Government Initiatives and Support

The Japan Electrical Electronic Computer Aided Design Market benefits significantly from various government initiatives aimed at promoting technological innovation. The Japanese government has implemented policies that encourage research and development in the electronics sector, including funding for startups and established companies. For instance, the 'Society 5.0' initiative aims to integrate advanced technologies into everyday life, which includes enhancing CAD capabilities. This governmental support is likely to foster a conducive environment for the growth of CAD tools, as companies are incentivized to adopt cutting-edge technologies. As a result, the Japan electrical electronic computer aided design market is poised to expand, driven by both public and private sector investments.

Rising Demand for Advanced Electronics

The Japan Electrical Electronic Computer Aided Design Market is experiencing a notable surge in demand for advanced electronic devices. This trend is driven by the increasing complexity of electronic systems, which necessitates sophisticated design tools. As of 2025, the market for electronic components in Japan is projected to reach approximately 1.5 trillion yen, reflecting a compound annual growth rate of around 5%. This growth is likely to propel the demand for CAD tools that can efficiently handle intricate designs and simulations. Furthermore, the push for miniaturization and enhanced functionality in consumer electronics is expected to further stimulate the adoption of advanced CAD solutions, thereby shaping the future landscape of the Japan electrical electronic computer aided design market.

Emergence of IoT and Smart Technologies

The proliferation of Internet of Things (IoT) devices and smart technologies is significantly influencing the Japan Electrical Electronic Computer Aided Design Market. As more devices become interconnected, the complexity of their design increases, necessitating advanced CAD tools that can accommodate these requirements. The IoT market in Japan is projected to reach 10 trillion yen by 2026, indicating a robust growth trajectory. This surge in IoT applications is likely to drive demand for CAD solutions that can effectively manage the design and integration of smart technologies. Consequently, the Japan electrical electronic computer aided design market is expected to evolve, adapting to the needs of a rapidly changing technological landscape.

Increased Focus on Automation and Efficiency

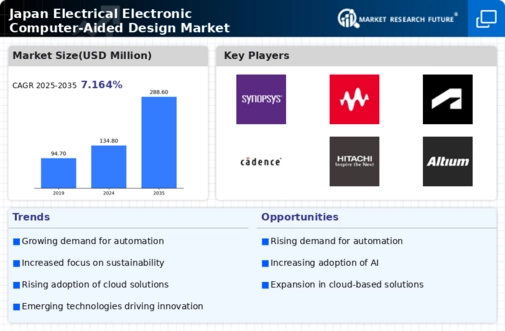

The Japan Electrical Electronic Computer Aided Design Market is witnessing a growing emphasis on automation and efficiency in design processes. Companies are increasingly adopting CAD tools that incorporate automation features to streamline workflows and reduce time-to-market. This trend is particularly evident in the automotive and aerospace sectors, where precision and speed are paramount. According to recent data, the adoption of automated CAD solutions in Japan is expected to grow by 20% over the next five years. This shift towards automation not only enhances productivity but also allows designers to focus on innovation rather than repetitive tasks, thereby driving the overall growth of the Japan electrical electronic computer aided design market.

Growing Importance of Collaborative Design Tools

The Japan Electrical Electronic Computer Aided Design Market is increasingly recognizing the value of collaborative design tools. As projects become more complex and involve multiple stakeholders, the need for platforms that facilitate real-time collaboration is paramount. Companies are investing in CAD solutions that enable teams to work together seamlessly, regardless of geographical location. This trend is particularly relevant in industries such as electronics and telecommunications, where collaboration is essential for innovation. The market for collaborative CAD tools in Japan is anticipated to grow by 15% annually, reflecting the industry's shift towards more integrated design processes. This evolution is likely to enhance the overall efficiency and effectiveness of the Japan electrical electronic computer aided design market.