Market Analysis

In-depth Analysis of Kitchen Chimney Market Industry Landscape

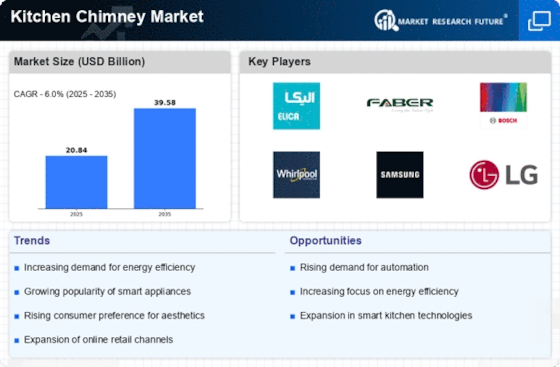

The Kitchen chimney industry is impacted by market influences that outcome from the multifaceted interaction of various elements that aggregately influence the area's development, patterns, and level of rivalry. An urgent component is the development of purchaser inclinations, which happen pair with ways of life and culinary practices. With the developing accentuation on contemporary kitchen feel and the quest for productive culinary arrangements, there has been a raised interest for kitchen fireplaces that are both stylishly satisfying and mechanically progressed. The development of customer inclinations spurs producers to adjust and acquaint novel progressions all together with fulfil the developing requests of the market. The market elements are being affected by mechanical headways in kitchen chimneys, which envelop contact controls, savvy advancements, and energy-proficient qualities. High level stack usefulness, easy to use interfaces, and effective ventilation are characteristics that customers look for. The developing inclination of shoppers for harmless to the ecosystem apparatuses is applying tension on makers to make items that are both energy-proficient and liable for the climate. The cutthroat climate is being moulded by severe discharge principles and eco-accommodating assembling processes. The industry is dependent upon a serious level of maker contest, which encourages continuous item development and improvement. The presence of a serious climate furnishes purchasers with many items that display qualities and cost levels. The market is considerably affected by administrative systems and government approaches, which command makers to stick to norms relating to somewhere safe, discharges, and energy productivity. Subsequently, these variables meaningfully affect item improvement techniques and the drawn-out feasibility of the business. The market elements of kitchen chimney are remarkably influenced by monetary circumstances, enveloping development, discretionary cashflow, and shopper certainty. During times of development, premium choices are more predominant, while during slumps, financial plan well-disposed options are more common. The kitchen chimney market is dependent upon the effect of the progress towards online retail, which gives upgraded item data, accommodation, and openness, subsequently changing the regular elements of the retail business. The market elements are impacted by social and segment factors, which require that makers redo their items to suit specific customer fragments and assurance contributions that resound. Purchaser inclinations, mechanical headways, natural elements, market rivalry, administrative systems, monetary circumstances, conveyance channels, and social impacts all add to the market's consistent development. Such patterns expect producers to adjust to fulfil market requests.

Leave a Comment