates Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.