Increased Focus on Data Security

As the internet of-things market expands in Japan, there is a growing emphasis on data security and privacy. With the proliferation of connected devices, concerns regarding data breaches and unauthorized access are becoming more pronounced. In response, companies are investing in advanced security measures to protect sensitive information. It is estimated that spending on IoT security solutions could reach ¥50 billion by 2026. This focus on security not only helps to build consumer trust but also ensures compliance with emerging regulations, thereby fostering a more robust and sustainable internet of-things market.

Government Initiatives and Support

The Japanese government is actively promoting the internet of-things market through various initiatives aimed at fostering innovation and technological development. Programs designed to support research and development in IoT technologies are being implemented, with funding allocations reaching approximately ¥100 billion in recent budgets. This governmental backing is crucial for startups and established companies alike, as it encourages investment in IoT solutions. Furthermore, regulatory frameworks are being established to ensure the safe and effective deployment of IoT technologies across different sectors, including transportation and healthcare, thereby enhancing the overall market landscape.

Industrial Automation and Efficiency

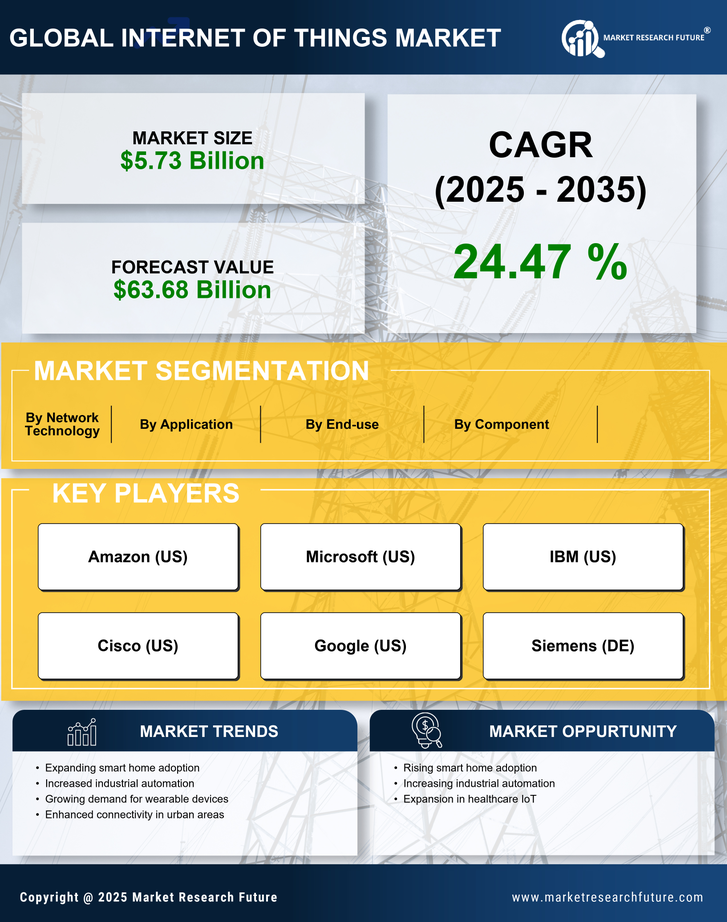

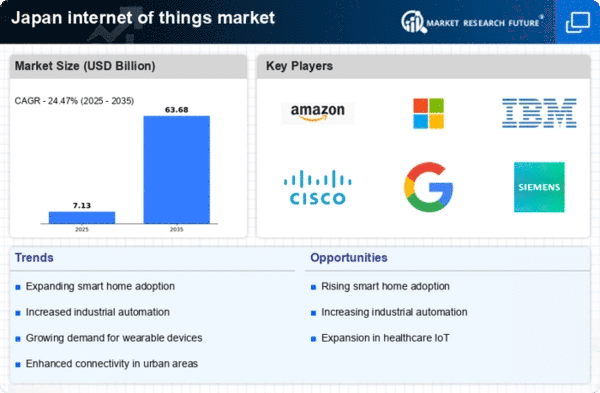

The push for industrial automation in Japan is significantly influencing the internet of-things market. As industries seek to enhance productivity and reduce operational costs, IoT technologies are being integrated into manufacturing processes. The market for industrial IoT is expected to grow by approximately 25% annually, driven by the need for real-time monitoring and predictive maintenance. This trend is particularly evident in sectors such as automotive and electronics, where efficiency gains can lead to substantial cost reductions. By leveraging IoT solutions, companies can optimize their supply chains and improve overall operational performance.

Growing Demand for Smart Home Solutions

In Japan, there is a notable increase in consumer interest in smart home solutions, which is driving the internet of-things market. As of 2025, it is projected that the smart home segment could account for over 30% of the total IoT market in the country. This growth is fueled by a desire for enhanced convenience, security, and energy efficiency among consumers. Products such as smart thermostats, security cameras, and home automation systems are becoming increasingly popular. The integration of these devices into daily life not only improves user experience but also contributes to energy savings, aligning with Japan's sustainability goals.

Technological Advancements in Connectivity

The internet of-things market in Japan is experiencing a surge due to rapid advancements in connectivity technologies. Innovations such as 5G networks are enhancing the ability of devices to communicate seamlessly, thereby facilitating real-time data exchange. This is particularly crucial for industries like manufacturing and healthcare, where timely information can lead to improved operational efficiency. As of 2025, it is estimated that 5G adoption in Japan could reach 50%, significantly impacting the internet of-things market. Enhanced connectivity not only supports existing applications but also paves the way for new use cases, such as remote monitoring and smart automation, which are becoming increasingly vital in various sectors.