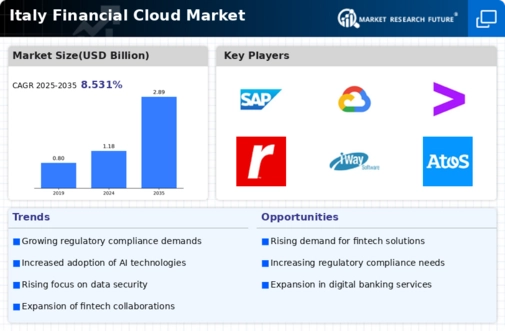

The Italy Financial Cloud Market has been experiencing substantial growth in recent years, driven by the increasing demand for advanced technological solutions within the financial services sector. With a wide array of services including data storage, processing, and analytics, financial institutions are progressively adopting cloud infrastructures to enhance their operational efficiencies. The competitive landscape is characterized by numerous local and international players, all vying for a significant market share. Key competitive insights reveal a focus on innovation, regulatory compliance, and security, as providers strive to address the unique challenges faced by financial organizations in Italy.

Additionally, the increasing shift towards digitization and the adoption of cloud-based services by banks create an environment ripe for competition, compelling companies to differentiate their offerings and establish strong partnerships.Within this dynamic market, SAP has established a solid presence, offering a comprehensive suite of cloud solutions tailored specifically for financial services in Italy. With its deep understanding of industry needs, SAP focuses on delivering integrated financial management, analytics, and real-time reporting features that empower organizations to make data-driven decisions. The company's strengths lie in its robust platform capabilities, which facilitate seamless integration with existing systems and applications.

Furthermore, SAP's commitment to compliance with local regulations, data security, and enhancing customer experience has solidified its reputation as a trusted provider in the Italian financial cloud space. The enterprise is known for leveraging advanced technologies such as machine learning and artificial intelligence, allowing financial institutions to automate processes and gain valuable insights into their operations, all while ensuring optimal performance and reliability.Fujitsu has also carved out a significant niche in the Italy Financial Cloud Market, primarily through its versatile cloud services that address the needs of financial institutions.

Known for its offerings in secure cloud computing solutions, Fujitsu provides essential services such as infrastructure as a service, platform as a service, and various financial analytics solutions, fostering innovation and enhancing customer engagement.

The company has strategically positioned itself in the market by focusing on building strong partnerships with local banks and financial organizations, which enables it to tailor its services to meet specific client requirements. Additionally, Fujitsu's strengths lie in its commitment to sustainability and delivering high-quality support services, ensuring that clients can swiftly adapt to the ever-evolving financial landscape. Recent mergers and acquisitions have further bolstered Fujitsu's capabilities, enriched its portfolio and enhanced its market presence within Italy, allowing the company to maintain a competitive edge and drive significant growth in the financial cloud sector.